More pressure on rapeseed from the global soyabean market? Grain market daily

Wednesday, 4 October 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £1.05/t yesterday, closing the session at £187.00/t. The Nov-24 contract closed at £200.25/t, up £1.50/t over the same period.

- Domestic wheat futures tracked global prices up yesterday following signs of strong Chinese import demand. The USDA announced yesterday that exporters had sold 220 Kt of US wheat to China.

- Paris rapeseed futures (Nov-23) were down €0.25/t yesterday, ending the session at €447.25/t. The Nov-24 contract closed at €462.50/t, down €3.00/t from Monday’s close.

- Rapeseed futures followed US soyabean prices down yesterday, read more information on this below.

More pressure on rapeseed from the global soyabean market?

Chicago soyabean futures (Nov-23) fell $1.56/t over yesterday’s session to the lowest point since the end of June, at $467.61/t. A stronger US dollar and expectations of plentiful global supply have seen prices generally in decline over the past few weeks. So, what can we expect going forward?

Global supply and demand

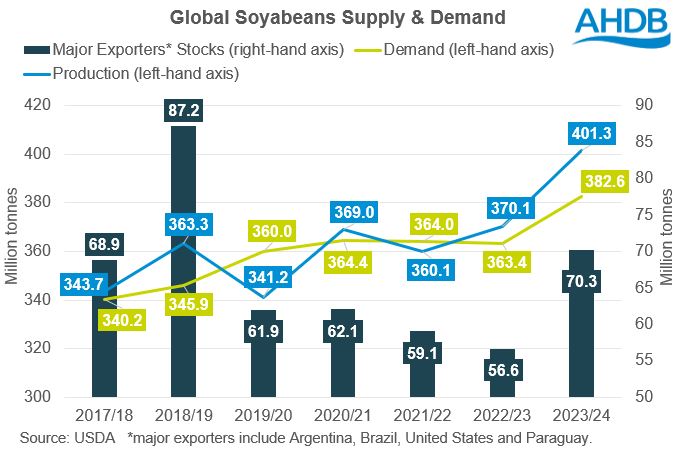

According to the latest USDA Word Agricultural Supply and Demand Estimates (WASDE) released in September, global supply of soyabeans is expected to be ample for the 2023/24 season. Total world production is forecast up 8.4% on the year at 401.3 Mt, with the major exporters (including Argentina, Brazil, United States and Paraguay) expected to make up for 83% of this. Ending stocks of soyabeans by major exporters is also expected to be at the highest level since 2018/19 at 70.3 Mt.

Of course, it is still early in the season, meaning that crop condition and progress in major exporting countries is in focus.

In the US, soyabean harvest is well underway, and crop condition scores showed a slight improvement in quality this week. As at week ending 1 October, US soyabean harvest was 23% complete, in line with the five-year average of 22% at this point in the season. In Monday’s update, 52% of the crop was rated in good/excellent condition, up from 50% the week before.

With signs that the US crop is showing improved conditions when compared to earlier in the summer, commodity broker StoneX raised its US soyabean yield estimate to 3.39 t/ha on Monday from 3.37 t/ha previously. With the USDA’s September yield estimate at 3.37 t/ha, any revision on the US soyabean yield will be a watchpoint in next week’s WASDE update.

Planting of an anticipated record soyabean crop is underway in Brazil. According to AgRural, as at 28 September, 5.2% of the expected area has been planted, ahead of 3.8% last season and the quickest pace ever for this period (Refinitiv). Argentina will also come into focus over the next few weeks when plantings begin, with the country due a 50 Mt crop this season, up from last year’s drought-stricken 21 Mt crop.

In terms of demand, 265 Kt of US soyabeans were purchased yesterday by China, suggesting there is some demand in the market. However, according to traders, values remain steady to lower on Tuesday due to light demand continuing, and as freight costs ease with more empty vessels available.

What does this mean for UK growers?

With ample availability of soyabeans expected on the global market this season and demand not currently looking as though it will climb to the same extent, it’s unlikely that prices will see much support overall over the coming months. Though, with global supply seeing some reliance on large South American soyabean crops only just going into the ground, we will follow developments with these crops closely.

As outlined in a previous analysis, rapeseed prices are trading very closely to US soyabean futures at the moment. Therefore, any downward pressure on soyabeans is likely to filter into domestic rapeseed prices, especially considering the ample global rapeseed supply expected this season. Something to consider when marketing rapeseed this season.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.