Mixed picture for UK trade in August

Tuesday, 19 October 2021

By Bethan Wilkins

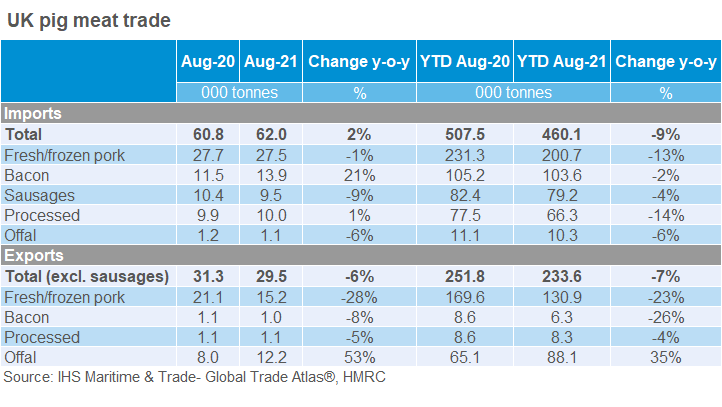

Despite a widening price differential between farmgate pig prices in the UK and EU, UK pig meat imports remained at relatively low levels during August. However, when looking at all pig meat products, there was a small increase compared to both a year earlier (+2%) and July 2021 (+3%).

Looking at fresh and frozen pork, volumes were still a little lower than August 2020. There were lower volumes coming in from several EU states, most notably Ireland. However, this was largely counteracted by increased shipments from Germany and Belgium. The German market is currently unable to export to most countries outside of the EU due to African swine fever cases within its borders. Most markets it can access have, therefore, taken more German pork this year and German prices have faced downward pressure.

Imports of bacon were higher than last year during August. However, imports were particularly low at this time last year, and compared with July 2021, volumes were 3% lower. The Netherlands and Denmark continue to dominate this market.

Since August, we have seen a continued increase in the number of consumers eating out, as well as increasing price competitiveness of continental pork. As a result, it may be that import volumes have risen since August. European pork can also exert price pressure on UK product without being imported, so long as the potential remains. The average price of pork imported during August was £2/kg, 10% lower than last year.

UK fresh and frozen pork export volumes in August were over a quarter lower than a year earlier, at 15,200 t, though this was 5% higher than July 2021. Much of the year-on-year fall can be attributed to lower shipments to China, which fell to just under 6,000 t. Exports to the EU were also lower though, particularly influenced by falling trade with Germany and the Netherlands.

Bacon and ham exports also continued to see some decline. The published sausages figure appears unusually high and is being queried.

In contrast to the overall trend, UK offal exports were higher than a year earlier. Shipments to China continued to show robust growth, despite a challenging muscle meat trade. Volumes to this key market were up by 56% compared to last year, totalling 6,200 t.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.