Mixed bag for Q1 dairy exports

Wednesday, 20 May 2020

by Kat Jack

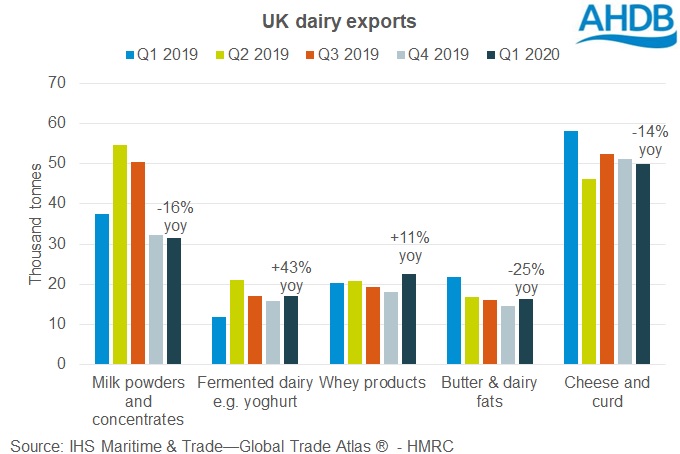

UK dairy exports had a mixed performance in the first quarter of 2020, with some categories in growth compared to a year previous but with key categories like cheese and milk powders in decline.

For butter and cheese, the decline is partly due to particularly high exports in Q1 2019. Back then, the UK was heading towards the March 29 Brexit deadline with no deal agreed. It is thought that extra trade was done for these products in fear of a hard Brexit that would have disrupted trade.

Milk powder exports, on the other hand, are more driven by product availability, which itself is driven by milk production, as excess is often dried and sold. Strong production from late 2018 and well into 2019 would have lifted supplies, whereas production was lower than expected in Q1 2020.

On a more positive note, exports of whey products and fermented dairy products were both up on the year in Q1 2020. For whey, the growth in volume was partly supported by a higher amount of liquid whey being exported, which will contribute more weight than if it was powdered.

Is there a coronavirus effect?

With trade data currently only available up to March, we are not yet seeing a significant impact from coronavirus. The UK’s primary trade partner is Europe, where lockdown restrictions in various countries generally didn’t start coming into play until March. Although restrictions haven’t specifically stopped food trade, lost demand from the closure of foodservice, and the logistical difficulties of transporting goods while social distancing, is expected to impact trade figures from April.

Further afield, Asia experienced outbreaks and lockdowns earlier in the year than the UK did. However, long distance exports are also usually agreed well in advance, and most Q1 trade would have been already committed at the time of the outbreaks. If we take China as an example, their Q1 imports of dairy products were up 2% year on year.

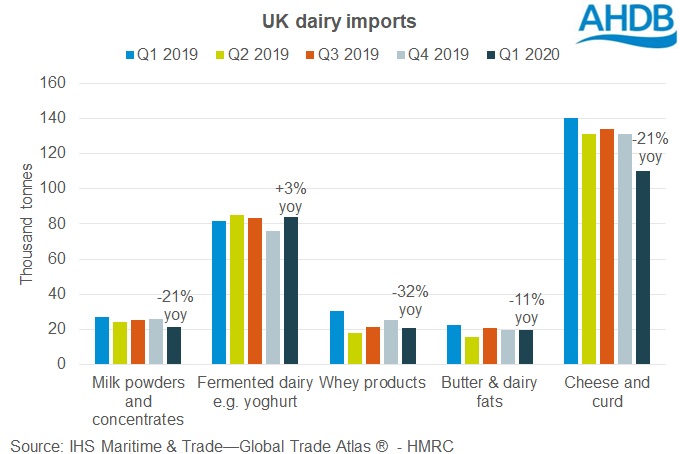

UK dairy imports also down

The UK’s imports of dairy products were also down on the year in January-March 2020. Most categories saw declines, although fermented dairy products were up 3%. Some year-ago figures have again been boosted by companies stocking up in advance of a potential hard Brexit.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.