Milling of imported wheat remains above average: Grain market daily

Friday, 6 December 2024

Market commentary

- UK feed wheat futures (May-25) closed at £186.00/t yesterday, rising £1.65/t from Wednesday’s close. The Nov-25 contract also gained £1.65/t over the same period, to close at £188.00/t.

- Russia’s deputy prime minister announced that Russian winter crops (inc. winter wheat) are in poor condition due to deficit soil moisture for some areas and may need to be replaced by spring crops. In addition, heavy rainfall during Australia’s wheat harvest has led to a deterioration in quality, lending support to European wheat markets too.

- In the latest monthly crop monitor report by GEOGLAM Crop Monitor, while wheat conditions are reported to be mixed globally, the outlook has improved since last month and is better than this time last year.

- Paris rapeseed futures (May-25) closed at €522.00/t yesterday, gaining €3.75/t from Wednesday’s close. The Aug-25 contract rose €1.25/t over the same period, to close at €476.25/t.

- Statistics Canada reported Canada’s rapeseed harvest for 2024 at 17.8 Mt, lower than the 19.0 Mt estimate released in November and the 2023 harvest of 19.2 Mt, supporting Paris rapeseed futures. Lower production in 2024 was reportedly due to both lower yields and planted area.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Milling of imported wheat remains above average

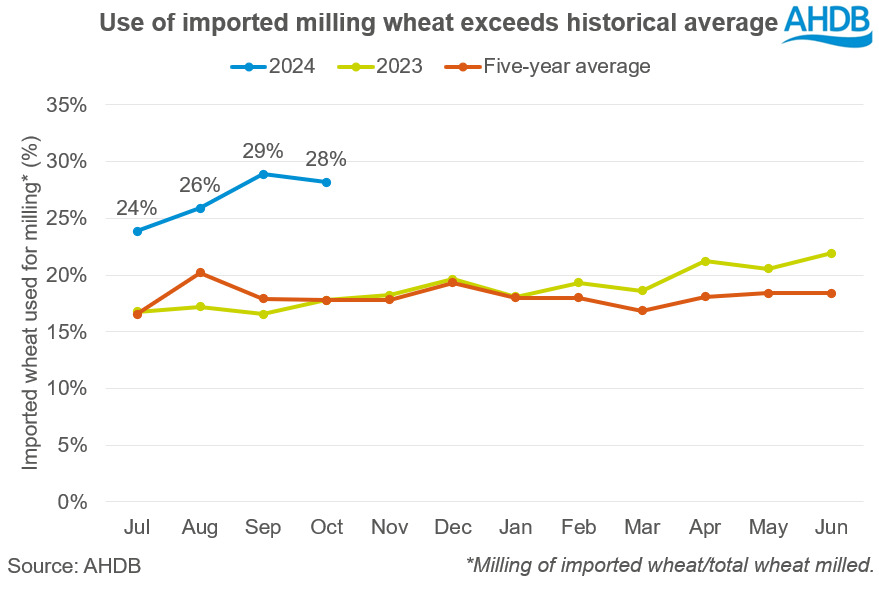

AHDB’s latest UK human and industrial (H&I) usage shows that since the start of the 2024/25 marketing year (July), total wheat milled has reached 2.0 Mt by the end of October. While this is 8.1% less than the same period last year, it is broadly in line with the five-year average for the same period of time (-0.9%). Firmness in the volume of wheat being milled has been supported by elevated wheat imports as domestic wheat usage has subsided due to a smaller crop with lower protein levels.

Greater percentage of imported wheat milled than domestic

Use of imported wheat began to rise in the months leading up to the 2024/25 marketing year as some mills took on greater volumes in preparation for the smaller UK milling wheat crop and concerns regarding quality.

Post harvest, despite the quality of the UK milling wheat crop exceeding anticipations of some, elevated imports of milling wheat has continued into the 2024/25 marketing year; which has been driving pressure on the milling wheat premium. As a result, the percentage of home-grown to imported wheat milled has differed from historical trends, with imported wheat making up a much larger share.

Firm overall demand but lesser domestic usage

While the continued elevated use of imported milling wheat into this marketing year helps support the availability of milling wheat for domestic millers and therefore satisfy demand, this is also weighing on the domestic milling wheat premium. UK trade data for October 2024 is due to be available next Friday (13 Dec).

In the latest AHDB supply and demand balance sheet, H&I usage of domestically produced wheat is estimated to fall 9% below the five-year average to 5.7 Mt, while H&I usage for total wheat (inc. imported) only 2% lower than the five-year average.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.