Markets pricing in long term grain pressure: Grain Market Daily

Wednesday, 6 May 2020

Market Commentary

- New crop Nov-20 UK feed wheat futures gained again yesterday following Paris milling wheat futures up £1.30/t, closing at £161.60/t. However, new crop futures remain well below the April and March highs following a steep decline at the end of April.

- While maize has been under pressure, and although prices appear to have found a floor, the EU has increased the duty on imported maize from the previously enacted €5.27/t to €10.40/t.

- Brent crude oil prices have shown signs of recovery, gaining from a low of $19.99/bbl on the 27 April to break above $30/bbl, closing at $30.97/bbl yesterday. While crude prices are showing signs of recovery with production cuts and signs of demand recovery, large fuel inventories and a continued reduced demand, further gains are likely to be minimal.

Markets pricing in long term grain pressure

While this time of year would normally be dominated by a weather market, the direction of commodity markets continues to be heavily influenced by politics, the pandemic and global economies to a larger extent.

That being said, there are plenty of weather stories that are feeding into the direction of new crop markets. Dryness in South America is leading to worsening maize yield outlooks for the Safrina crop, which would traditionally provide support. Additionally, the impacts of the lack of rainfall in Black Sea wheat regions, including Romania, is still being assessed, again this would ‘normally’ provide new crop support.

Yet the major driver for agricultural commodity markets continues to be demand, rather than supply. Following year on year gains in global grain consumption, the pandemic has led to a greater degree of uncertainty and volatility.

Maize remains under pressure

The pandemic has led to a large fall in maize demand, especially from transport, weighing on all grain markets. While the correlation between oil price and maize price is not always closely linked, both are tied to demand.

Although signs of a recovery in demand have been seen, and maize prices have found a degree of support, gains are likely to be capped by the prospects of next season’s crop. New-crop Chicago maize futures are trading only slightly above old-crop values, with demand in 2020/21 likely to be outstripped by swelling stocks and production forecasts.

Wheat outlook

EU wheat production is likely to be down year on year, with Strategie Grains forecasting a 135Mt soft wheat crop in April, down from 146.4Mt in 2019/20. Additionally, Black Sea wheat crop prospects have been hampered following lack of rainfall.

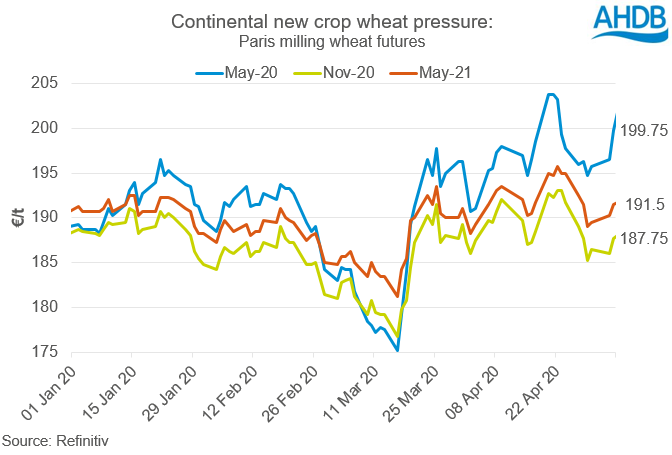

However, new-crop Paris milling wheat futures are trading below old-crop values. Nov-20 Paris milling wheat futures closing at €187.75/t yesterday, €12/t below yesterdays old crop May-20 contract. May-21 Paris milling wheat futures closing at €191.50/t yesterday, €8.25/t below the May-20 contract, as potential global demand weighs heavier than reduced supply.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.