At nearly $3 a bushel, is Maize finding its feet? Grain Market Daily

Friday, 1 May 2020

Market Commentary

- Rainfall across the UK, Europe and Black Sea regions have taken the pressure off wheat markets. Unless dry conditions return, wheat looks likely to drift further as production outlooks improve and there remains a large spread to maize. New crop UK feed wheat futures having fallen £8/t from Thursday 23 to Thursday 30 April.

- A degree of upward movement has been recorded in Brent crude oil, from closing at $21.33/bbl on Thursday 23 to trade back above $25/bbl by yesterday, closing at $25.27/bbl. This allowed Paris rapeseed futures some more headroom with May-20 Paris rapeseed futures closing at the highest level since February at €379.50/t. New-crop prices have struggled to make ground as global production outlooks improved.

At nearly $3 a bushel, is Maize finding its feet?

With nearby US maize prices touching a significant resistance point of $3/bushel, are there sufficient additional factors to drag US maize lower?

Further reductions in US daily ethanol production has been recorded, falling from over 1,000k barrels a day in March, to just 537k by the week of 24 April. As production has fallen by over 40%, maize demand has fallen at the same rate, leading to Chicago maize futures falling over 17% since the start of March.

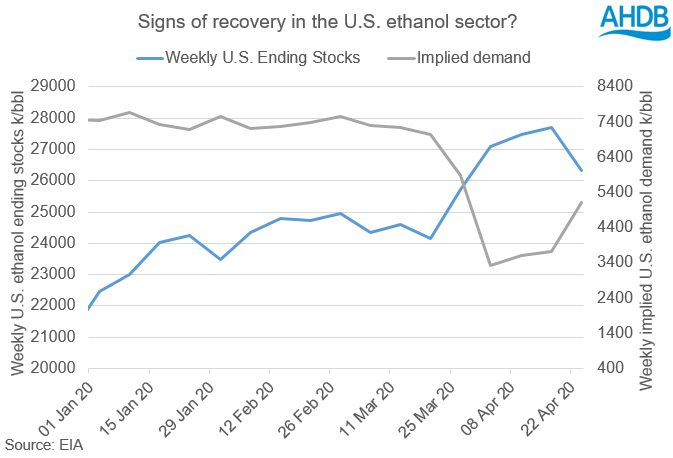

However, there are signs that US ethanol demand is now outweighing supply, with a drawdown in weekly ethanol stocks recorded. Falling from 27,689k barrels to 26,337k barrels, US stocks showed a 1,352k barrel reduction ( -5% ) from 17 April to 24 April. Although US ethanol stocks remain at swelled levels, a second consecutive week of similar drawdown would drag ethanol stocks back to levels recorded in February.

With production at 537k barrels a day, and weekly 1,352kt drawdown on stocks, there was an implied demand of 5,111k barrels of ethanol per week, the greatest demand in 4 weeks; this is a 37% week on week rise in demand. However, while implied demand has increased in the last week, there remains an overall 2,000k barrel a week reduction in US demand from pre-pandemic levels.

Yet as there are increasing calls for a re-opening of the economy, fuel demand is likely to recover, with a return for maize demand in US ethanol production.

But, and it’s a big but, even if demand returns, this is still an overall loss in annual usage with an implied build-up of US maize stocks, so while a degree of sort term support is on the cards, maize prices are unlikely to fully recover.

Further, looking to 2020/21, US perspective plantings released a month ago have US maize plantings up 8%. While the current low prices could dissuade some from increasing the area, there is likely to be increased supply in 2020/21, maintaining pressure on all grain markets especially into next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.