Market Report – 31 August 2021

Tuesday, 31 August 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

The global wheat market has tightened once more, with smaller Canadian crops. Strong export demand is supporting European prices. Slow US export demand has increased the discount of Chicago wheat to Paris wheat, capping gains.

Improved weather prospects have capped values in the short-term. Concerns of a second La Niña for Brazil and low water levels on the Paraná River in Argentina offer support.

Strong domestic demand has supported feed barley values, narrowing the discount to feed wheat. However, barley needs to remain competitive in the longer term.

Global grain markets

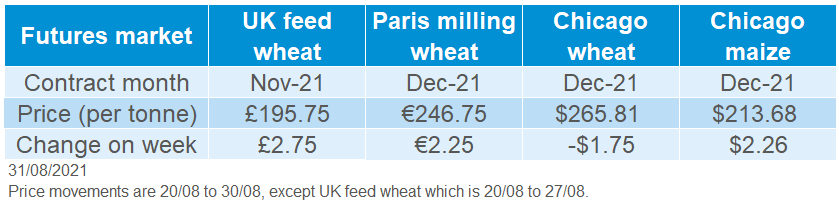

Global grain futures

International grain markets (Chicago and Paris) ended last week strong. Chicago maize futures gained more than 3% across the week (Friday-Friday), supported by news of a second La Niña which may hinder South American maize this winter. Wheat gained less, although prices have seen some considerable strength in recent weeks.

US markets started the week by writing off much of last weeks gains. Increased rainfall in the US Midwest has improved crop prospects for maize. In yesterday’s USDA crop progress report maize conditions for the US were unchanged on the week, 60% of the crop is rated as “good” or “excellent”. The Midwest tends drier over the next fourteen days.

There is some concern for US supply disruption as Hurricane Ida hit key states across the Gulf of Mexico.

US wheat prices saw a steep decline yesterday (-1.2%), while Paris milling wheat remained static. Paris wheat continues to be supported by strong export demand, with Romania once again a top origin in the latest Egyptian (GASC) tender. Of the 180Kt purchased, two 60Kt cargoes were of Romanian origin while the third was Ukrainian. Russian wheat remains too expensive. US exports to the week ending 19 August, are behind the five-year average pace. This may be a driver of the increased discount of Chicago futures (nearby) to Paris.

Statistics Canada released its production forecasts for the 2021/22 season yesterday. Production of all wheat is seen at 22.9Mt, down 34.8% year-on-year. The Canadian forecast is 1.1Mt less than the latest USDA forecast. Crucially for the UK market, Canadian spring wheat production is seen down 37.7% year-on-year, at a 14-year low of 16.1Mt.

While maize markets will remain pressured by any positive weather stories, which are lacking at present, wheat markets are likely to remain supported to some degree by the tightening global outlook.

UK focus

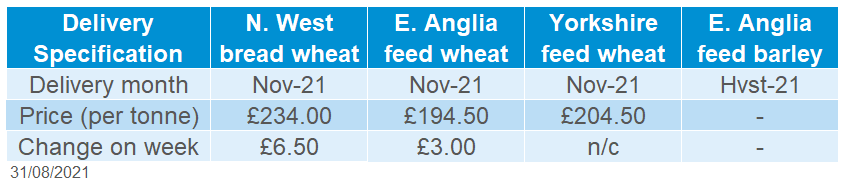

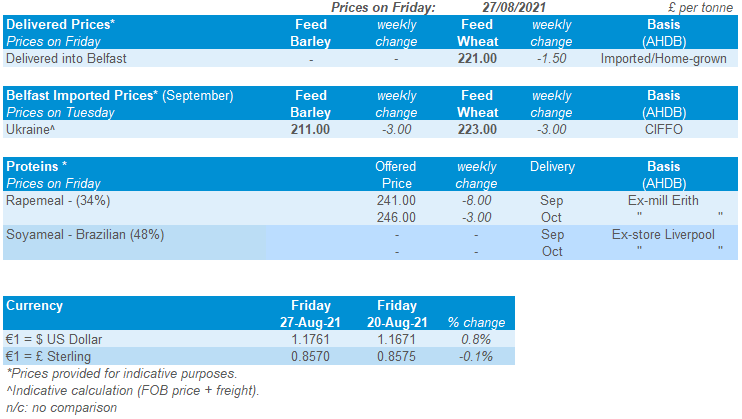

Delivered cereals

UK feed wheat futures (Nov-21) went into the bank holiday £2.75/t higher, Friday-Friday, at £195.75/t. The move in UK markets followed the strength in Paris milling wheat futures.

UK milling wheat premiums firmed slightly last week. Milling wheat delivered North West (Nov-21) was quoted at £234.00/t, as at Thursday, £38.00/t over futures. Nearby milling premiums are behind last year’s levels, but well ahead of the five-year average.

The latest harvest report was published last week. The wheat harvest still lags last year, with yields estimated at 8.0t/ha to 8.4t/ha. Protein and Hagberg Falling Numbers of milling wheat samples generally meet milling specification, whilst specific weights are seen to be slightly low.

Oilseeds

Rapeseed

Soyabeans

Latest data from Statistics Canada confirms the small domestic canola crop. Global supplies are still forecast to be tight for 2021/22 despite an element of demand destruction from the EU.

Chinese purchasing is providing some support to the market currently. However, rains across the U.S. Midwest at the weekend provide a more bearish sentiment. US soyabeans crop conditions scores were unchanged week-on-week.

Global oilseed markets

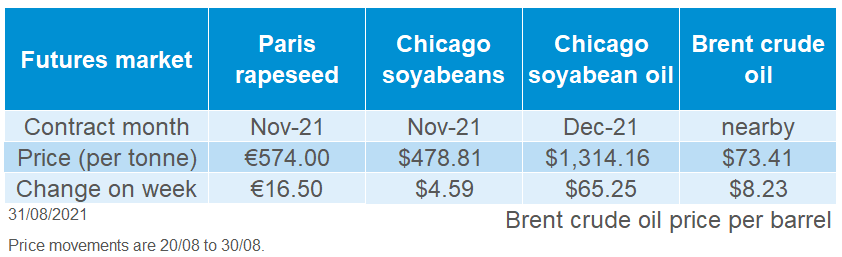

Global oilseed futures

Chicago soyabeans (Nov-21) were supported across the week (20-27 Aug), up 2.5%, closing on Friday at $486.21/t. In the first half of the week, the contract was supported before tailing off towards the end of the week, with rains forecast in key U.S. regions over the weekend.

Currently supporting soyabeans is active Chinese purchasing. Since 23 August, over 782Kt of US sales of soyabeans have been reported through the daily reporting system, with 650Kt of purchases from China.

Beneficial rains over the weekend in the U.S. Midwest have weighed on price. Chicago soyabean futures (Nov-21) closed yesterday 1.5% lower. These rains are set to continue throughout the next 7 days across key states in the Midwest and states bordering the Mississippi river.

The latest USDA crop condition report, released yesterday, pegged 56% of soyabeans in “good” or “excellent” condition, unchanged from the week before.

The impacts from Hurricane Ida are being assessed. Some export facilities around the Mississippi Gulf shut over the weekend. Although soyabean export activity is ongoing, any uplift will not be until October when the new U.S. crop comes online.

Rapeseed focus

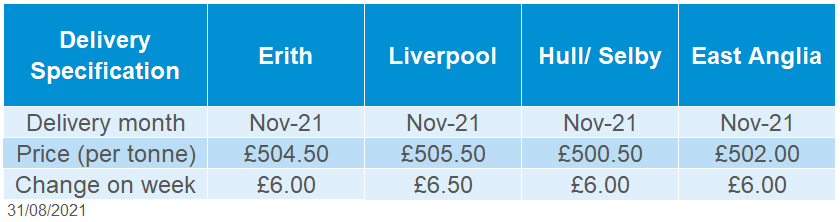

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) closed on Friday at €571.50/t, gaining €14.00/t across the week. Delivered oilseed rape (Erith, Nov-21) shadowed these gains quoted at £504.50/t on Friday, up £6.00/t across the week.

Gains were limited on the domestic market as sterling strengthened marginally (+0.11%) against the euro across the week, closing on Friday at £1 = €1.1665.

Yesterday Paris rapeseed futures (Nov-21) opened the week higher at €574.00/t, a gain of €2.50/t on Friday’s close.

Yesterday saw the release of the Statistics Canada production estimates. This report pegged canola production at 14.7Mt, down 24% from last year. This is lower than the USDA estimate of 16Mt, although larger than the average trade forecast of 14.1Mt.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.