Market Report - 29 March 2021

Monday, 29 March 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

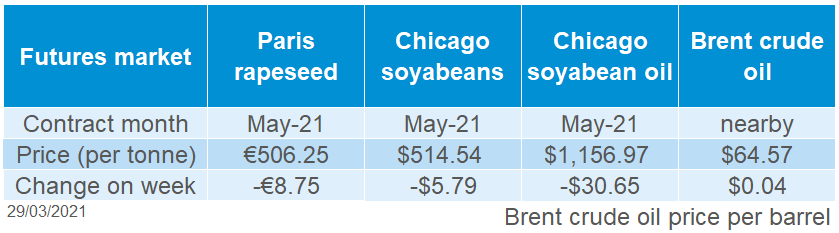

Paris rapeseed futures (May-21) closed on Friday at €506.25/t, down €8.75/t across the week. Delivered rapeseed (May-21, into Erith) was quoted Friday at £450.00/t, with domestic trade reported thin across the week.

Sterling strengthened by 0.40% against the Euro, to close Friday at £1 = €1.169. The successful roll out of the vaccination programme in the UK continued to support sterling.

Wheat

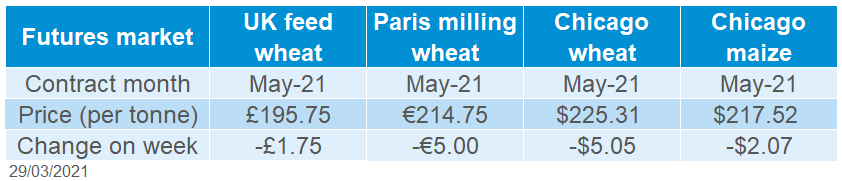

Global wheat markets continued to fall last week as markets lack positivity in the lead up to the two USDA reports on Wednesday. Poll estimates point to the lowest US wheat stocks since 2015.

Global grain markets

Maize

Sentiment in maize markets move from strength to strength ahead of the two USDA reports, with markets anticipating bullish reports for the commodity. However, US maize futures contracts eased off slightly from highs seen in early March.

Global grain futures

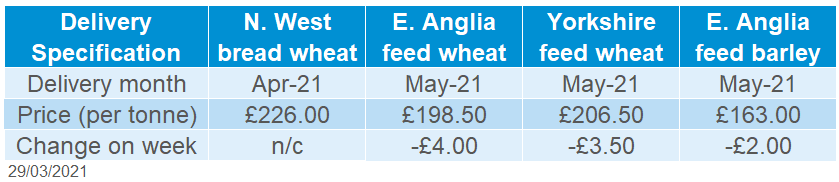

Barley

Domestic barley markets tracked wheat declines. Despite this, UK feed inclusions remain strong, providing a baseline support for prices.

UK focus

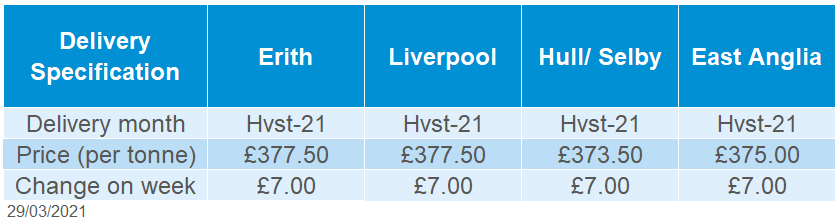

Delivered cereals

Grain markets have been quiet on the week, with wheat seeing a degree of pressure, as we await two important reports from the USDA. The prospective plantings report and crop stocks report are due at 16:00 GMT on Wednesday.

In anticipation of a strong report, US fund positions in the net-long position for maize have moved to their highest point since February 2011, with over 20% of open interest being long. If the report is more bearish than expected, we could see an increased sell-off risk as positions are exited. A downward pressure on maize markets and grain markets as a whole could be felt as an effect.

Average industry poll estimates point towards the smallest figures since 2015 for US maize and wheat stocks, as of March 1.

Last week, the EU Commission estimated 2021/22 wheat production at 127.7Mt for the EU-27. If realised, this is 9.7Mt higher than last season and 4% above the five-year average. If the UK is to be a net-importer next season, import parity levels could be pressured by having the EU well supplied again.

Oilseeds

Last week, global wheat markets continued their drop off from the week previous. Domestic prices were unable to prevent drops reaching our markets, with the May-21 contract down £1.75/t to £195.75/t. The May-22 contract dropped £2.75/t to £168.45/t. The USDA reports could provide a technical rebound as May-21 approaches the £190/t mark. However, they could also speed up the downward trend if increased wheat stocks appear in the report.

UK delivered cereal prices felt the wheat market pressure too. Feed wheat into East Anglia fell £4.00/t to £198.50/t for May delivery. Harvest delivered prices fell £2.00/t to be at £160.00/t for East Anglia.

Rapeseed

Support is likely to continue for rapeseed values on a global scale until new-crop comes online. On a continental level, supplies continue to look tight as we head into the 2021/22 marketing year.

Global oilseed markets

Soyabeans

Markets remain supported at the moment. Brazil’s soyabean harvest is at 60.1% (19 March, Conab), behind last year’s figure of 70.8%. Wednesday’s prospective planting and stocks reports from the USDA will bring fresh news to the market.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Chicago soyabean futures (May-21) were down $5.79/t Friday to Friday, closing at $514.60/t.

Initially the contract gained support as U.S. President Biden’s renewable fuel targets increased demand for vegetable oil based biodiesels.

However, the contract subsequently ended down on the week. This was driven by pressures on Chicago soyoil (May-21), which ended down 2.58% across the week, and funds squaring positions ahead of the end of March USDA planting intentions and quarterly stocks data.

For soyabeans, analyst’s averages in a Reuters poll are estimating stocks at 1.543 billion bushels, 35% below the three-year average. 2021 soyabean plantings are estimated to be at 89.996 million acres.

On Thursday, the International Grains Council released their latest world forecasts. 2021/22 production of soyabeans is set to total 383Mt, up 22.5Mt from the forecasted 2020/21 production of 361Mt. Production rises in Brazil and the US are the main contributors to this increase, read more here on the report in Friday’s Grain Market Daily.

Brent crude oil closed Friday at $64.57/barrel, gaining only $0.04/barrel across the week, after a week of swinging prices.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.