Market Report - 24 May 2021

Monday, 24 May 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK supply and demand in focus

This week we’re diving deeper into UK supply and demand in Grain market daily, focusing on a different crop each day (Tue-Fri). This is to mark the release of updated UK cereal supply and demand estimates on Thursday 27 May. These will include the first forecasts of end of season stocks and exports for wheat and barley in 2020/21.

We’ll be looking at barley on Tuesday, rapeseed on Wednesday, wheat on Thursday and concluding with oats on Friday. Click here to sign up to Grain market daily or follow @AHDB_Cereals on Twitter.

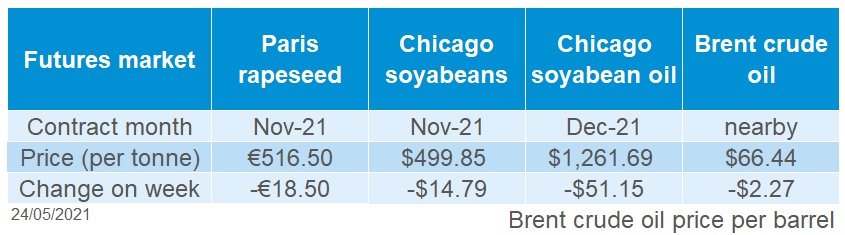

Rapeseed values last week followed the greater oilseed complex lower. Pressure in Brent crude oil futures (nearby), which was down 3.3% across the week, added to this.

Paris rapeseed futures (Nov-21) closed Friday at €516.50/t, down €18.50/t across the week. Delivered rapeseed (into Erith, Nov-21) showed this loss and was quoted Friday at £452.00/t, down £21.00/t Friday-Friday. But, there was added pressure due to the slight strengthening (+0.1%) of sterling against the euro, which closed Friday at £1 = €1.1616.

Canadian canola futures were also down last week, as crop prospects improved and widespread rain across Alberta helped alleviate some soil moisture deficits.

Wheat

Global grain markets

Maize

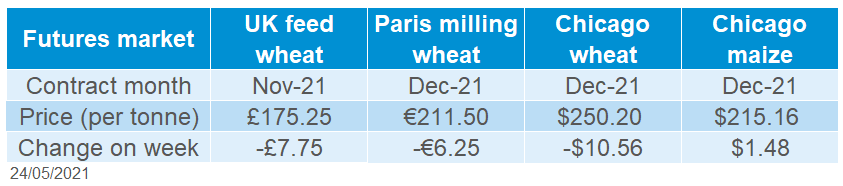

Global grain futures

Barley

Lessening global crop concerns have caused falls in wheat futures prices. A tight picture for global grain supply and demand remains for the 2021/22 season, which may support prices.

Concerns remain around the size of the 2020/21 Brazilian maize crop considering recent dry weather, though new-crop supply looks adequate. Strong Chinese demand continues to support prices.

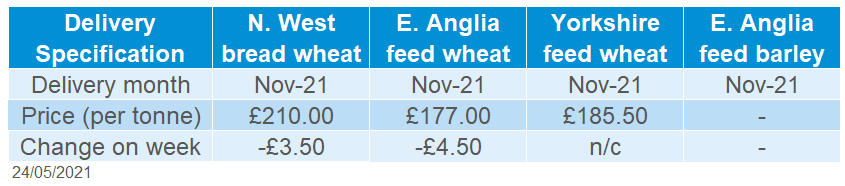

UK focus

Barley prices continue to follow other feed grains. New crop feed barley delivered into Avonrange (Nov-21) was quoted on Thursday with a discount of £13.00/t to wheat, down from £14.50/t discount the week before.

Delivered cereals

Chicago maize futures (Dec-21) gained $1.48/t on the week, to close at $215.16/t due to strong Chinese demand. On Thursday, the USDA announced maize export sales to China totalling 1.22Mt for 2021/22 delivery. This was the sixth consecutive day reporting exports sales to China, five of which have been over 1Mt. However, favourable US weather, with warmer and wetter forecasts for the next few weeks, caused some profit taking at the end of last week.

Between 11 and 18 May, managed money funds cut their net-long position on Chicago maize futures by 11%, the biggest selling week in almost a year. Concerns remain for the size of the Brazilian maize crop and what this means for global supply. But, there is a feeling forecasts may be priced into the market.

In contrast, global wheat markets closed down last week on improved crop prospects in the US and EU. Favourable US weather eased some concerns in global wheat prices, though US spring wheat areas is yet to benefit from rainfall and some Canadian spring wheat areas remain dry despite recent rains. The Chicago wheat Dec-21 contract fell to its lowest value in one month ($250.20/t) on Friday.

Paris wheat futures also fell on the week, with Dec-21 losing €6.25/t to close at €211.50/t. Last week FranceAgriMer kept soft wheat crop condition as 79% good or excellent condition to 17 May. This is for the second consecutive week (compared to 57% last year), as rain eases dryness concerns.

Friday also brought news on Russian wheat. Despite the forecasted 2021/22 grain crop to be down 6.1Mt on the year, grain exports are forecasted to rise 3Mt to 51Mt for the 2021/22 season according to the Agriculture Ministry.

Oilseeds

UK feed wheat futures (Nov-21) fell back £7.75/t on the week (Fri-Fri), to close at £175.25/t. This is the second consecutive weekly fall, following global price falls on easing supply concerns.

New crop physical prices in the UK followed a similar trend (Thurs-Thurs) to global futures.

Feed wheat for East Anglia (Nov-21) fell further last week, down £4.50/t to £177.00/t and £0.50/t below Nov-21 futures. Feed barley into Avonrange (Nov-21) fell £4.50/t on the week too, to £165.50/t on Thursday.

North West bread wheat (Nov-21 delivery) fell by less last week. It was quoted at £210.00/t on Thursday, down £3.50/t on the week.

Rapeseed

Global oilseed markets

Soyabeans

Global oilseed futures

Despite the pressure last week, there is underlying support for next season’s rapeseed values, as ending stocks are forecast to reduce. Could relatively high prices possibly increase global plantings for the 2022/23 marketing year?

Soyabeans prices are currently under pressure from lacklustre demand and improved US weather prospects. But, fundamental support is there, as US stocks are predicted to only marginally increase in 2021/22.

Rapeseed focus

UK delivered oilseed prices

Global oilseed markets were pressured last week. Chicago soyabeans (Nov-21) were down 2.8% across the week, to close Friday at $499.85/t. This is a three-week low for this contract.

Prolonged high prices are having an impact on the demand for soyabeans, both in the US and for exports. Warmer temperatures and further rains are forecast in the U.S Midwest in the next three weeks, boosting harvest prospects for spring cropping.

Further to that, Safras & Mercado raised its Brazilian soyabean crop forecast for 2020/21 to 137.2Mt, up from the 134.1Mt previously forecast.

This pressure in soyabean markets is bearing on the whole oilseeds complex. Export prices for Ukrainian sunflower oil were reported down by $20.00/t the back of weak demand (APK inform).

Malaysian palm oil futures values are pressured due to demand being low from domestic lockdown concerns and tracking the wider sell-off in edible oils. Despite this, exports of Malaysian palm oil products for 1-20 May, rose by 17.1% (Intertek Testing Services) in comparison to the same period last month.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.