Market Report - 23 March 2020

Monday, 23 March 2020

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

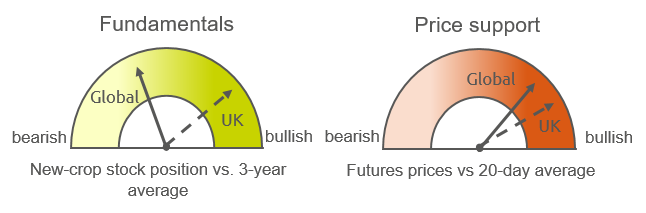

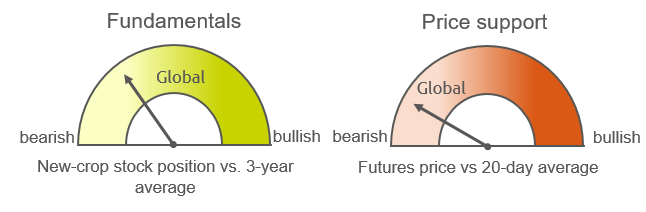

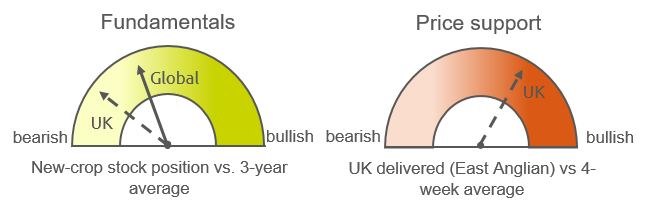

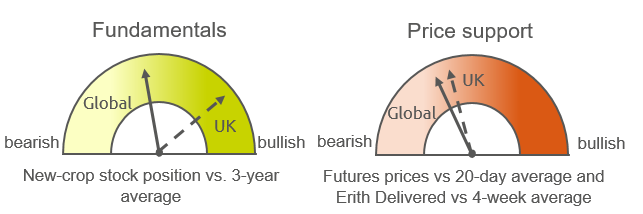

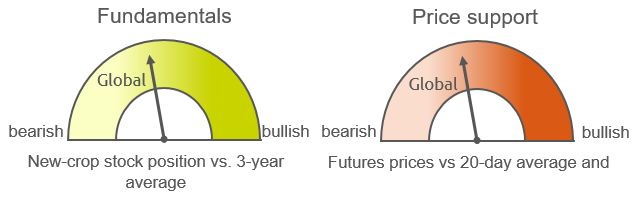

In light of the current market situation, where fundamentals and price direction are differing, we have updated the crop dials. The left hand dial reflects the position of new crop stock estimates against a three-year average. The right hand dial shows where prices as at Friday’s close stood against the previous 20-day/ four-week average.

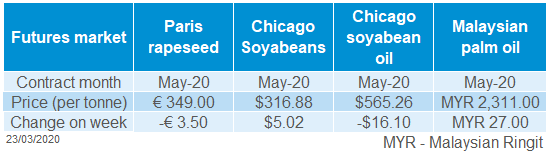

Paris rapeseed (May-20) futures closed at €349.00/t on Friday, down €3.50/t from the previous Friday. European rapeseed prices fell due to the influence of crude oil, but struggled to recover as strongly as soyabeans. This potentially reflects stronger influence of crude oil on rapeseed than soyabeans due to rapeseed’s higher oil content.

However new crop rapeseed futures fared better, with the Nov-20 contract ending the week at €357.00/t, the same price as on 13 March.

Yield expectations for EU rapeseed in 2020 are above both last year and the five year average according to the latest EU crop monitoring (MARS) report, released today. The report highlights the year on year improvements for top producer, Germany.

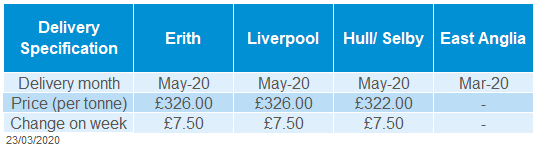

From a UK perspective, rapeseed prices gained sharply as sterling weakened against the euro. Rapeseed for May-20 (delivered Erith) was reported at £326.00/t on Friday, up £7.50/t from the previous week. Larger gains were reported over the same period in new crop prices (Nov-20, delivered Erith), up £11.00/t to £334.50/t.

Oilseed and veg oil prices fell sharply last Monday (16 March) following a drop in the price of crude oil, due to continuing global economic worries caused by the coronavirus pandemic. Anthony discusses the link between crude oil and oilseeds in his latest Analyst’s Insight. Oilseed and veg oil prices recovered through the week but the extent varied, with currency movements playing a big role.

Chicago soyabean futures (May-20) closed at $316.91/t on Friday, up $5.05/t from 13 March. The recovery from Tuesday onwards was due to hopes of increased demand for US soyabeans, both domestically and overseas. New sales of 110Kt of US soyabeans to unknown destinations (reportedly China) were reported by private exporters, while the USDA reported total net sales last week at 632Kt for 2019/20 shipment vs 303Kt the week before.

Logistics were also in focus for the potential demand. Soyabean shipments from Brazil were delayed over the weekend as rain slowed loading. In addition, port workers vote on possible strikes later today, which could cause further delays. Meanwhile, there is concern that measures to tackle coronavirus could also slow loading from some Argentinian ports.

Rain provided welcome moisture for still growing soyabean crops in northern Argentina but hampered harvesting further south. The rain is welcome after drier weather in recent weeks has curbed yield potential.

Palm oil futures ended the week slightly higher, after the Malaysian government exempted the industry from lockdown measures. Palm oil is a key export for Malaysia. However, prices dropped back again this morning on fears that demand for the oil could fall due to lockdown measures amongst many importers, such as India.

There are also reports that China, the globes’ top soyabean importer, could introduce quarantine measures at ports as part of the country’s efforts to deal with the coronavirus pandemic. As such measures could slow the transport of soyabeans to crushers in the country, this pushed up Chinese soyameal futures earlier today.

Global grain markets

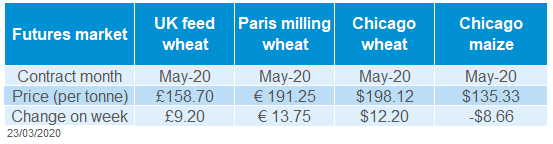

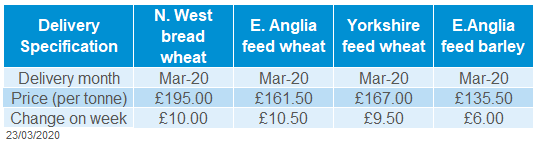

Global grain futures

UK focus

Delivered cereals

The global wheat market is relatively well supplied, despite a reduced view of Ukrainian wheat production. UK wheat production is expected to be tight. Last week, prices were supported by coronavirus uncertainty, moving well above the previous four week average.

Oilseeds

Maize production in South America and in the US is likely to large once again, prices have responded to this, and lacking demand remaining relatively pressured.

UK barley supplies are expected to be ample next season, especially given the derogation to the three crop rule. Prices have followed wheat markets higher but remain at a healthy discount.

The coronavirus pandemic continues to have a huge impact on the direction of global grain markets. Against the grain of fundamentals, US, EU and UK wheat futures have all seen support over the past week. While US maize futures fell back early on last week on ethanol demand worries, they recovered slightly as the week went as China purchased a large volume of US maize.

According to Reuters, France is reportedly feeling the logistical strain of coronavirus. A weak euro and subsequent strong export demand, combined with panic buying, is increasing the pressure on the nation’s haulage fleet.

While global market direction is heavily influenced by coronavirus, there have still been some fundamental shifts worth noting over the past week.

Dryness in the Black Sea region is something that has been watched closely for the last couple of months. Following a lack of over winter snowfall and in response to dry conditions, new crop winter wheat supplies have been estimated 12.5% lower year-on-year, at 24.2Mt by Ukraine’s national research institute. Maize production is estimated at 32.2Mt, down 10.3% year-on-year.

However, as far as old crop prices are concerned there is fundamental support in the region. Strong Ukrainian exports and seven year low grain stocks in the nation have seen cash prices in the region supported.

The latest EU crop monitoring (MARS) report, released today, highlights the mild and wet winter in western and northern parts of the EU, and the contrasting picture in the east. Overall EU cereal yields are seen down on the year but ahead of the five-year average; unsurprisingly there is some significant variation in these results.

Global oilseed markets

Global oilseed futures

With macroeconomic performance and the weakness in sterling the predominant drivers of grain markets last week, UK wheat gained significant ground. Old crop, May-20, UK feed wheat futures increased by £9.20/t in the week to Friday 20 March, closing at £158.70/t. New crop futures (Nov-20) increased by £8.30/t, to £168.45/t.

UK delivered cereal prices followed suit, feed wheat delivered into East Anglia (May-20) was quoted at £164.00/t, a rise of £10.50/t, as at Thursday. Feed barley continues to maintain a big discount to wheat quoted at £136.50/t.

Milling wheat continues to follow the path of futures, with North West May-20 delivery quoted at £37.75/t over futures, at £197.00/t.

In the weeks ahead, domestic logistics and demand will likely play a huge role in the direction of grain prices.

As we move into unprecedented territory with coronavirus, the UK grain trade has come together to provide advice on the steps to take when loading grain on farm, into port, or receiving deliveries of inputs. The coronavirus guidance for combinable crop deliveries and collections is available here.

On top of the new challenges faced by the domestic supply chain, persistent rainfall has been a huge problem for many since October, hampering winter crop planting efforts. In response to recent flooding, Defra have announced a blanket derogation of the three crop rule this season. On top of this the Environment Secretary, George Eustice, has announce a Farming Recovery Fund for those seriously affected by flooding in particular parts of the country. You can read more on both of these elements here.

EU agency COCERAL have estimated the UK wheat area at 1.478Mha, close to the AHDB Early Bird Survey (EBS) estimate of 1.504Mha. The derogation of the three crop rule frees up potential land for spring grains, and could drive a potential increase in spring barley planting. The EBS estimated the 2020 spring barley area at 1.042Mha.

Currency

Last week, currency was pivotal to market direction and will continue to be as we understand more about the implications of coronavirus and the actions taken by governments and central banks.

As global financial markets stumbled last week, the US dollar was viewed as a safe haven. Sterling lost significant ground against the US dollar, falling 5.2% Friday-Friday (13 March- 20 March), ending the week at £1=$1.16379. Over the past two weeks sterling has lost 10.8% against the dollar.

The euro lost 3.7% against the dollar Friday-Friday, closing at €1=$1.106923.

The UK government and Bank of England have announced a myriad of measures to try and curtail the impact of coronavirus on the domestic economy.

Sterling held more value against the euro, falling 1.5% Friday-Friday, to close at £1=€1.1048. As we move through the course of this week, new government responses to coronavirus, particularly that of the US, will be crucial to market direction.

Rapeseed focus

UK delivered oilseed prices

A sharply lower UK area for harvest 2020, contrasts with good EU yield potential and the prospect of good global supplies. The devaluation of sterling has pushed up UK delivered prices last week but they remain below the four week average.

South American harvests are generally progressing well. This, along with a large US area for 2020/21, looks set to keep global supplies topped up, capping prices.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.