Market Report - 18 October 2021

Monday, 18 October 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

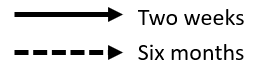

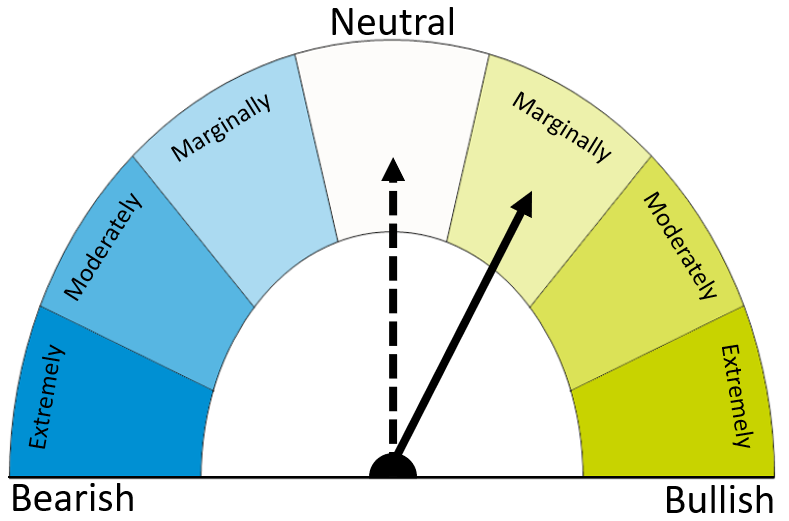

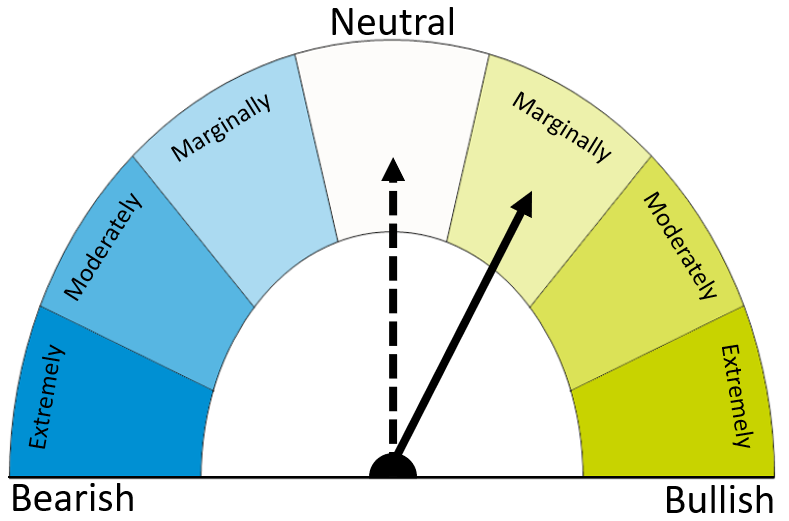

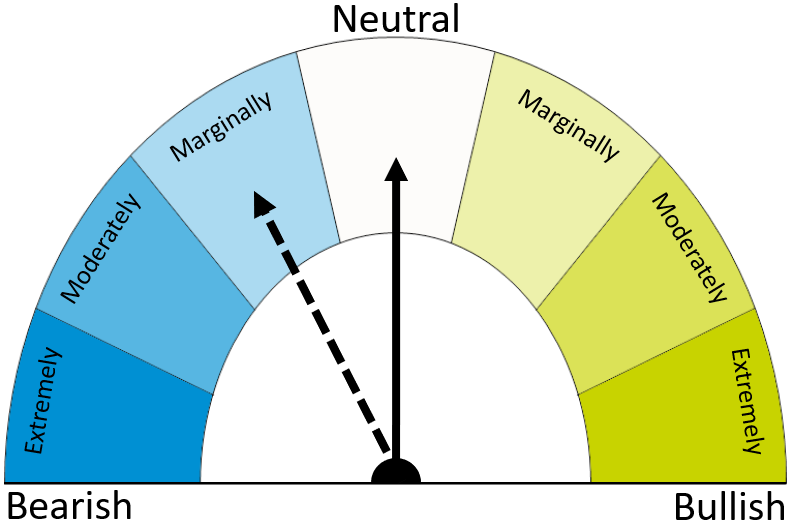

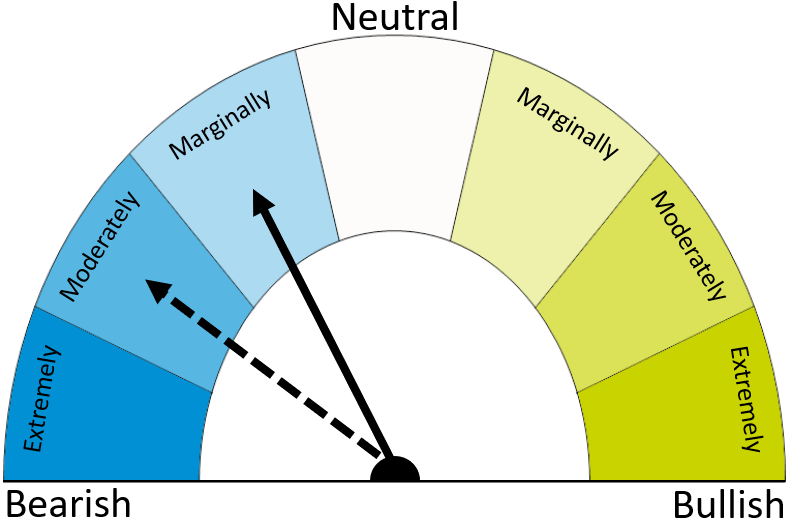

Following requested feedback earlier in the year, we have amended our dials. The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

The global wheat market remains tight, with further production cuts for North America. Demand destruction may cap the longer-term potential for prices.

Maize

There is short-term pressure from the ongoing US harvest, but longer-term, the increased likelihood of a La Niña this winter may offer price support.

Barley

Barley markets continue to show strength. UK exports in the first two months of this year were strong, as was animal feed demand.

Global grain markets

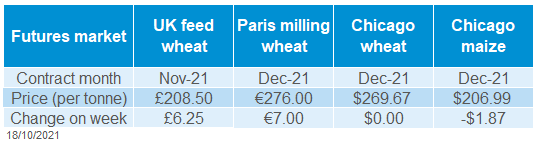

Global grain futures

There were mixed movements in grain markets last week. European markets were elevated, with Paris milling wheat futures (Dec-21) up €7.00/t Friday-Friday, to €276.00/t. Whereas Chicago markets were flat to lower last week. Chicago wheat closed unchanged, while maize tracked lower.

There was support for wheat markets from tighter stocks for the major wheat exporters. In Tuesday’s USDA supply and demand estimates (WASDE), there was reductions to production forecasts in the US, Canada, and the Middle East. However, these were met with smaller reductions to consumption. This leaves the stocks-to-disappearance ratio of major exporters at the tightest point since the USDA first published EU data collectively (1999/2000).

There are further signals that the strength in the wheat market may be starting to take its toll on demand. Last week, Egypt’s state grain buyer GASC cancelled a tender for November/ December delivery. Further, data from the General Administration for Customs in China suggested that wheat imports were down in September year-on-year (Refinitiv).

The maize market continued to see some pressure last week, with a strong global crop outlook. US and EU maize prospects were improved in last week’s WASDE, with global ending stocks growing as a result.

The USDA left maize production unchanged for both Brazil and Argentina. With large crops expected in both countries’, conditions need watching closely. Last week, the El Niño-Southern Oscillation status was raised from a La Niña “watch” to “alert”. This raises the prospect of dry weather in South America this winter, which could impinge on yields and support markets.

UK focus

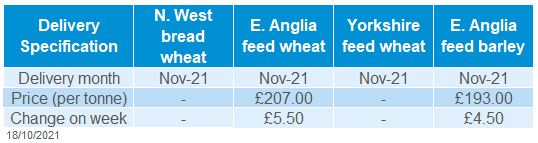

Delivered cereals

UK wheat prices tracked up with Paris wheat futures last week. The Nov-21 UK feed wheat futures contract gained £6.25/t, closing on Friday at £208.50/t.

As highlighted last week, the UK production figures were published provisionally on Monday. Further data published on Thursday highlights where challenges in production were felt most. Lower yields are highlighted in the South and East of England, outweighing stronger yields in the North and in Scotland.

UK trade data to August was published last week. Imports of both wheat and maize are off to a strong start, with 449Kt of wheat (exc. durum) imported and 242Kt of maize. Wheat imports are 68Kt ahead of the same point last season. This likely reflects the tight stocks position in the UK at the start of this season.

UK delivered prices followed the trends seen in futures markets. Last week no milling wheat prices were published in the AHDB delivered cereals survey. This reflected the difficulties in pricing domestic milling wheat, with quality challenging.

Defra is still collecting replies for the UK production survey. If you’ve received this form, you can complete it online or post it back until 25 October. More responses mean better information for everyone in the industry, from growers to end-users and policy makers.

Oilseeds

Rapeseed

EU prices remain relatively supported by tight supply and demand, though a bumper Australian crop is expected in November.

Soyabeans

Increased US supply and lower-than-expected US crush continues to pressure prices. Chinese purchasing was strong last week, though this will need to be sustained longer term to prevent further price falls.

Global oilseed markets

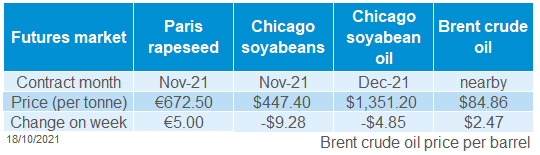

Global oilseed futures

Last week, Chicago soyabean (Nov-21) futures fell $9.28/t (Friday to Friday), to close at $447.40/t. Price gains at the end of the week did not offset falls made Monday to Wednesday.

On Wednesday, Chicago soyabean futures (Nov-21) fell to its lowest close since March 2021. This was a reaction to the higher-than-expected soyabean supply in the USDA’S latest world agricultural supply and demand estimates (WASDE) on Tuesday night.

Global 2021/22 ending stocks were increased by 5.7Mt from September, to 104.6Mt. This was due to increased beginning stocks (in the US, Argentina, and China primarily) and higher US production (up 2.0Mt to 121.1Mt) on improved yields. The bigger supply met with a 1.1Mt cut to total demand, month-on-month. The boost to US soyabean supplies also increased total global oilseed supply on the month, up 2.7Mt to 741.6Mt.

Soyabean markets did see some support at the end of the week from strong export demand for US soyabeans by China. From Wednesday to Friday, the USDA confirmed a series of soyabean export sales for 2021/22, totalling 462Kt to China and 1.1Mt to unknown destinations.

US soyabean crush figures, released on Friday, were lower than market expectations. According to the National Oilseed Processors Association (NOPA), soyabeans crushed in September were down 3.2% from August and 4.8% below September 2020. NOPA soya oil stocks were up 1% from August.

Rapeseed focus

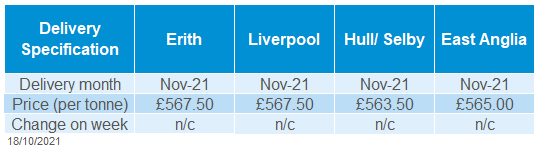

UK delivered oilseed prices

Paris futures (Nov-21) gained €5.00/t on the week (Friday to Friday), to close at €672.50/t. This is despite sharp falls mid-week on the larger global oilseed supply (more above). Gains at the end of the week followed US price rebounds. Prices were readjusting following the USDA WASDE with further support from speculative trading.

UK delivered rapeseed prices (Nov-21) were quoted at £567.50/t into Erith, on Friday. Delivered prices for May-22 (into Erith) were down £5.00/t on the week, at £573.00/t. Prices fell in line with Paris rapeseed futures, at the time of the survey. Paris rapeseed futures then closed higher on Friday.

Defra released their provisional crop production figures for harvest 2021. The rapeseed crop was the smallest in 32 years. At 977Kt, the crop is 6% below harvest 2020. A 20% fall in area for harvest 2021, was in part offset by increased yields on the year (provisionally at 3.2t/ha for 2021).

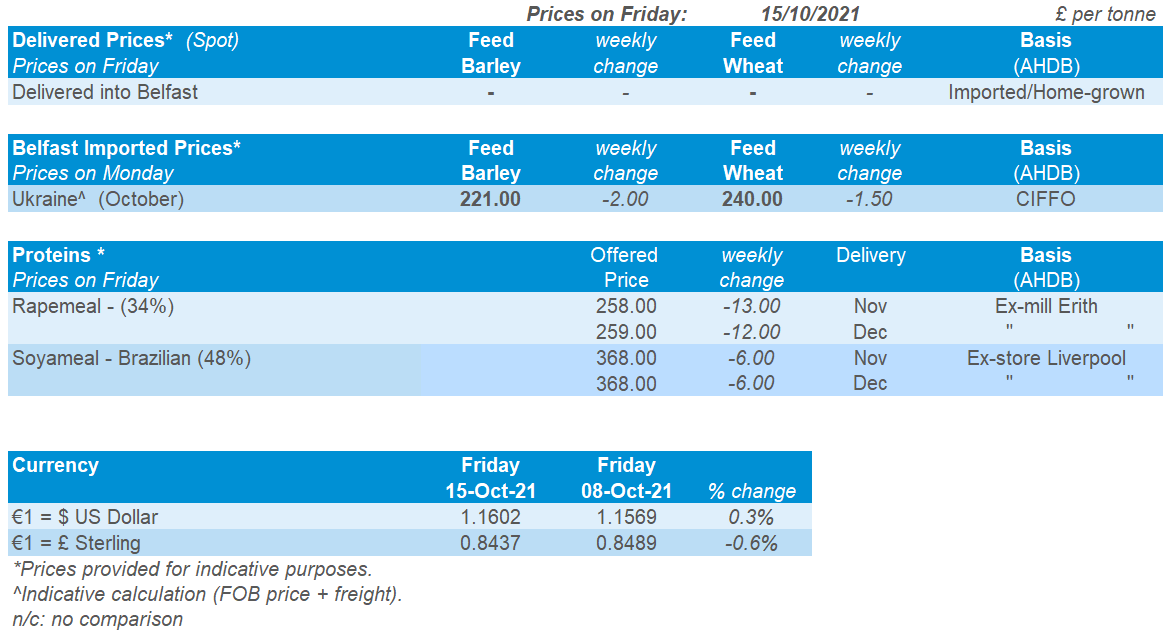

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.