Market Report - 17 May 2021

Monday, 17 May 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

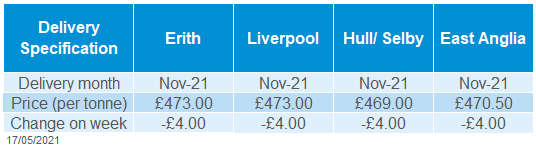

UK delivered rapeseed prices fell slightly last week after successive weeks of gains. Delivered prices for Erith (November) were quoted at £473.00/t, down £4.00/t. Prices for harvest delivery fell slightly less, down £2.50/t, quoted at £466.50/t.

Next season, Black Sea countries are forecast to harvest 6.25Mt of rapeseed, up 135Kt on 2020/21 according to the USDA. This is due to better yield prospects for some of the countries in the group, with the rapeseed planted area unchanged. The EU-27 will look, in part, to the Black Sea region to fulfil its 6.3Mt rapeseed import requirement.

Canada is also a popular rapeseed import origin for the EU-27, accounting for 35.1% of imports in the season to 9 May. Some drought concerns across the Canadian Prairies are affecting canola crop emergence at present. Canadian crop condition reports will be vital for price direction in the coming weeks.

Wheat

Last week’s WASDE showed a tightening picture for wheat. However, this was outweighed by a bearish maize picture. There are still some key watch points for all crops in relation to the weather.

Global grain markets

Maize

The bearish maize picture presented by the USDA has seen prices pull back. There are still concerns around Brazilian maize and a number of private estimates remain tighter than the view of the USDA and Conab.

Global grain futures

Barley

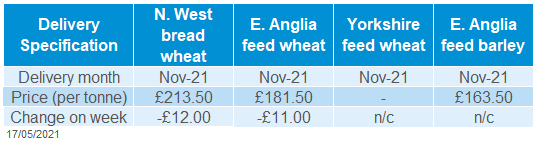

Barley continues to take the lead from other feed grains. New crop (Nov-21) feed barley, delivered East Anglia was quoted on Friday at an £18.00/t discount to feed wheat.

UK focus

Delivered cereals

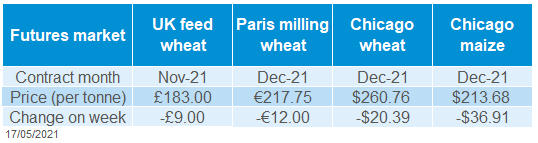

Last week was a turbulent one for grain markets. Key data releases combined with fund activity to drive a volatile week for prices. Chicago maize futures (Dec-21), which have been a key driver of the global grain rally in recent months, lost 14.7% Friday-Friday.

One of the key reports released last week was the USDA world supply and demand estimates (WASDE). Published on Wednesday, the report gave the USDA’s first official view of new crop (2021/22) supply and demand. Both supply and use of maize are expected to hit record level in 2021/22. Despite that, global stocks-to-use of maize is seen increasing slightly.

For wheat, despite increases in the production and stocks outlook, global stocks-to-use is seen tightening. There are some key watch points in the report, including Russian wheat production, which seems high, and Brazilian old crop (2020/21) maize production. You can read more on the WASDE in last week’s Grain Market Daily publications.

Last week also saw the release of the latest Brazilian safrinha maize output forecast from Conab. The report pegged total maize production for 2020/21 at 106.4Mt, down 3.4% on the previous report. It is the view of Conab that crops continued to develop well in the period to the latest report. However, rainfall, particularly in the Brazilian Midwest (64% of safrinha maize acreage), will need watching very closely.

On the demand side, China have cancelled 334Kt of old crop maize exports from the US, in the week ending 6 May. However, new crop purchases of US maize last week totalled 3.7Mt.

Finally, in the week to 11 May, managed money funds trimmed their net long position in Chicago maize futures by 3.2% percentage points, contributing to the pull back in prices.

Oilseeds

UK feed wheat futures (Nov-21) fell back £9.00/t over the course of last week, closing at £183.00/t on Friday. The decline in global grain markets was a key driver for the fall in UK wheat prices, as were gains in the value of sterling against both the euro and the dollar. Old crop futures continued to make gains, as the May-21 contract draws to a close.

This week domestic markets will continue to be focused on global trends, particularly weather and planting/crop progress in North America.

UK physical prices followed the trends in futures last week (Thurs-Thurs). North West milling wheat (Nov-21) was quoted at £213.50/t, down £12.00/t. Feed wheat delivered into East Anglia (Nov-21) was quoted at £181.50/t, down £11.00/t.

Global oilseed markets

Global oilseed futures

Rapeseed

Supply tightness in old crop markets has supported prices to near record levels. This looks set to continue with another 6Mt+ import requirement for the EU-27 next season.

Soyabeans

Despite a degree of market correction last week, sentiment remains bullish for soyabeans. US supply balances look tight next season, with weather news a watch point for the developing US crop.

Rapeseed focus

UK delivered oilseed prices

Oilseed markets took a breather last week, leading to declines in new crop soyabean futures and delivered rapeseed prices. Old crop soyabean futures fared better, falling less, owing to a tighter supply balance at present and continued strength in vegetable oil markets.

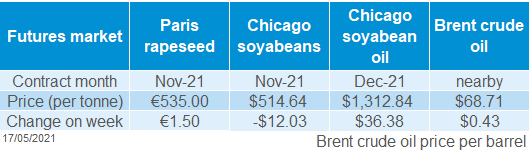

From Friday to Friday, old crop US soyabeans (Jul-21) lost $1.28/t to $582.79/t (£413.83/t), whereas new crop (Nov-21) lost $12.03/t to $514.64/t (£365.43/t) over the same period.

Losses were seen following the release of the USDA WASDE report last Wednesday. US ending stock figures were above market expectations, but remain fairly tight. Ending stocks in 2020/21 at 3.25Mt are at their lowest since 2013/14.

Last Friday, analysis firm IHS Markit estimated US soyabean acreage at 88.5Ma, down from its previous estimate of 89.7Ma. The new estimate remains higher than the current USDA intentions of 87.6Ma. The next US planting progress report is due out this afternoon. Last week saw soyabean planting progressing well, up 20 percentage points on the five year average.

Nearby palm oil futures hit their highest point since 2012 on 7 May and continued to show strength last week. Prices were aided by supply concerns derived from harvest loses. Exports of Malaysian palm oil products for the first half of May increased 18.8% from April figures.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.