Markets drop on post-USDA profit-taking: Grain market daily

Friday, 14 May 2021

Market commentary

- Grain markets fell sharply again yesterday led by the US markets (see below). Nov-21 UK feed wheat futures fell £6.75/t to £180.25/t, while the Nov-22 contract fell £1.40/t to £166.50/t.

- Old crop UK feed wheat futures resisted the fall, but this is likely due to technical factors. The last trading day for May-21 is next Friday and it still has an unusually high 1,485 open contracts, which need to be tendered against or settled by then.

- Paris rapeseed prices also fell yesterday, under pressure from falling soyabean prices. The Nov-21 contract fell €19.50/t from Wednesday’s new contract to close at €522.75/t (£449.89/t). Nov-22 futures fell by €3.00/t to €439.50/t (£378.25/t).

- Also adding pressure to the US prices is a problem with a bridge on the Mississippi River, which has halted water traffic (Refintiv). This route is crucial for grain and oilseeds moving for export from the US Gulf and could delay shipments.

Markets drop on post-USDA profit-taking

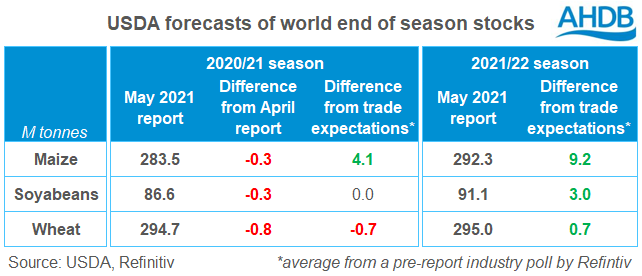

Grain and oilseed futures prices fell yesterday, as speculative traders continue to book profits. The estimates in Wednesday’s USDA report for US and World 2021/22 stocks plus the 2020/21 South American crops, were all in line with, or above, industry expectations.

The USDA predicts big US maize and soyabean crops in 2021/22, which would be the second and third highest on record, respectively. To do this it uses a ‘trend’ yield. It seems likely that the forecast sharp rises in US production contributed to the higher than expected stock predictions.

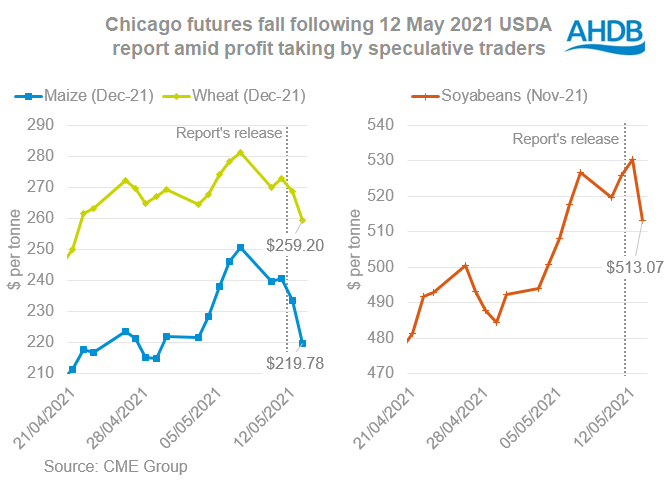

Prices for wheat, maize and soyabeans had all risen sharply in the run-up to the USDA report, amid crop worries and strong demand. Speculative traders have bought heavily into the Chicago futures markets in recent months as prices have risen.

The USDA estimates matching industry expectations prompted speculative traders to sell off some of their long positions. This contributed to a fall in prices, which in turn has likely triggered further selling.

Yesterday was the second day of grain prices declines. Oilseed prices rose on Wednesday after the report’s release, but momentum shifted yesterday and they too fell sharply.

Where next?

It could take a few more days for the dust to settle as the market continues to digest the report. Where prices go after that depends largely on the weather. Even if the all the USDA’s projections are confirmed, global stocks of grain and oilseeds will only rise slightly compared to demand. As Anthony highlighted yesterday, this leaves little room for error in terms of adverse weather.

In particular, we will be watching:

- US weather: The forecast record US maize and near-record soyabean yields require good weather through to harvest. The forecast looks more favourable: warmer and wetter. But, weather in July and August, when crops are in their reproductive and grain/pod fill stages, is critical.

- Changes in Russian wheat forecast: The USDA’s forecast for the Russian 2021 wheat crop at 85.0Mt (excluding Crimea) is above some industry forecasts and only slightly down on last year’s 85.4Mt. Meanwhile, SovEcon pegs the crop at 81.7Mt including Crimea. But, this is 1.0Mt higher than the company predicted previously.

- The continued dryness in Brazil: For Brazil, the 2020/21 maize crop estimate form the USDA is still above some industry forecasters, though below Conab. More dry weather is expected over the next couple of weeks.

- South American planted area/intentions: Record 2021/22 South American maize and soyabean crops will likely depend on a combination of larger areas and yields. But, it’s important to remember these crops won’t be planted until this autumn.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.