Market Report - 12 April 2021

Monday, 12 April 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Planting and Variety Survey

The AHDB Spring Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. In a post-subsidy world impartial information and data is key to give a view of domestic food and feed production. This data can help with regional strategies and marketing decisions.

Play a part in creating accurate data for your industry by completing the planting survey form, click here to complete the form. Five minutes of your time can provide huge value to our great industry.

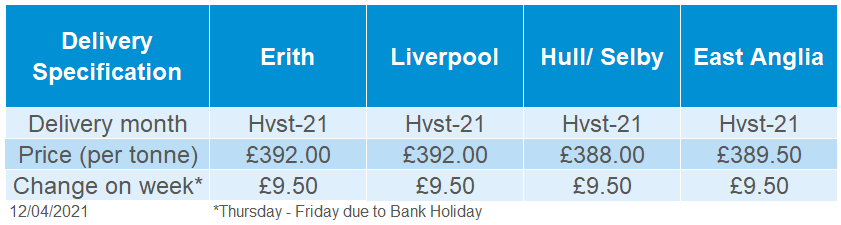

New crop delivered rapeseed (Harvest-21, Erith) were quoted at £392.00/t on Friday, gaining £9.50/t on last Thursday’s quote of £382.50/t.

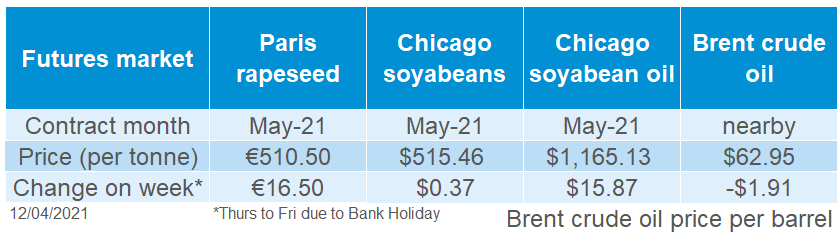

This shadowed gains in Paris rapeseed futures as the nearby May contract gained €16.50/t across the week to close Friday at €510.50/t.

Gains domestically were constrained as sterling weakened significantly across the week (-2.0%) against the euro to close Friday £1 = €1.1517 (Refinitiv).

Canadian ICE canola futures (Nov-21) closed Friday at CA$629.20/t, gaining CA$11.30/t across the week. New crops futures rose as dry conditions posed a risk to crops being planted this spring. Soil moisture across the Prairies is a key watch point, for when the crops are sown in May and June.

Global grain markets

Global grain futures

Wheat

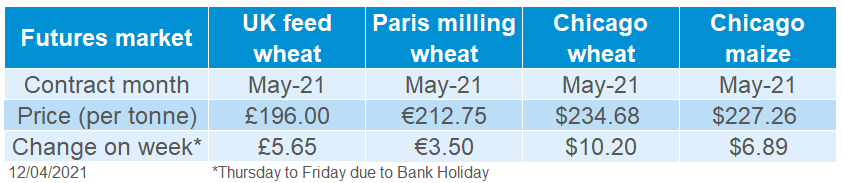

Wheat fundamentals are currently more bearish than maize, however strong maize prices should provide wheat markets with some support, in both the short and medium-term.

Maize

Maize continues to be well supported and this looks set to continue to into the new season. Supplies are currently tight, pushing Chicago futures up to multi-year highs. However, it is key to remember that continued Chinese purchasing will be key to keeping this market underpinned.

UK focus

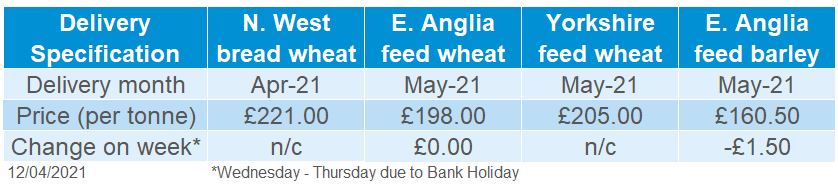

Barley

UK barley is not competitive on the export market but, domestic demand remains strong due to its large discount to wheat and maize. This demand is expected to start to ease as we move through the spring.

Delivered cereals

In Friday’s USDA supply and demand report, maize stocks were cut to their lowest levels in 7 years due to a forecast increase in consumption and increased exports. This caused maize futures to rally to almost an 8-year high. However, it was a bearish report for wheat due to an expected rise in Russian production for harvest 2021.

China’s Ministry of Agriculture raised its maize import forecast for the 2020/21 season to more than double the previous forecast. Imports are now expected to total 22Mt, up from 10Mt last month. Despite this large jump, a report released alongside this increase said that supply and demand should stay relatively balanced in the short term, and so prices are unlikely to be effected. The USDA already has full season imports at 24Mt.

US wheat futures rallied on Thursday as dryness in the north of the US continues to cause concern, ahead of spring wheat plantings. The USDA’s first crop progress report, last Monday, showed that 35% of the area’s topsoil moisture levels were short or very short, versus just 8% at the same time last year. The report also had the first condition ratings of 2021 for winter wheat. 53% was rated “good” or “excellent”, behind the 62% this time last year.

Russia’s agricultural consultancy, Sovecon, increased its Russian wheat production for harvest 2021 to 80.7Mt. This was an increase of 1.4Mt from the previous estimate and was down to improving conditions in the south of the country.

Oilseeds

UK old crop (May-21) wheat futures closed at £194.00/t on Friday 09 April, gaining £5.65/t from Thursday 01 April. Over the same time period, new crop (Nov-21) futures also gained, although not to the same extent, up £4.25/t, to close on Friday at £167.50/t.

On Wednesday, AHDB released the domestic crop progress report as at end-March. Crop conditions were notably better than the previous year. Winter wheat had 63% rated in “good” or “excellent” condition, compared with 49% at this time last year. Winter barley was rated 60% “good” or “excellent” compared with 45% the previous year.

As at end-March it is thought that 70% of intended spring wheat area had been planted, and 40% of intended spring barley area. An estimated 12% of spring wheat had emerged, all rated in “good” condition, whilst 6% of spring barley had emerged and all was in “good” or “excellent” condition.

Global oilseed markets

Global oilseed futures

Rapeseed

Old crop rapeseed is expected to be relatively supported for the rest of this marketing year. New crop values could be supported due to limited EU supplies. However, prices will depend on the greater oilseed complex as we head into 2021/22.

Soyabeans

Global stocks are higher than anticipated for this marketing year, but stocks remain tight in the US, which will support values. Global demand remains strong and there is a lot of weather yet to determine new-crop values.

Rapeseed focus

UK delivered oilseed prices

Chicago soyabeans futures (May-21) closed Friday at $515.46/t, relatively unchanged across the week. However, the bearish news in the latest USDA supply & demand estimates, which were released last Friday, could start to pressure prices.

Higher than expected global stockpiles were reported in the April USDA report. This was due to an increase in soyabean production Brazil and Argentina, which the USDA now forecast production at 136.0Mt and 47.5Mt, respectively. Due to these increases, global ending soyabeans stocks were revised up 3.1Mt to 86.9Mt, higher than the trade estimate of 83.5Mt (Refinitiv).

Despite this US stocks are expected to remain tight, so spring plantings in the US will be a close watchpoint in the coming month.

Export demand for US soyabeans is slowing as global purchasers shift their buying to South America as the harvest in Brazil progresses. Conab estimate that as at 03 April the soyabean harvest was 79% complete.

On Friday, the Brazilian government temporarily reduced its biodiesel blending mandate to 10% from 13%. This reduction in blending is due to higher soyabean prices. Although Brazilian supplies are forecast to be high this season, US stocks remain tight and consumption in China is growing.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.