Market Report - 10 May 2021

Monday, 10 May 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

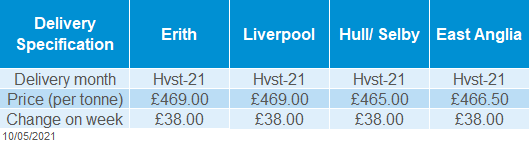

UK oilseed rape prices firmed considerably last week. Delivered prices (Erith, harvest) firmed £38.00/t, quoted at £469.00/t on Friday. November prices (Erith) also gained £38.00/t, to £477.00/t. These are the highest prices we have ever quoted in our delivered oilseed survey, which dates back to July 2004.

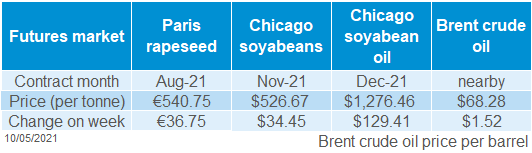

Rising UK prices followed Paris markets, new crop rapeseed futures (Aug-21) gained €36.75/t week-on-week, closing at €540.75 on Friday. Values firmed on the back of weather issues and supply concerns in South America. Cold weather in the UK and EU are also adding to supply worries.

End-March Canadian canola stock were down 37.7% compared with the previous year. This is due to increased demand because of the coronavirus pandemic, and reduced supply for some key exporters.

Wheat

Large gains in maize markets provides incentive for wheat usage in global feed rations, as price margins narrow. Much needed rainfall in the UK over the last week will help allay some previously held dryness concerns.

Global grain markets

Maize

Maize markets await the publication of two key reports on Wednesday, including new crop (2021/22) supply and demand figures. The first US new-crop maize purchase by China last week provides initial indications of longer term purchasing by China.

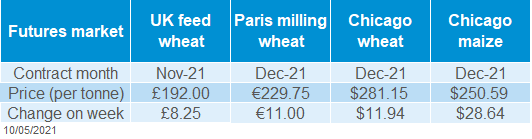

Global grain futures

Barley

Gains in global grain markets provide support for barley prices. French winter barley condition ratings fell 1 percentage point on the week, rated at 77% ‘good’ or ‘very good’.

UK focus

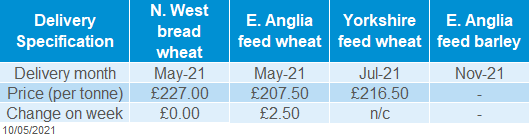

Delivered cereals

Grain markets went from strength to strength last week, UK Nov-21 wheat futures gained £8.25/t, in the week to 07 May. Price support was mainly led by new crop concerns for Brazil’s maize crop.

Prices were also supported by Chinese purchases of US maize and the declining quality of France’s soft wheat crop, now at 79% ‘good’ or ‘very good’.

In its first purchases of US new crop maize, China booked 1.36Mt for delivery next season. This signifies China’s intention to purchase large volumes for next season, even at current high prices.

The big news due this week is the next instalment of the USDA global supply and demand estimates report (WASDE), on 12 May. This will include first estimates of the 2021/22 season.

The 2020/21 Brazilian maize crop is also expected to see cuts as a result of the dryness afflicting the country at present. The Brazilian government firm Conab will also release its maize production estimates on Wednesday. These reports are likely to be key to price moves after publication.

Chinese maize production for 2021 is forecast to rise 4.3% to 272Mt. This is due to a 3.3% increase in planted area, according to China National Grain & Oils Information Centre (CNGOIC). If realised, this will likely affect the country’s import requirement for next season.

Oilseeds

Gains in global grain markets last week brought healthy support to both UK wheat futures and UK delivered wheat prices. Delivered prices for new crop saw the largest gains, echoing gains in UK Nov-21 futures. Feed wheat delivered into East Anglia, for harvest delivery, was quoted at £188.00/t as at 06 May, up £9.50/t.

The UK Nov-21 futures contract has dropped £5.40/t this morning to £186.60/t (as at midday), on profit taking and strength in sterling. In the run-up to the WASDE release on Wednesday it is likely that we will see a degree of repositioning by funds, impacting prices.

Human and Industrial cereal usage figures for March-21 were released last week. Milling of imported wheat was at 126.7Kt, up 4% on the month. Imported supplies have been an increased focus for millers this season, with season-to-March usage at 1.13Mt, up 92% on the year.

Global oilseed markets

Global oilseed futures

Rapeseed

Prices remain supported by strong soyabean prices, as well as ongoing concerns about new crop supply for both rapeseed and soyabeans.

Soyabeans

Adverse weather in both North and South America continue to create question marks for global supply keeping markets supported.

Rapeseed focus

UK delivered oilseed prices

Chicago soyabeans (Nov-21) gained $34.45/t week-on-week, closing on Friday at $526.67/t hitting over 8-year highs. Dry weather in Brazil continues to cause supply concerns, combined with ongoing strong demand from China.

Soyabean imports by China, for April, jumped 11% year on year, to 7.45Mt. This is likely due to a delay in cargos arriving from Brazil, which should have arrived in March. Imports for May are likely to be even greater as they reach the peak of Brazilian shipments. Demand is set to remain strong as China continue to rebuild their pig herd and build stocks.

Malaysian palm oil futures gained 5% on Friday, the largest weekly gain since 2001, to reach their highest level since 2008. Palm oil continues to be supported by the global rally in commodity prices, as well as being underpinned by growing concerns in supply globally.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.