Market Report - 07 December 2020

Monday, 7 December 2020

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK delivered rapeseed (into Erith) gained £2.00/t on the week to be quoted at £375.00/t for Feb-21 delivery. Ongoing EU exit negotiations will play a part in future price direction with currency markets watching especially closely. Gains in UK delivered prices came primarily from a weakening sterling against the euro.

Paris rapeseed futures (Feb-21) lost €4.75/t from Friday-Friday last week to close at €409.25/t (£369.14/t).

Stratégie Grains estimate EU + UK rapeseed production could reach 18.20Mt next season, an increase of 1.0Mt from the very low production seen this season.

The AHDB crop conditions report released on Friday indicated domestic rapeseed crops were in a much better state going into December than last year. An estimated 77% of the winter OSR crop was in ‘good’ to ‘excellent’ condition at the end of November.

Global grain markets

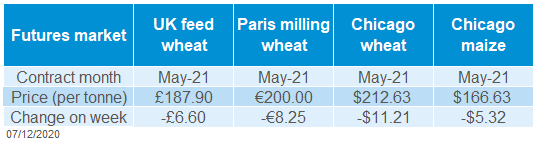

Global grain futures

Wheat

There will be less crop news in the weeks ahead as northern hemisphere crops enter winter dormancy. As such, prices seem more likely to be driven news about demand and trade, plus economics and politics.

Maize

Recent rain in South America has helped crops in the short term, taking some of the heat out of the market but more is needed. Global maize supplies are already tight, keeping an underlying level of support in maize and so feed grain markets.

UK focus

Barley

Barley’s fortunes continue to largely depend on those for wheat and maize because of large global barley crops. While feed demand is up, the outlook for malting demand remains gloomy until COVID restrictions are lifted.

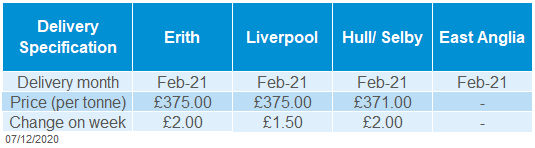

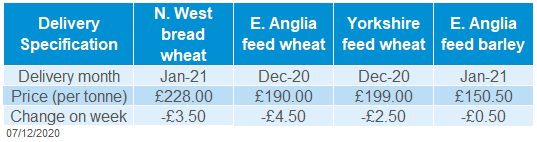

Delivered cereals

Grain prices fell last week due to better supply prospects for wheat and rain for maize crops in South America. The price falls were compounded amid profit taking by speculative traders in the Chicago markets, especially wheat. Speculative traders returned to a net short position in wheat for the first time since August.

The estimate of Australia’s 2020/21 wheat crop was increased by another 2.3Mt last week by their government. Meanwhile, Canada’s wheat crop was confirmed by Statistics Canada as the largest in seven years. Russia’s export quota for February to June could also be increased by 1Mt.

These three factors add to the confidence in global wheat supplies this season. There are still worries about 2021/22 wheat crops but large stocks would partly cushion a possible fall in production.

Maize prices fell less than wheat prices, as global maize demand is already expected to exceed supply this season. Also, while the rain in South America is welcome, more will be needed and the biggest (Safrinha) maize crops won’t be planted until after the soyabean harvest.

The next forecasts of global supply and demand from the USDA are out on Thursday night. These could influence prices, but the key factors for markets remain South American weather and the rate of import buying, especially by China. More rain is expected for the some of the key growing areas in Brazil this week but parts of Argentina are expected to remain mostly dry.

Oilseeds

UK feed wheat futures prices fell last week, following the global trend.

Prices for bread and feed wheat delivered in GB fell by a similar amount to futures prices Thursday to Thursday. However, prices for delivered feed barley were only slightly lower over the same period.

More barley (+43%) and maize (+51%) but less wheat (-17%) continued to be used to produce GB animal feed in October, compared with the same period in 2019.

Barley usage by UK brewers, maltsters and distillers from July to October decreased by 13% year on year. Since the end of October tighter COVID restrictions have been introduced across the UK, limiting demand for malting barley in November and December.

AHDB’s crop condition report showed GB winter cereals for harvest 2021 were off to a much better start than a year ago. Despite rain in October still bringing challenges, the vast majority of crops had been drilled by the end of November.

Currency will be a key influence on UK prices this week, which is an important one for the EU-UK trade negotiations. At midday today sterling was sharply down against the euro, trading around £1 = €1.0943, compared to £1 = €1.1089 at Friday’s close (Refinitiv).

Global oilseed markets

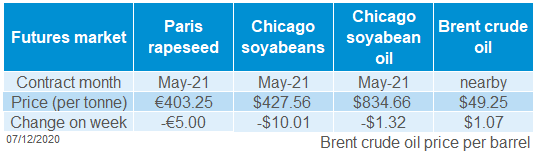

Global oilseed futures

Rapeseed

A weakening sterling provides some protection from declines in EU rapeseed prices. EU rapeseed production for 2021/22 is forecast to recover slightly from the lows seen last season.

Soyabeans

Smaller Chinese purchases of US soyabeans last week cast a somewhat bearish tone to oilseed markets. However, some bullish sentiment is seen from crop condition reports in Southern Brazil.

Rapeseed focus

UK delivered oilseed prices

Chicago soyabean markets saw declines last week after approaching the important $12.00/bushel mark. The Jan-21 contract closed on Friday at $11.63/bsh ($427.33/t, £318.02/t).

Weekly US net export sales of soyabeans, at 406.9Kt in the week ending 26 Nov for 2020/21 delivery, were the lowest weekly volume for the marketing year so far. Sales were down 47% from the previous week, which itself was a previous new low for the marketing year, indicating perhaps a touch on the brakes for Chinese purchasers.

There is some mildly bullish news for soyabean markets. The southern Brazilian state of Parana, a top soya producing region, reported that 72% soyabeans in the region were rated in good condition, with 4% in poor condition. This is down from 81% in good condition last year for this point and is the lowest ‘good’ rating for five years. Rainfall is needed across Brazil for the crop to reach its 133.0Mt USDA estimate.

Commodity markets will be looking to this Thursday (10 Dec) for the next world supply and demand estimates (WASDE) by the USDA. Reductions to production figures will provide support to oilseed markets.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.