Market Report - 04 January 2021

Monday, 4 January 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

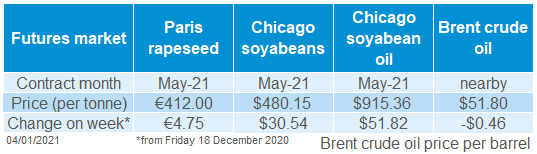

From Thursday (24 December) to Thursday (31 December), Paris rapeseed futures (Feb-21) gained €3.75/t to close at €418.25/t (£373.59/t), this a life-of-contract high.

A strengthened sterling over the last week of 2020 meant gains in domestic markets were less so. The resolution to EU-exit talks with a deal pushed sterling above the £1=€1.11 point.

Canadian canola futures (Mar-21) reached a life-of-contract high of $637.00/t (£365.97/t) on 30 December, tracking gains in wider oilseed markets.

As of 21 December, EU imports of non-EU rapeseed had totalled 3.24Mt, with 60% derived from Ukraine and 36.4% as Canadian origin. Imports are forecast to reach 5.9Mt this season, according to Stratégie Grains.

Global grain markets

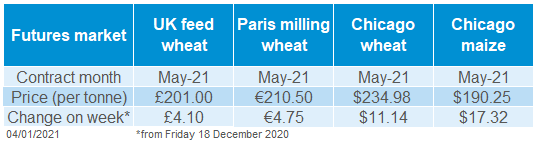

Global grain futures

Wheat

The maize market is currently a key influence on wheat prices because the global wheat market is well supplied in 2020/21. Early insights into 2021/22 wheat crops will be increasingly important in the weeks ahead.

Maize

Suspended exports from Argentina increases demand for maize from Brazil and the US, pushing up global prices. Weather across South America will be a key factor for prices over the coming months.

UK focus

Barley

Barley prices continue to take their lead from wheat. The UK-EU trade deal supports the potential for continued UK barley exports to the bloc in the second half of 2020/21.

Delivered cereals

Maize prices are far higher than they were before the Christmas holidays. The biggest gains were in the final days of 2020 on Argentine export restrictions and strong US export sales. Nearby Chicago maize prices hit a six and half year high on 31 December.

Argentina has suspended exports of maize until 28 February to protect domestic supplies. The country is battling food price inflation and a shrinking economy, partly due to the coronavirus pandemic. Argentina accounted for 22% of global maize exports in 2019/20 (USDA).

Dry weather is also forecast across much of South America for the next two weeks. Recent rainfall supported crop development and planting. A return to drier weather could slow planting in Argentina and adversely impact developing crops. Earlier planted crops have started their pollination stage; this is critical for yields but very vulnerable to drought stress.

Global demand for maize is already expected to exceed supply this season. Any South American crop losses are likely to widen this deficit.

If this happens, more wheat may need to be used as animal feed globally in place of maize. This possibility is helping wheat prices to rise. Chicago wheat prices rose more than European prices due to short covering by speculative traders.

Oilseeds

May-21 UK feed wheat futures gained £4.10/t between 18 and 31 December. Yet, UK prices rose less than global prices, in part because sterling strengthened against both the euro and US dollar.

The UK 2020 wheat crop was even smaller than estimated last October. Defra’s final estimate is 9.658Mt, down 475Kt from October. Against 2019, this is a 40.5% decrease in production and the lowest UK wheat production figure since 1981. Most the decline is from lower yield estimates, but the area was also trimmed.

UK barley production was also cut by 246Kt from October to 8.117Mt.

The smaller crops confirm the UK’s dependence on imported grain in the 2020/21 season. The UK's free trade deal with the EU-27 means imports from this key trading partner continue without tariffs. But there will still be additional costs and AHDB analysis estimates these at 2% to 5% for crops.

Regional 2021 UK area intentions are now available after our Early Bird Survey was updated with the final 2020 Defra data. In all regions there is an estimated increase in wheat areas.

NB. Delivered prices will be collected and published again on 8 January 2021.

Rapeseed

Rapeseed markets have been tracking wider gains in soyabean and crude oil markets over the holiday period. Stricter coronavirus lockdown measures in the UK and across Europe could pressure prices.

Global oilseed markets

Soyabeans

Continued lack of substantial rainfall for Brazil and Argentina has worried markets over the condition of the soyabean crops. Demand from China looks set to continue over the near future, providing support for soyabean markets.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

From Thursday (24 Dec) to Thursday (31 Dec), Chicago soybeans (May-21) gained $16.17/t to close at $480.15/t (£351.17/t). The contract saw plenty of volume in the final three days of 2020, bolstered by dry weather fears for parts of South America and increased demand for soymeal.

Though areas of Brazil have received rains, it has mostly been in the form of scattered showers rather than the widespread rainfall that is typical for this part of the year. Soil moisture levels for key producing regions are below average. This, along with soyabean demand from China, has been a key bullish factor for markets for several weeks now.

Chinese demand seems set to continue too, with Chinese soyameal futures (May-21) hitting life-of-contract highs on 31 Dec. In the run-up to Chinese New Year on 12 February, soyabean demand could increase from the poultry sectors and the recovering pork herd.

Finally, Argentina’s export tax on soyabeans and other agricultural commodities will increase this month. The tax will be 33% for soyabeans. Back in October, the then-incoming political administration reduced export taxes to 30% for soyabeans to incentivise farmer selling. However, poorer weather conditions this season have meant an increased need to keep agricultural products in the country and the tax has slowly increased.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.