UK crop production cut further in Defra final June survey estimates: Grain market daily

Tuesday, 22 December 2020

Market Commentary

- UK feed wheat futures increased yesterday following a weakening of the pound sterling against the euro. The May-21 contract closed at £198.50/t, up £1.60/t. The Nov-21 also increased to £159.40/t yesterday, up £1.10/t.

- Following news of stricter lockdown measures for England and still uncertainty surrounding the EU-exit, sterling weakened against the US dollar and the Euro, quoted at £1=$1.3434 and £1=€1.0987 this morning.

- Worker strikes occurring across Argentine ports prevented more than 100 cargo ships from loading agricultural goods yesterday. Soyabean crushing factories have paused operations, and with ports on strike, this could stop agricultural exports over the near future.

UK crop production cut further in Defra final June survey estimates

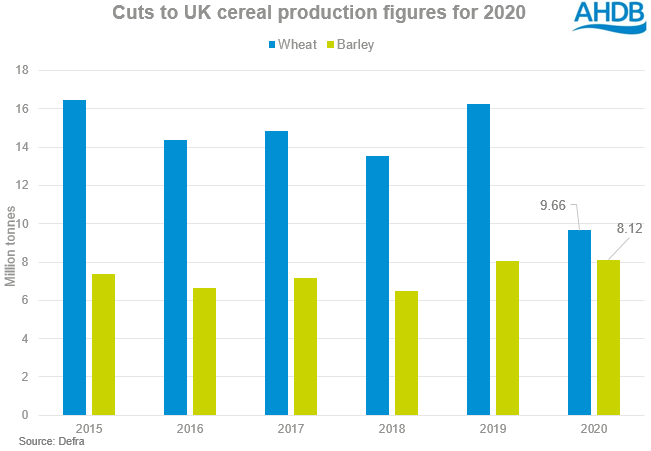

This morning, DEFRA released their final estimates for the 2020 UK crop, updating the provisional figures published in October. Reductions have been seen for wheat, barley and oilseed rape production.

The declines are most notable for wheat, with UK production now estimated at 9.658Mt, down 475Kt from estimates published in October. Against 2019, this is a 40.5% decrease in production year-on-year and would be the lowest UK wheat production figure since 1981.

Changes to the production figure arise from reductions to both the area and yield estimates. The wheat area is now estimated at 1.387Mha, down 28Kha from October, and is 23.6% below 2019 figures. In Defra’s figures, the English wheat area is cut 25Kha to 1.265Mha.

Primarily the decline in the wheat production estimate comes from updated yield estimates. Defra now pin the UK average yield at 7.0t/ha, down from 7.2t/ha published in October. This is a stark decline from the five year average of 8.4t/ha. With the new area and yield in mind, England accounts for an estimated 433Kt of the total 475Kt decline from the 10.1Mt figure published in October.

Barley too has seen its production figures cut, now estimated at 8.117Mt from 8.363Mt in October. This estimate remains above the five year average of 7.2Mt, and is reflective of a large increase in spring barley production figures year on year.

The decline in production can be mainly be attributed to changes to English area and UK winter barley yield figures. In the final release, the English spring barley area was cut 21Kha from October, giving a decline of 121.8Kt using the yield figure of 5.8t/ha estimated by Defra.

Scottish total barley production increased year-on-year by 7.4% to 2.086Mt. Scottish area and yield both increased by 3.5% and 3.2% respectively year-on-year. The area was estimated at 302Kha, the highest since 2015, whilst yield was estimated at 6.9t/ha.

The decrease in winter barley yield from 6.4t/ha estimated in October to 6.2t/ha in the final release, coupled with an area cut of 6Kha totals a decline of 89Kt in English winter barley production.

The cuts to wheat and barley figures will come as a surprise to some, and will mean reduced domestic availability. Having a sub-10Mt wheat crop confirmed spells an increase in import requirements and could support domestic prices. A slightly smaller barley crop lowers our exportable surplus and eases some pressure on domestic barley prices. The continued presence of EU-exit uncertainty leans heavily on trade with the 2021 import tariff situation for wheat still unclear at this late stage.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.