Margins squeezed as production costs rise and pig prices fall

Thursday, 26 November 2020

By Felicity Rusk

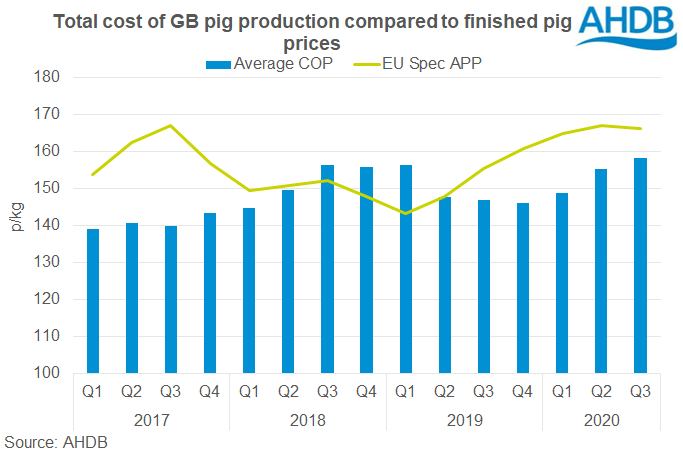

In Q3 2020, the estimated net margin for GB pig production was 8p/kg deadweight or £7/head. This was 4p/kg (or £3/head) less than in the previous quarter, according to our latest estimates.

Finished pig prices started to drop back in the third quarter of the year. Low prices in Europe, reflecting a combination of disrupted demand due to the pandemic, constrained slaughter capacity and some challenges exporting to China, ultimately also started to pressure prices here. The EU-spec APP averaged 166p/kg in Q3.

The average cost of GB pig production in Q3 was 158p/kg, 3p more than in the previous quarter. This was the highest quarterly production cost since 2013. Feed costs continued to rise in Q3, which accounted for the majority of the rise in production costs (+2p). Higher feed prices and increased feed usage both contributed to the rise in costs. ‘Other’ variable costs also recorded a slight uplift compared to the previous quarter (+1p). This was due to the sharp drop in cull sow prices, which made breeding costs more expensive.

GB finished pig prices have fallen further in recent weeks. The EU-spec APP was only about 159p/kg by early November, just above our estimated average production cost for Q3. However, feed prices have also been on the rise recently, reflecting the tighter domestic grain situation. In October, GB ex-farm prices for feed wheat averaged £180/tonne, £17 (11%) more than the average in July and £15 (9%) more than the average across Q3. With this in mind, it looks like average margins could now be entering negative territory.

The outlook is challenging for the British pork industry currently. Supplies available are testing demand levels, particularly as processors tackle lost efficiency as plants adhere to social distancing measures, while reports indicate pigs are backed up on farms. This, alongside the likelihood of more muted Christmas demand and ongoing low prices in wider Europe, will likely keep British prices under pressure in the coming weeks.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.