Malting premiums sharply lower on the year: Grain market daily

Tuesday, 3 September 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £181.45/t, up £0.20/t from Friday’s close. The May-25 contract ended the session at £194.65/t, up £1.10/t over the same period.

- Domestic wheat futures followed European wheat prices up yesterday. European markets remained underpinned by last week’s technical rebound, though any gains were limited, with US markets closed for the Labor Day federal holiday.

- Nov-24 Paris rapeseed futures closed at €471.25/t yesterday, gaining €1.00/t from Friday’s close. The May-25 contract gained €0.50/t over the same period, ending at €472.75/t.

- European rapeseed prices were supported yesterday following downward revisions to EU rapeseed and sunseed crop estimates. Stratégie Grains pegged this season’s EU rapeseed crop at 16.9 Mt yesterday, down 340 Kt on July’s figure. If confirmed, this would be down 15% on the year.

Malting premiums sharply lower on the year

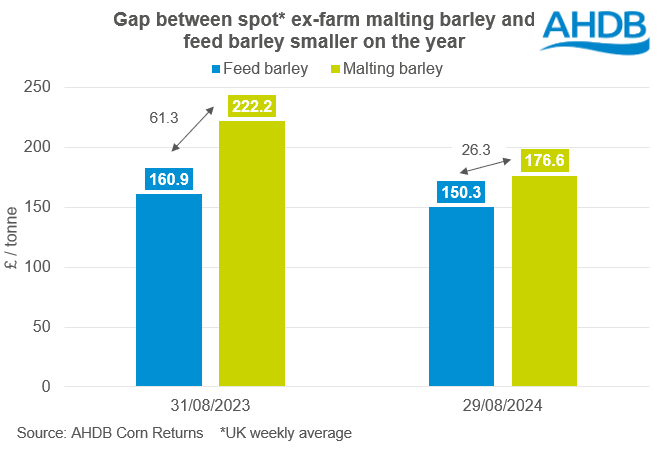

Ex-farm malting barley prices so far in 2024/25 are sharply lower than in the early months of last season (AHDB). In the Corn Returns for the week ending Thursday 29 August, premium malting barley for spot delivery averaged £176.60/t. This is notably lower than £222.20/t, the average for the last week of August 2023 (w/e 31 August 2023).

Last week’s price also equated to just £26.30/t more than the spot UK average feed barley price. A year ago, the gap between spot ex-farm premium malting and feed barley was over £60/t.

The fall in prices and premiums over feed barley comes as lower nitrogen (N) contents are being reported for malting barley in 2024. With the UK winter barley harvest complete, AHDB’s latest harvest report showed the nitrogen content of winter malting variety samples analysed to date are averaging 1.5% with a range of 1.3% to 1.6%.

While the spring barley harvest is at an earlier stage, 32% complete by 28 August, samples analysed so far also show a similar pattern. Spring barley samples so far are averaging 1.45% N, with the majority below 1.6% N despite being weighted to the South and East of England. The harvest in Scotland has begun but is still in its early stages.

While both winter and spring crops so far are reported to be useable within the UK, this could prove a challenge for exporting. Higher nitrogen levels are required for continental malting so the lower levels in the 2024 crop could mean more barley needs to find a home in the UK. This is likely contributing to ex-farm malting barley premiums over feed barley being notably lower than this time last year.

There is also provisionally a 6% larger barley area in England, which could translate into a larger UK area depending on the Scottish area. However, yields will be important and after a very encouraging start more variability in spring barley yield levels is emerging, so this will need to be monitored closely.

In addition, while lower nitrogen levels are also reported in France and Germany, there’s currently still an expectation that global malting barley supplies won’t be as tight as in 2023/24 (RMI Analytics). Unless this changes as harvests progress, this could limit the outlook for spot malting barley prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.