Malting barley premium returns to historical average: Grain market daily

Wednesday, 30 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £180.90/t yesterday, rising £1.95/t from Monday’s close. The May-25 contract also rose £1.95/t over the same period, to close at £194.70/t. Both contracts bounced back from multi-month lows, which for the Nov-24 contract was over seven months and the May-25 contract was over two months.

- UK feed wheat futures rose with global wheat markets as the first condition score for the US winter wheat crop was reported 38% in good or excellent condition, far below the average analyst estimate of 47% and the second poorest condition score for this time of year since 1986 (when records began).

- Paris rapeseed futures (Nov-24) closed at €509.25/t yesterday, rising €6.75/t from Monday’s close. The May-25 contract also rose €6.75/t over the same period, to close at €513.00/t.

- Paris rapeseed futures tracked gains across the wider vegetable oilseeds complex as concerns were raised regarding reduced palm oil production and lower domestic stocks in Malaysia. Despite a modest fall in Brent crude oil futures (Dec-24) during yesterday’s trading session (-0.4%), the contract appeared more firm after the 6% slide on Monday, also offering some support.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Malting barley premium returns to historical average

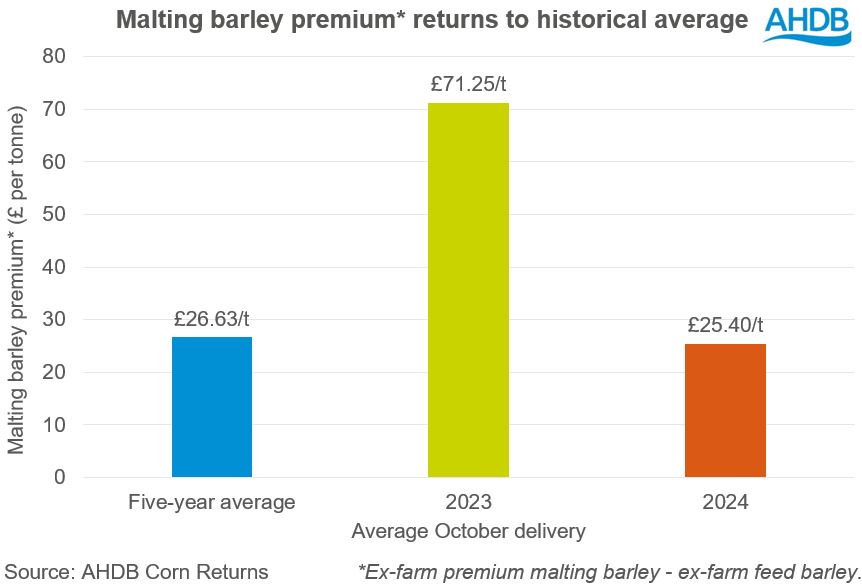

The malting barley premium has continued to come under pressure since it was last reported in September, falling back from the highs seen last year. Ample supply and relatively weaker demand are both key factors weighing on the premium this marketing year.

On Monday, the latest Corn Returns reported ex-farm premium malting barley for spot delivery at £175.40/t, while ex-farm feed barley was reported at £153.10/t, offering a premium of £22.30/t. This is starkly lower than last year, where the malting barley premium for October delivery was £71.25/t on average. However, 2023 was an exceptional year, the current premium is more of a return to the historical average as opposed to being historically low.

Greater domestic supply

The release of the English and Scottish cereal production figures confirmed expectations of a larger spring barley crop, both reported greater than their five-year average by 3% and 7% respectively. The UK’s barley crop is estimated at 7.2 Mt (4.8 Mt spring barley and 2.4 Mt winter barley), up from last year’s production of 7.0 Mt. In addition to greater supply, the spring crop also benefitted from more favourable weather during its development, leading to better quality too.

Lower domestic demand

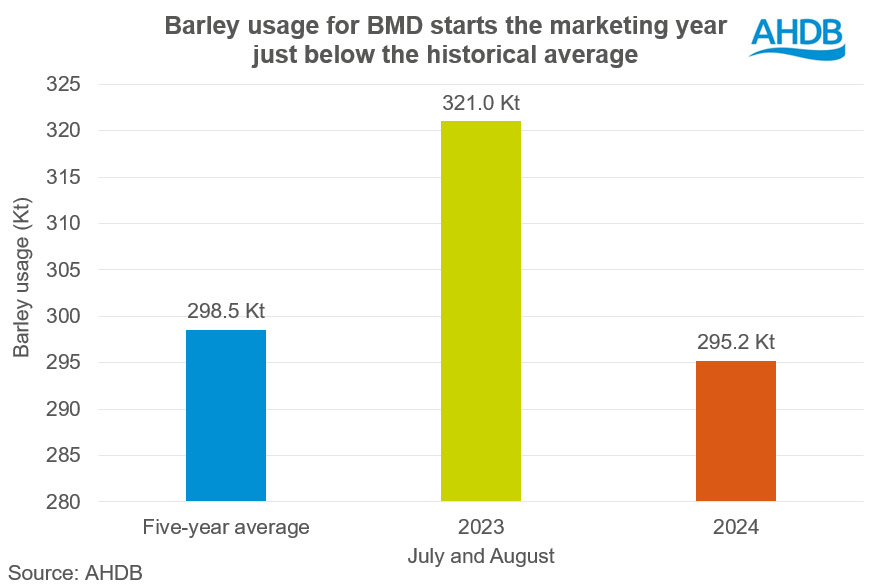

As reported in the 2024/25 Early Balance Sheet, domestic demand from the brewing, malting, and distilling (BMD) sector is expected to decline on the year following weaker consumption as well as maintenance for current production sites.

The latest UK human and industrial cereal usage report shows that the barley usage across the BMD sector is 8% down on the year for July and August. However, it’s worth mentioning that last year was an exceptionally strong start for the BMD sector, at 321 Kt for July and August, the greatest usage for that time frame since at least 2000. So far, barley usage for the BMD sector is more in line with historical demand.

Export market offering support

Given some strength in the EU malting barley market, and relatively low price in the UK, the export market is offering support to the premium. However, the recent strength in sterling over the euro is limiting how much support this market can offer.

How could the malting barley premium continue to price

Therefore, considering the current ample supply of malting barley and weaker BMD sector on the year, it is likely that the malting barley premium will continue to price at the historical average. If the premium contracts further, there is an increased likelihood that barley of malting specification could be used for animal feed as the risk of rejection and potential cost implications may exceed the return from the premium for some.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.