US winter wheat conditions poorer than expected: Grain market daily

Tuesday, 29 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £178.95/t, down £1.70/t on Friday’s close. The May-25 contract closed at £192.75/t, down £1.10/t over the same period.

- Domestic markets mirrored the decline in Chicago futures yesterday. The market faced pressure due to favourable weather in Russia and competitive exports from the region. Sovecon raised its October export estimate for Russia by 0.2 Mt to a potential new record of 5.0 Mt, up from 4.7 Mt last year.

- Nov-24 Paris rapeseed futures closed at €502.50/t yesterday, down €5.25/t from Friday’s close. The May-25 contract was down €5.50/t over the same period, ending at €506.25/t.

- European rapeseed prices followed the wider oilseeds complex down yesterday. Dec-24 Brent crude oil futures decreased 6.09% on Monday from Friday’s close. Accelerating soyabean planting in Brazil and historically high harvest pace in the US weighed on prices.

US winter wheat conditions poorer than expected

For the 2024/25 season, global wheat stocks are projected to decrease among major exporting countries, with many of the key exporters experiencing production cuts. However, the US wheat crop is forecast up on year earlier levels, and with a tight global balance, could play a significant role in influencing market trends going forward. Therefore, it is important to closely monitor US crop conditions.

After the US market closed yesterday, the USDA released its weekly crop progress report, which included the initial assessment of US winter wheat conditions. As at October 27, only 38% of US winter wheat was rated as good or excellent. This is notably lower than last year’s initial rating of 47% and the five-year average of 43.4%. It also fell short of the average analyst expectation of 47% (LSEG), and among the worst ever recorded at this time of the year, only above 2022.

In terms of crop development, the USDA recorded that winter wheat planting was 80% complete and 56% of the crop had emerged as at 27 October. This progress lags behind both last year’s pace and the five-year average.

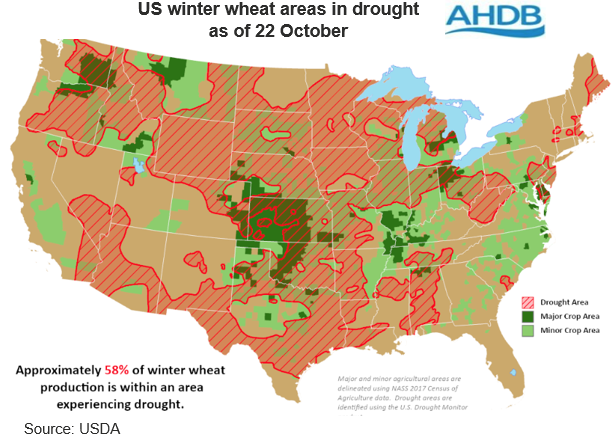

The poorer conditions of the US winter wheat crop are largely caused by lack of rainfall this year, raising concerns about crop yields for the 2025 harvest. In the past few weeks, the drought situation in the US has intensified, which could be linked to the La Niña weather event.

As at 22 October, the USDA reported that 58% of the US winter wheat area is experiencing drought. This is up from 52% the previous week and 47% two weeks earlier. Additionally, top winter wheat producing state of Kansas has 70% of its wheat area in drought.

Summary

While these reports offer valuable insights into the 2025 US wheat crop, it is important to remember that the season is only just beginning, with ample time for conditions to change. Forecasted rain in central parts of the country over the next week could help moderate some concerns about crop development. However, the crop’s overall poor condition compared to recent years could be a factor for markets in the coming days.

Longer term, ongoing concerns over global supply in 2025 means the market will remain reactive to any revisions in major producing countries. As such, US crop conditions will be in focus later in the year, and we could see some support if the crop does not improve.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.