Low specific weights a problem for wheat: Grain market daily

Friday, 17 September 2021

Market commentary

- UK feed wheat futures (Nov-21) continued to make gains yesterday. The Nov-21 contract closed yesterday at £190.65/t, up £0.70/t on the day. The May-22, and Nov-22 contracts both saw small declines, down £0.20/t and £0.05/t respectively, closing at £196.20/t and £178.00/t.

- Yesterday, Stratégie Grains cut its estimate of EU soft wheat production in 2021/22 by a further 2.4Mt, to 129.1Mt. EU soft wheat exports are pegged at 31.0Mt, 1.7Mt lower than in the organisations last report. Barley production in the EU is seen 700Kt lower, at 52.3Mt.

- Rapeseed plantings in France look set for a large increase. French oilseed growers group FOP, estimate that plantings of rapeseed could be up between 15-20% year-on-year, at 1.12Mha to 1.17Mha.

Low specific weights a problem for wheat

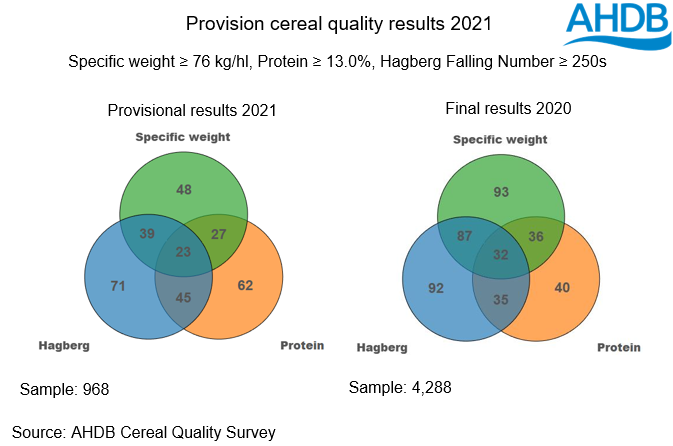

This year’s provisional GB Cereal Quality Survey results show domestic milling wheat varieties have exhibited low specific weights, so far this season. The results of the Cereal Quality Survey captures data to 7 September.

With inclement weather throughout summer this year, grain filling was seemingly affected. The average specific weight of UK flour millers Group 1 varieties, at 75.4kg/hl, is the lowest since 2012 (70.7kg/hl). Beyond 2012, you must look back to 2004 for the last time the average specific weight of Group 1 samples failed to meet the milling specification of greater than or equal to 76kg/hl.

Looking at other quality measures, wheat proteins are averaging 13.3% across Group 1 samples. The average of the Hagberg Falling Number is 286s, the lowest start to the Cereal Quality Survey results since 2017. This arguably reflects the stop-start nature of this year’s harvest.

It is important to look at the proportion of Group 1 samples meeting a “typical” Group 1 specification (specific weight ≥76kg/hl, HFN ≥250s, protein ≥13.0%). The proportion meeting specification at 23%, is down nine percentage points on last season.

The early signs of challenging quality for UK millers this season, supports the strength we’ve seen in milling premiums so far. So far in September, ex-farm milling premiums are the highest they’ve been for six years.

Barley nitrogen content down, year-on-year

Nitrogen in spring barley samples is significantly lower year-on-year. The average nitrogen content of spring barley samples, at 1.45%, is down 0.38 percentage points from the first survey results last year. It is worth noting that there is a high volume of Scottish samples included, which were not seen this time last season. The lower nitrogen requirement for distilling markets, a key part of Scottish barley demand, is likely pulling the average down.

Average specific weights across both winter and spring samples are down year-on-year. Again, this may reflect the large volume of Scottish samples included in the data.

Screenings are notably high this year. In winter barley, the proportion of barley retained by a 2.5mm sieve is 85.3%, this is 8.9 percentage points lower than the same point last season. Screenings in spring barley samples are better, but still down on last year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.