Largest GB wheat crop since 2015: Grain Market Daily

Friday, 30 August 2019

Market Commentary

- The International Grains council (IGC) increased its estimate for wheat production yesterday to 764Mt (+1Mt). Globally the wheat market remains well supplied with conditions looking good for wheat crops across the globe.

- UK feed wheat futures (Nov-19) dropped marginally yesterday to £131.85/t. Declines in global wheat futures were offset by further weakening of sterling yesterday with political uncertainty driving currency movements

- The dry weather last week allowed for good harvest progress to be made. The wheat harvest is now 79% complete, with yields 6-8% above the five year average (read more below).

Largest GB wheat crop since 2015

- Dry weather meant that good progress was made with 79% of wheat and 62% of spring barley now cleared.

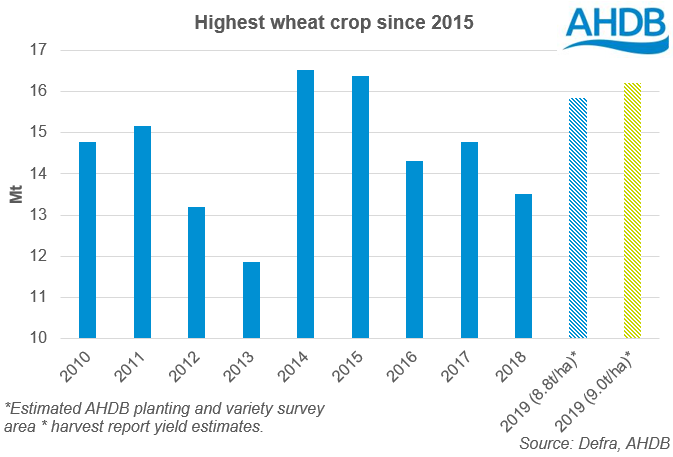

- Wheat yields coming in at 8.8-9.0 (6-8% above average), estimated production is the highest since 2015 at 15.9-16.2Mt.

- The oilseed rape yield estimate has increased following harvests in the north of England and Scotland. As such, production is now estimated at 1.64Mt to 1.80Mt.

The good weather over the past week has allowed for swift progress to be made with the GB wheat harvest, estimated at 79% harvested by week ending 27 August. The 875Kha harvested is the largest wheat area cleared in a single week since records going back to 2008.

Clearance of spring barley was also well underway with 62% now complete. The winter barley and oilseed rape harvest have now all but drawn to a close. The oilseed rape yield estimate has increased following harvests in the north of England and Scotland. As such, production is now estimated at 1.64Mt to 1.80Mt.

Yields for wheat crops are currently looking good, averaging 8.8-9.0t/ha, 6-8% above the five year average (8.3t/ha). On farm yields for winter wheat have ranged from 6.0t/ha to 14.5t/ha.

Working off area estimates in the AHDB planting and variety survey this means that production could be between 15.9Mt and 16.2Mt. If realised this would be the largest wheat crop since 2015 and 17-20% above last year’s drought hit crop.

There is the potential for a large exportable surplus of both wheat and barley which will need to find homes. With tariffs into the EU in the event of a no deal Brexit, the state of play after October is highly uncertain.

Click here for more on the implications of a no deal Brexit on barley trade.

Globally the wheat market remains well supplied and there appears to be little upside from a fundamental standpoint. Domestically pricing will remain highly driven by exchange rates. The continual uncertainty and possibility of a parliamentary shutdown has meant that sterling has weakened over the past few days.

Sterling has recovered slightly today following 2 days of declines against the dollar, trading at £1=$1.2183 as at 11am this morning.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.