June dairy market review

Wednesday, 13 July 2022

By Patty Clayton

Milk production

GB milk deliveries for the peak month of May totalled 1,139 million litres, 1.5% behind May 2021. June fared little better, with production down 2.1% on the year at 1,045m litres.

Our latest forecast has been updated to reflect the lower yields, bringing expected production for the 2022/23 season to 12.23bn litres, 1.0% below 2021/22. High input costs continue to challenge farm budgets, and despite rising milk prices, production remains down year on year.

Global milk production also remains low, with May deliveries estimated to be down 1.8% year on year. With the exception of Argentina, deliveries in all key regions were down year on year in May. The EU saw the largest deficit, but this was partly due to comparably high deliveries in 2021.

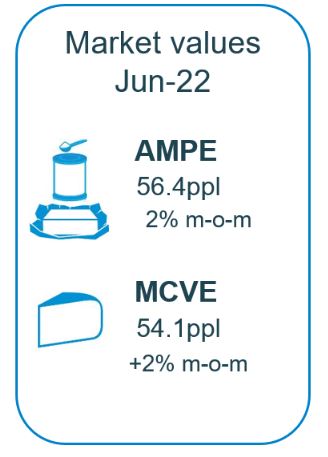

Wholesale markets

Wholesale prices firmed again in June as production passed peak and started its seasonal decline. Overall, prices were up from May, with cream seeing the largest monthly jump due to more limited availability.

In turn, both market indicators moved up by 2% in June, pulling up the average milk market value (MMV) by 1.03ppl. Firmness in wholesale markets continues to provide support for farmgate milk prices, although returns to processors are also being diluted by higher processing costs. These have now been incorporated into our market indicators to account for Q1 2022 inflation.

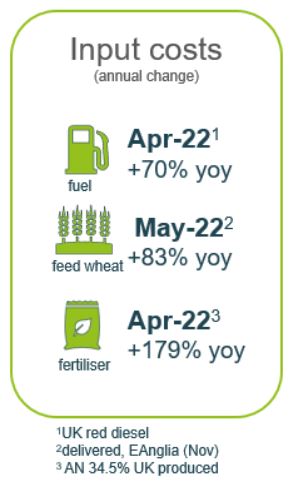

Farmgate prices and input costs

Farmgate prices in GB have seen significant increases so far in 2022, up by more than 12ppl on average. The GB average price in May for all milk was 39.8ppl, with more price increases yet to be applied for June and July.

Despite this, recent farm input data shows there has been no ‘net’ benefit to farm finances from the higher prices, as they have increased at roughly the same rate as agricultural input costs so far in 2022. With many farmers likely still working to fully recover the relatively large cost increase from late last year, when milk price increases were lagging, there is little incentive to push for higher yields.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.