Japanese pork imports falling slightly

Thursday, 19 August 2021

By Bethan Wilkins

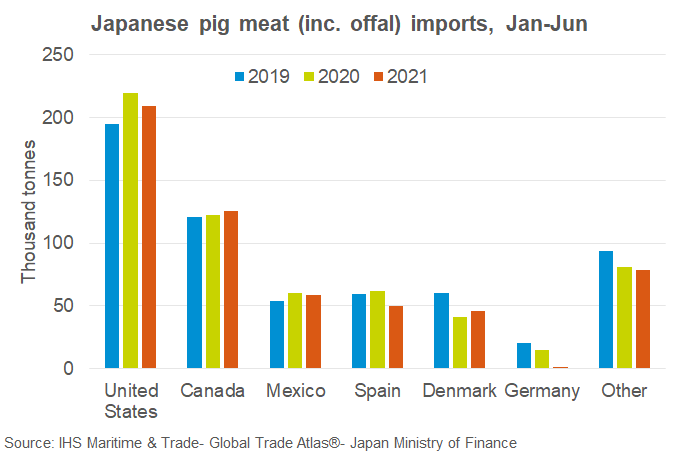

Total pig meat shipments to Japan were down slightly in the first half of this year compared with last year. Volumes totalled 567,700 tonnes, 5% lower than in 2020.

Lower imports have been influenced by ongoing weakness in foodservice demand due to coronavirus restrictions. This is likely to remain a challenge in the short-medium term, as Japan is currently struggling with rising cases of the Delta variant, with much of the country under a state of emergency.

Strong competition for limited supplies has also remained on the global pork market for the first half of this year. Other, more lucrative, markets have been available for key suppliers. The US remained the largest supplier, though volumes were 5% below last year at 208,800 tonnes. Strong domestic demand and limited supplies have constrained the US’ export potential this year, and driven pig prices to record highs. This is somewhat reflected in the price of pork imported from the US, which was 3% higher than last year at ¥473/kg. Overall, import prices were similar to last year at ¥507/kg.

Canadian suppliers perhaps benefitted from reduced US competition, as deliveries were 3% higher than last year at 125,200 tonnes.

Imports from the EU were 13% lower at 139,200 tonnes. Germany had previously been a moderate supplier of pork to Japan but was banned late last year due to African Swine Fever cases within its borders. Imports from Spain also recorded a sharp drop of 19% to 49,900 tonnes; this product has likely been diverted to more attractive markets available due to the restrictions Germany is facing. Other EU suppliers increased shipments and compensated for these declines to some extent. Denmark and Ireland are the most notable examples, with volumes totalling 45,600 tonnes (+11%) and 7,300 tonnes (+139%) respectively.

Despite a weak demand picture so far this year, and ongoing difficulties, the latest commentary from Rabobank suggests imports could fare somewhat better in the second half of 2021. This is because of low stocks of imported pork. The latest forecasts from the USDA, published in July, also indicate a 1% growth in import volumes is expected for 2021 overall. Japan’s pork import requirements, and the price they are willing to pay, will be an interesting watch-point for many exporting nations in the coming months. This is especially the case given the apparent drop-off in Chinese demand.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.