Is the recent bullish news providing a marketing opportunity? Grain market daily

Tuesday, 27 June 2023

Market commentary

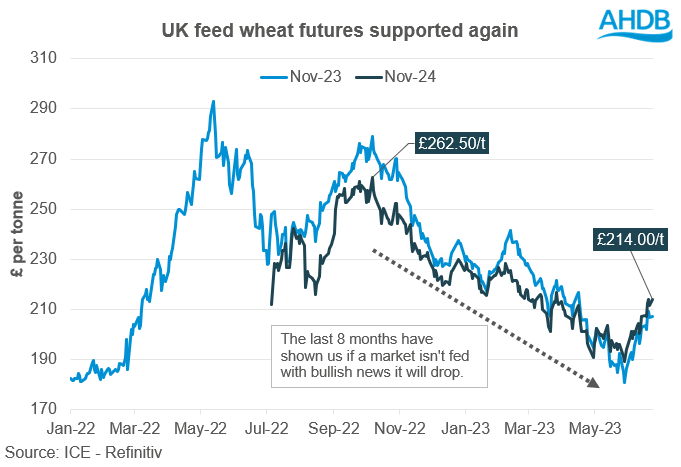

- UK feed wheat futures (Nov-23) closed yesterday at £207.25/t, gaining £0.25/t from Friday’s close. Nov-24 futures closed at £214.00/t, gaining £2.50/t over the same period.

- There was mixed price movements for global wheat markets yesterday. While Chicago wheat futures rose on Monday over concerns about political stability in Russia, prices later declined in a technical and profit-taking retreat. The Paris wheat market also ended down, as much of Europe will receive some rain over the next seven days which will benefit spring cropping.

- Paris rapeseed futures (Nov-23) closed yesterday at €448.75/t, gaining €10.00/t from Friday’s close. Rapeseed prices gained from support in both Chicago soyabean and soya oil markets. There are concerns of persistent drought conditions in the US Midwest, despite scattered rains in some areas.

Is the recent bullish news providing a marketing opportunity?

With harvest 2023 fast approaching, inputs for the 2024 crop are starting to be procured and planting intentions finalised. Could recent support over the last month be providing an opportunity to be marketing grain for harvest 2024?

Arable crop margins in large have been squeezed for the 2023/24 marketing year in comparison to pre-war times, from high input costs such as fertiliser and fuel. To give context, in May 2022, UK produced AN for spot delivery averaged £716/t, with Nov-23 UK feed wheat futures averaging c.£275/t for the month (May 2022). This May, UK produced AN averaged £390/t, and Nov-24 futures have averaged c.£197/t over the same month. While there are many factors to consider when looking at margins, with fertiliser prices dropping faster than grain prices, margins could be improving for crop 2024.

Recently, Nov-24 futures have been supported from the dry weather in both the USA and EU as well as reignited political instability around the Black Sea. Read more in yesterday’s market report.

Over the last eight months, the continuation of the Black Sea Initiative, combined with benign weather in key growing regions, has led to Nov-24 futures falling from their peak of £262.50/t in October 2022 to as low as £189.40/t at the end of May 2023. However, recent events (mentioned above) have seen the contract climb to £214.00/t, based on yesterday’s close (26 June).

So if you have procured your fertiliser and seed for harvest 2024, formulating cost of production or a breakeven point will be clearer. While output is unknown for a crop that hasn’t even been put in the ground yet, it is worth assessing whether these forward prices could be profitable.

The bullish news of dryness and further Black Sea tensions is currently being factored into the market – and as history has shown us, if it’s not constantly fed with ‘new news’, then grain markets could drop again when a peak is reached.

Although the peak of £262.50/t last October for the Nov-24 contract may have passed, short-term bullish news could provide an opportunity for marketing grain. It goes back to the old adage: “The best time to plant a tree was 20 years ago. The second-best time is now.” The same goes for marketing grain: the best time to market the 2024 crop might have been last October, but what if now is the second-best time, to lock in a margin if your overheads are known?

However, all considerations need to be made when locking in prices. There isn’t a crystal ball to indicate whether prices will reach the recent historic highs; it all depends on fundamentally what happens in the Black Sea.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.