Arable market report - 26 June 2023

Monday, 26 June 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

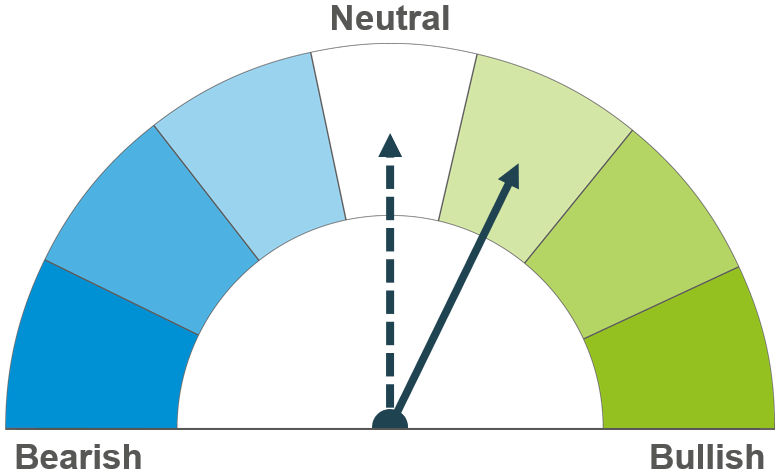

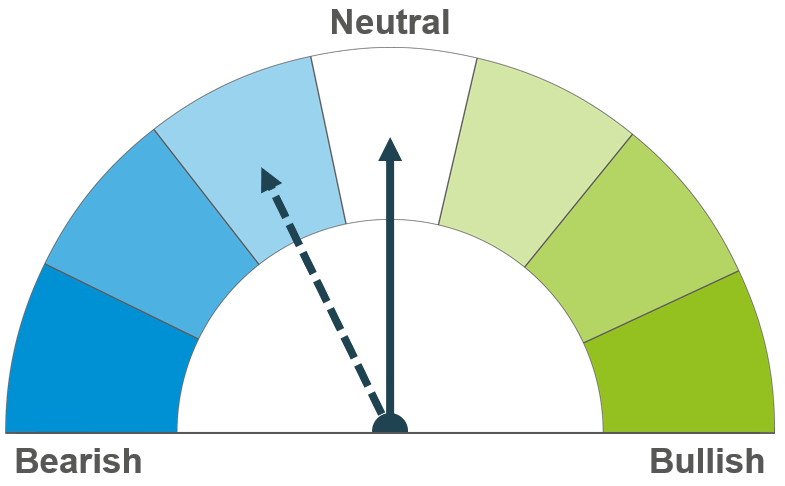

Potential for tight world wheat supply and demand is driving markets and uncertainty over access to Black Sea grain is once again in focus. Maize availability will also impact the longer-term outlook for markets, so needs to be watched.

Forecast rain in the Midwest has calmed market sentiment short-term, but crop conditions still point to lower US yields than forecast. The key question to the longer-term outlook is how much lower?

Global barley supplies are looking tighter, with yield concerns centring on spring barley in Europe. The overall market direction will still depend on wheat and maize.

Global grain markets

Global grain futures

Both wheat and maize grain prices rose Monday to Wednesday last week driven by concerns over hot, dry weather in the US Midwest, where much of the maize crop is grown. The condition of the crop last week points to lower yields than the USDA currently forecasts.

But forecasts of rain for the US Midwest led to profit taking and maize prices falling towards the end of the week. As a result, Dec-23 Chicago maize futures ended the week lower.

The USDA issues updated crop condition scores tonight, plus its final planted area statistics and quarterly stock levels on Friday night.

However, global wheat prices ended the week up and have moved up again in early trading today (26 June). The Russian political situation jumped into the headlines over the weekend due to the rebellion by the Wagner group of mercenaries.

It also seems more likely that the Black Sea Initiative (Ukrainian export corridor) will not be extended, based on statements by both Ukraine and Russia. Plus, Romania may give priority access to domestic grain in the port of Constanta. The port has handled around a third of Ukrainian grain exported since the invasion of Ukraine (Refinitiv).

This means renewed uncertainty about global access to Black Sea grain at a time when there are suggestions that global wheat supplies are looking tighter.

The EU MARS crop report trimmed EU-27 wheat, maize and barley yield prospects last week, with the largest cuts for spring barley. SovEcon trimmed its forecast for the 2023 Russian wheat crop by 1.2 Mt to 86.6 Mt, and an industry body expects the Indian wheat crop to be 10% smaller than the Indian government forecast.

UK focus

Delivered cereals

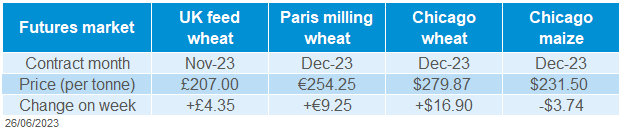

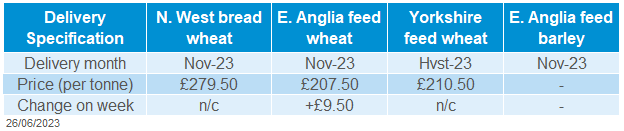

Both the Nov-23 and Nov-24 UK feed wheat futures contracts gained £4.35/t last week. The Nov-23 contract closed at £207.00/t on Friday, while the Nov-24 contract reached £211.50/t.

Premiums for delivered bread wheat over UK feed wheat futures remain historically high. Last Thursday, bread wheat delivered to the North West in Nov-23 was quoted at a £70.50/t premium to Nov-23 futures in AHDB’s delivered price survey. This compares to a premium over Nov-22 futures of £67.00/t for Nov-22 delivery at the end of June 2022. At the end of June 2021, the premium over Nov-21 futures for Nov-21 delivery was £33.50/t.

AHDB’s latest crop development report gives insight into the impact of dry, sunny weather in early June. The impact was greatest for crops those on lighter and thinner soils.

All regions benefited from rain in mid-June, though the storms were localised, and rainfall was highly variable. Most winter cereals are now in good condition, but spring cereals are more variable, especially spring barley.

For the week ending Tuesday 20 June, 76% of the GB winter wheat crop was in good/excellent condition. This is down 9% on the month and 6% below the 82% last season. Meanwhile, just 53% of spring barley crops are now rated as in good/excellent condition. This is a marked decline from 74% in the week ending 30 May and 77% at this point last season. Get the full report and interactive data here.

Oilseeds

Rapeseed

Soyabeans

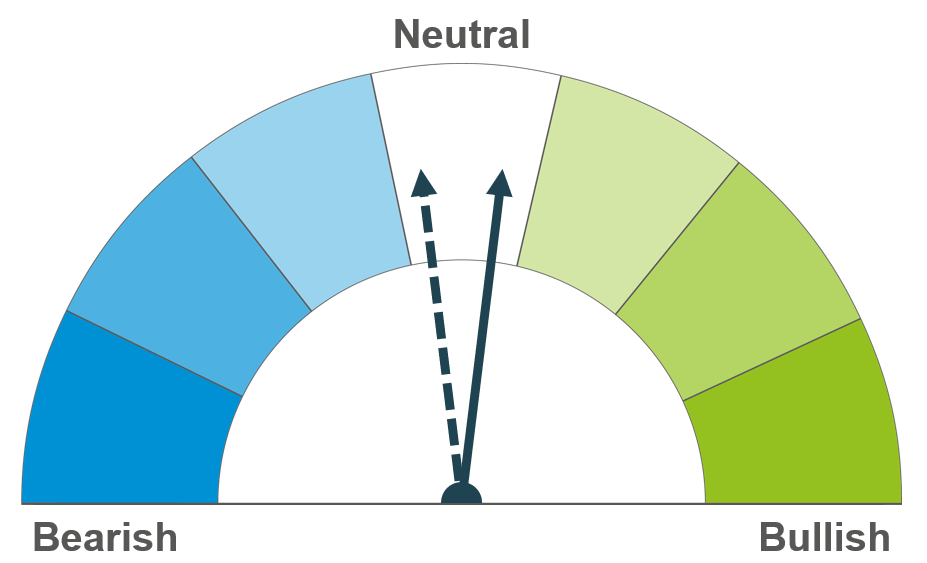

Short-term, rapeseed prices will be reactive to both soyabean prices and crude oil. Longer-term the EU rapeseed balance looks to be heavier entering the next marketing year (2023/24).

All focus currently is on US weather as the soyabean crop enters critical development stages. Longer term, initial estimates show that large South American crops are expected from the start of 2024, which could weigh on market sentiment.

Global oilseed markets

Global oilseed futures

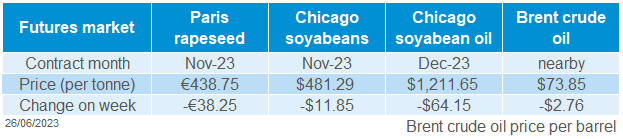

The main story driving the oilseed complex over the last week was US weather. Chicago soyabean futures (Nov-23) ended down 2% across the week. However, on Wednesday the contract climbed to the highest close since the start of March. This support was from worries crop production in places like the US and EU could potentially fall shorter than anticipated due to the recent dry weather.

The USDA crop progress report released last Tuesday (to week ending 18 June) cut the US soyabeans good-to-excellent rating to 54%, down from 59% the week before. This was greater cut than expected, with notable downward revisions in Iowa and Illinois. There will be another update to crop conditions this evening.

Despite this support at the start of the week, the market actually ended the week down. The market dropped with investors locking in profits, and a weakness in crude oil markets from a negative economic sentiment as markets focused on rising interest rates. Finally, the main point was the weather in the US Midwest looked to improve, taking some fuel out of the bullish sentiment.

Over the next seven days the majority of the US Midwest is expected to receive rain, albeit minimal in some areas. The majority of rain is expected towards the end of the week which could potentially pressure the market. However, the US soyabean crop is entering critical stages and significant damage could change market sentiment.

There was also pressure across the week for both Chicago soybean oil and Malaysian palm oil. The Biden administration increased the amount of biofuel refiners must blend into fuel over the next three years. But the volume was lower than expected, which caused pressure on the vegetable oil market.

Rapeseed focus

UK delivered oilseed prices

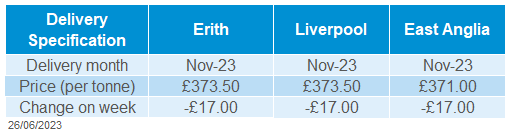

Pressure on crude oil and the wider oilseed complex fed into rapeseed prices. Paris rapeseed futures (Nov-23) closed Friday at €438.75/t, down €38.25/t across the week. Domestic delivered prices (into Erith, Nov-23) were quoted at £373.50/t, down £17.00/t. Domestic prices were sheltered to some extent as sterling weakened (-0.5%) against the euro across the week, closing Friday at £1 = €1.1667 (Refinitiv).

Nearby Brent crude oil futures closed Friday at $73.85/barrel, down 3.6% across the week. Pressure came on Thursday for crude oil when the Bank of England raised the base rate interest rate from 4.5% to 5.0%, the highest level for 15 years, this is in a bid to slow the rise in the cost of living.

This morning the latest AHDB crop development report has been published. Oilseed rape crop conditions remain very variable. Damage from CSFB, pigeons and rape stem weevil are the main causes of variability. At week ending Tuesday 20 June, 63% of winter oilseed rape was in good/excellent condition. This is down from 68% at the same point last season but unchanged from the week ending 30 May.

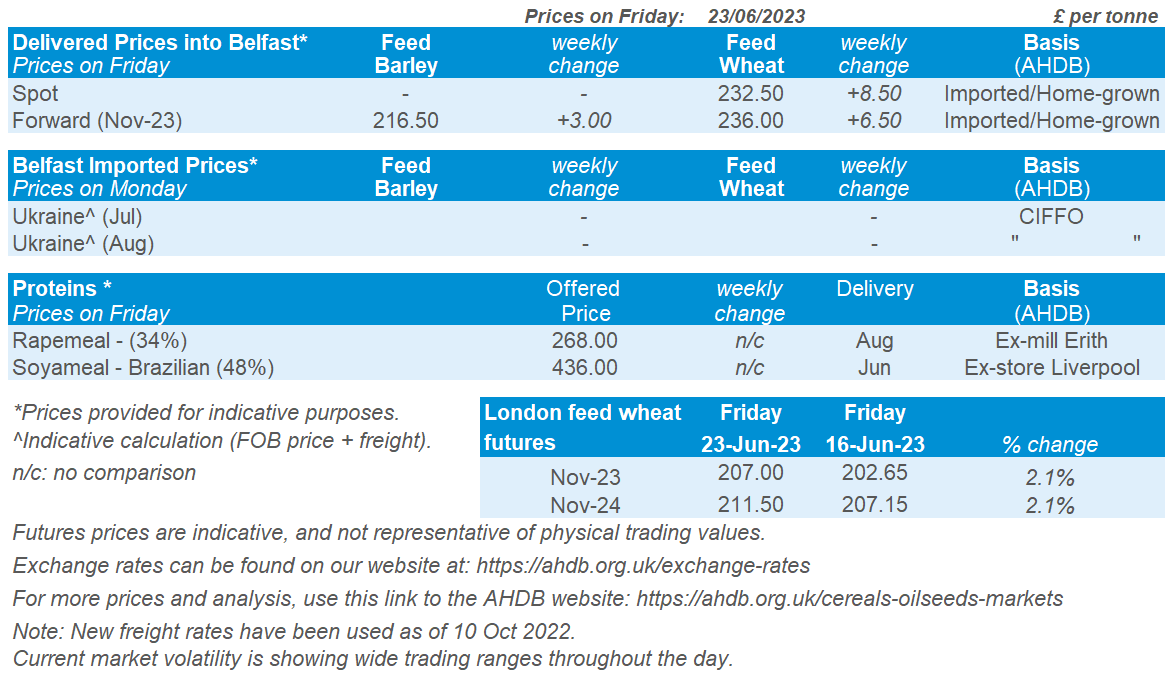

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.