Irish sheep throughput, exports and prices rise

Friday, 27 November 2020

By Bronwyn Magee

Throughput

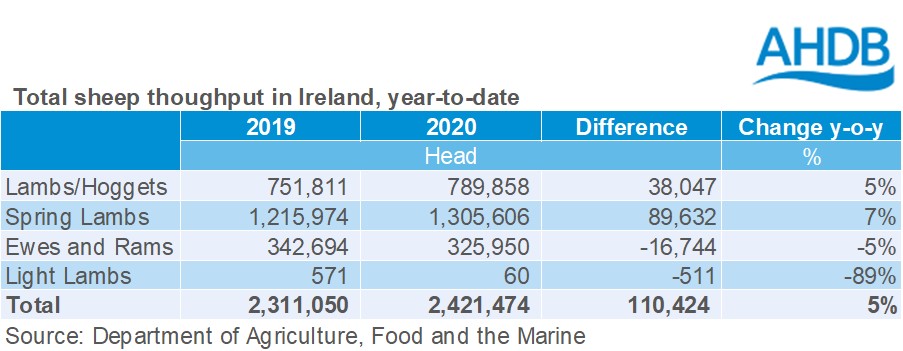

In the year to 26 October, a total of 2.42 million sheep have been processed in Ireland, according to government data. This is an increase of over 110,400 animals (5%) when compared to the same period last year, accounted for by an increased clean sheep throughput, with a lower adult kill.

Bord Bia expects throughput to remain lower for the rest of 2020 compared to last year’s levels, due to a significant increase in animals coming forward over the summer period. Good grass growth earlier in the year, a bumper lamb crop and higher weight limits at processors are said to all have contributed.

Trade

Irish sheep meat exports (fresh and frozen) between January and September were up 7% (2,800 tonnes) on the same period last year, to total 41,900 tonnes. Shipments to the rest of the EU accounted for most of this increase, also up by 7% (2,000 tonnes). The largest increases were to France (+950 tonnes, 8%) and Sweden (+770 tonnes, 20%). Meanwhile, exports to Non-EU countries also increased marginally by 760 tonnes.

Exports to the UK were lower compared the corresponding period in 2019, down by almost 550 tonnes (-6%). Despite this, the UK remained the second largest export market for Ireland, totalling 8,700 tonnes in the year to September.

Prices

As in the UK, sheep prices in Ireland continue to trend above those seen last year. The average deadweight price stood at €5.21/kg in the week ending 21 November. This measure is up around 63 eurocents (+14%) on the same week last year. Industry reports suggest prices will continue to tick up over the coming weeks, with supplies tightening and demand remaining strong.

The GB price is currently marginally above the Irish price, averaging the equivalent of €5.16/kg in the week ending 15 November. The gap between the two series has tightened in recent weeks, with both series on an upward trajectory.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.