Inflation drops to 1.7%: Grain market daily

Thursday, 17 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £186.35/t, up £1.25/t from Tuesday’s close. The May-25 contract ended the session at £200.85/t, up £0.75/t over the same period.

- Domestic wheat futures tracked global wheat prices up yesterday. Support came from a combination of factors, including rising spot wheat prices in Ukraine and Russia with potential limits to selling (quotas), decreasing French stock forecasts. There were also worries about if polar winds could intensify dry weather hitting wheat and maize crops in Argentina. However, favourable rain expected in Russian and US winter wheat belts tempered gains. Financial investors extended their short positions in Paris milling wheat futures in the week to 11 October.

- Nov-24 Paris rapeseed futures closed at €492.00/t yesterday, up €0.75/t from Tuesday’s close. The May-25 contract declined by €1.75/t over the same period, ending at €495.75/t.

- European rapeseed prices closed mixed yesterday; Nov-24 gained but forward delivery months decreased. European rapeseed prices tried to find direction between Winnipeg canola futures increasing and Chicago soybean decreasing. The National Agricultural Statistics Service (NASS) showed the US soybean harvest at 67% complete as of Sunday. That is 16 percentage points ahead of the five-year average pace.

Inflation drops to 1.7%

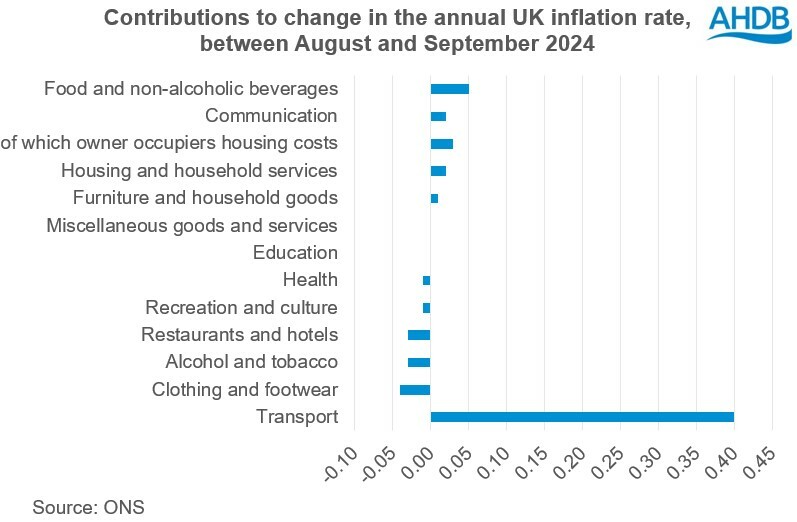

Consumer price Inflation, (CPI) dropped to 1.7% in September according to the latest figures from the Office for National Statistics (ONS), down from 2.2% in August 2024, and well below its recent peak of 11.1% in October 2022.

Lower transport costs, mainly driven by lower motor fuel and air fares were the main contributors to the drop. For motor fuels, the average price of petrol fell by 5.5 pence per litre between August and September 2024 to stand at 136.8 pence per litre, down from 153.6 pence per litre in September 2023. Diesel prices fell by 6.0 pence per litre in September 2024 to stand at 141.8 pence per litre, down from 157.4 pence per litre in September 2023.

However, Food and non-alcoholic beverage prices rose by 1.8% in the year to September, up from 1.3% in August 2024. This is the first time since March 2023 that the annual rate of inflation for food and non-alcoholic beverages has strengthened. The annual rate of 1.8% is down from a recent high of 19.2% in March 2023, the highest annual rate seen for over 45 years.

This latest news on inflation does increase the likelihood of an interest rate cut in the near future. It is still not a certainty though as other factors, such as the threat further escalation in the Middle East are still a major concern.

Along with the direct impact on business finances, any changes (or expected changes) to interest rates also impact exchange rates. Shifts in exchange rates in turn impact UK prices for grain and oilseeds.

With sharply smaller UK wheat and oilseed rape crops, and below average barley and oat crops, the UK market is more reliant on imports than usual this season. A stronger pound often makes imports more attractive against UK grain, which in turn, can put pressure on UK grain and oilseed prices or (partially) offset rises in global markets. Conversely, a weaker pound makes imports more expensive and can offer relative support to UK grain and oilseed prices.

The latest inflation data and market speculation for UK interest rates contributed to a dip in sterling against both the US dollar and euro. Yesterday, the pound fell 0.4% against the US dollar to a one month low of £1 = $1.3034, and 0.3% against the euro to £1 = €1.1961 (ECB). This may have contributed to the support for UK feed wheat futures prices yesterday.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.