Indian Dairy: Demand and supply developments

Thursday, 6 November 2025

- Population and economic growth driving India’s milk consumption by 3.1% per capita, per year.

- Milk production is also expected to see strong growth of 3.6% p.a. between 2025 and 2034 as the national herd grows, and efficiencies improve.

- The Indian dairy sector is currently largely fragmented but experiencing huge developments and modernisation.

A young, growing population with increasing demand

India is one of the main drivers for world dairy consumption growth, due to income and population growth. India has the world’s largest population at around 1.5 billion people, with almost 47% of its population under 25 years old.

India’s GDP is expected to grow by 6.3% in 2026. Rising rural incomes and urbanisation are also increasing demand for dairy products. As a predominantly vegetarian population, dairy products are valued as an important source of protein, fat and calories.

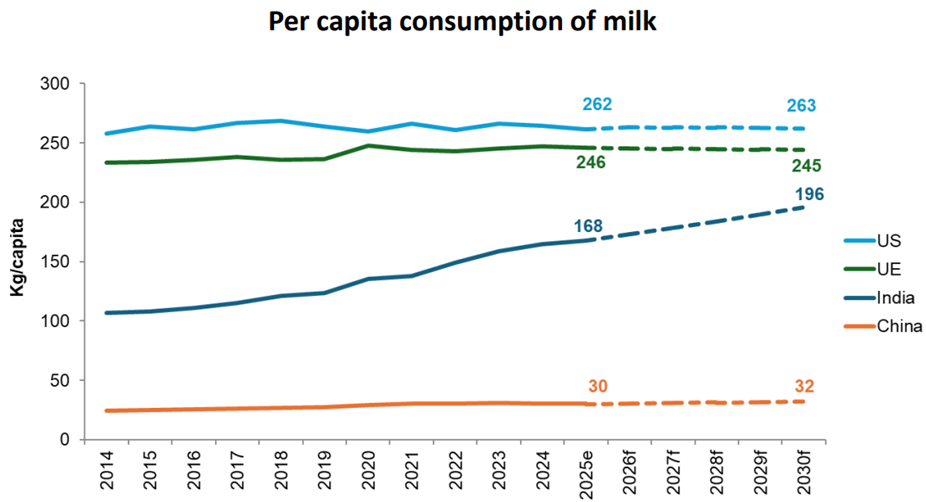

According to Gira, India’s consumption of milk is rising by 3.1% per capita, per year, showing remarkable growth in comparison to other developing countries.

Source: Gira

UE refers to the French abbreviation of the European Union

Liquid drinking milk remains the most widely consumed dairy product, but consumers have an increasing interest in nutrition, quality and value-added options. Butter fat in the form of ghee is also widely used in cooking.

Price is still a key factor, but consumers are increasingly willing to pay more for a product that offers multiple health benefits, and products which may be perceived as higher quality. From 2025 to 2030, demand for processed dairy products, such as yogurt and cheese are expected to see large growth of 12% and 11%, respectively. The cheese category is dominated by paneer but ‘other cheeses’ (cheddar, processed cheese and mozzarella) are forecast to see larger growth.

Sales channels are also changing, amid rising disposable incomes and urban lifestyles. Supermarkets and online retail platforms are becoming more popular and there is growing availability of a wider variety of dairy products.

Lactose intolerance is common in India, so lactose free products are becoming more widely available, across dairy categories which is another opportunity.

Increasing milk volumes and adding value

According to the OECD, Indian milk production is likely to grow at an impressive rate of 3.6% p.a. between 2025 and 2034. This is the highest growth forecast for any country in the global market, driven by herd expansion and improved genetics and productivity.

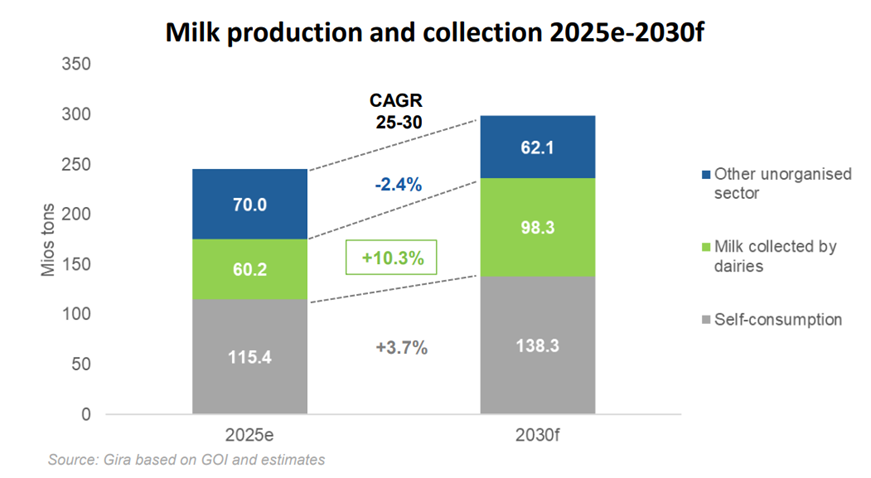

Currently only around 25% of the milk collected goes to dairies, with informal milk being the largest route to consumption. This includes local milkmen, vendors, and household use. As supply chains are evolving, the volume of milk going through dairies is expected to grow by 10.3% from 2025 to 2030.

Technological advancements and private sector investments are accelerating developments, though geographical challenges have potential to limit growth, such as feed availability, water and potential for heat stress.

Trade and market opportunities

Indian dairy farming is protected due to its cultural significance, as well as being recognised as an important Indian agricultural sector, contributing 4% of the country’s GDP and 25% of the total agricultural GDP. Government policy towards foreign companies will be a watchpoint, with large potential to have an impact on investment levels.

The growing consumption levels are expected to be largely met by domestic production, with limited trade currently. The currently fragmented supply chain reduces efficiencies, and cold chain is remaining a bottleneck so far.

India’s exports are currently limited, as trade policies, and quality compliance limit its full potential. The Indian government has expressed its aspirations to increase dairy exports by offering policy incentives, infrastructure support, and market development initiatives. Given the size, and growth trajectory, of India’s dairy production, and the UK’s trade deal this future potential must be taken seriously.

Future developments in milk processing (particularly of powders) to meet export standards will aid future trading opportunities for India.

On the other hand, import demand for high quality ingredients is also increasing, particularly for products with high regulatory requirements, such as infant formula.

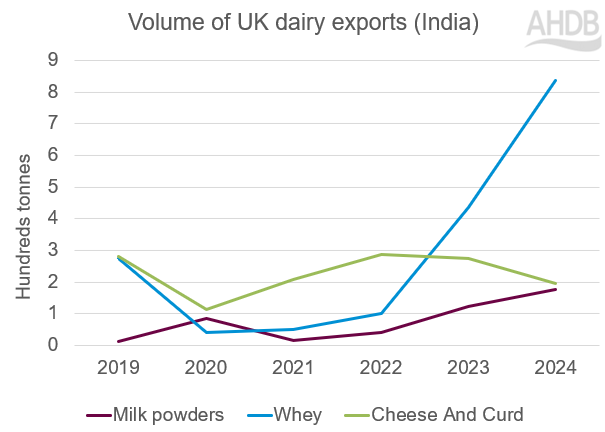

Source: HMRC compiled by Trade Data Monitor LLC

Between 2019 and 2024, annual volumes of dairy exports from the UK to India increased by 119.8%, while value increased by 88.7%. Whey saw the largest increase of 562 tonnes followed by milk powders at 165 tonnes. Cheese did witness a decline of 84 tonnes between 2019 and 2024, but remains an important part of the export basket, and is expected to grow. Additionally, there is particular potential for opportunities for UK infant powder and dairy based protein concentrates in health products.

The UK has signed a free trade agreement with India, presenting an opportunity for some UK businesses, to market high quality goods. However, despite the FTA, India is very protective of its dairy industry so tariffs (at around 30%), will remain in place for most UK dairy products into India.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.