Increasing competition on Chinese pork import market

Tuesday, 5 May 2020

By Bethan Wilkins

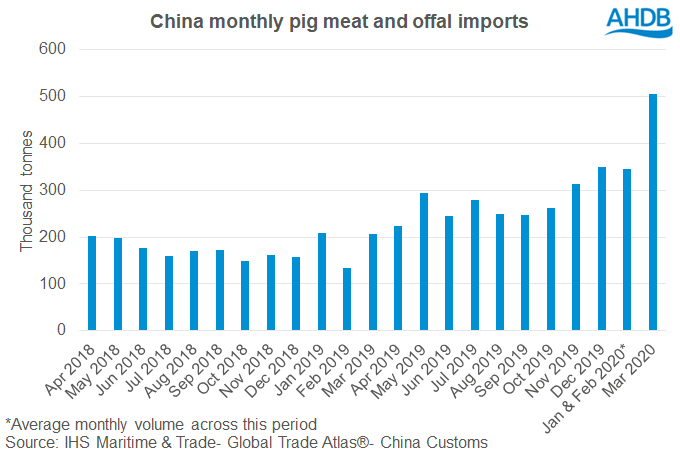

China customs has now released import figures for March 2020. Pig meat imports were more than 150% higher than during the same month last year, a much sharper increase than was recorded across January and February. Coronavirus-induced disruption at ports started to ease during the month, enabling some delayed containers finally to be unloaded.

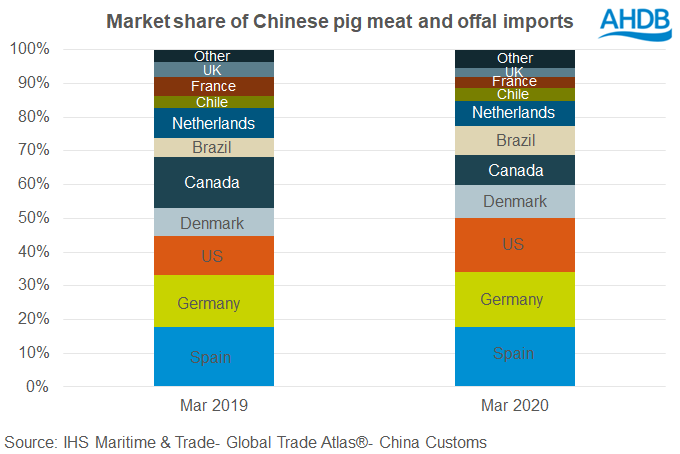

All suppliers benefitted from the rise in shipments, although to differing degrees. The US in particular has been gaining market share this year and shipments from Brazil also increased above the total market rate. This does not seem to be an entirely price-driven dynamic; although US pork had one of the lowest average prices, Brazilian pork was the most expensive.

Even Canadian shipments were 44% above year earlier levels, showing the first signs of real recovery after the ban on Canadian pork was lifted in November 2019. Market share reached 9%, still well below the 15% achieved in the month last year, but similar to 2018.

Although volumes were up 132% on the year, the EU + UK saw market share fall on the year. Some of the smaller suppliers didn’t see the same level of growth as the market overall. In particular, volumes from France were only up by 40%. Trade with the UK also recorded a comparatively small 65% increase. With US relations improving due to the China-US trade deal, Canada regaining access, and an increasing number of small players sending shipments, competition between suppliers is increasing.

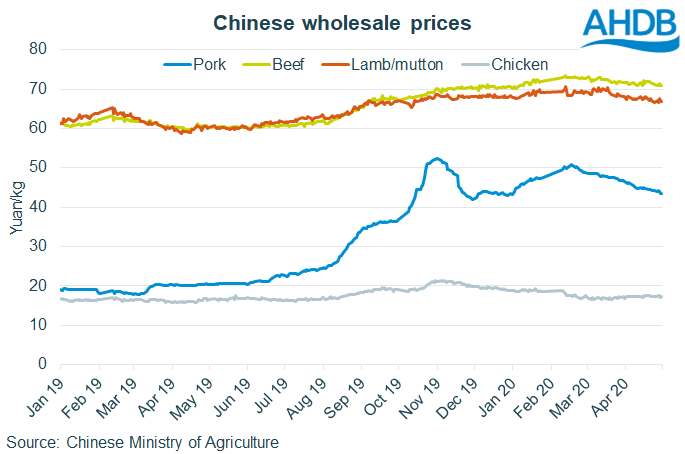

The price paid for imported pork also dipped from the peak earlier in the year, to 19.67CNY/kg. A similar declining pattern has been recorded in Chinese live pig prices, which have fallen from 37.51CNY/kg in mid-February to 33.30CNY/kg in the week ending 22 April. On the wholesale market, pork prices were around 45.50CNY/kg by the end of April, compared to over 50CNY/kg in February. Of course, these are still extremely high prices, but slowing Chinese demand during the “lockdown” and some reported increase in slaughter levels have had an effect.

In recent weeks, all the key pork exporters have had to contend with the loss of a domestic foodservice market. In the US, prices have fallen significantly, also influenced by closures of processing plants. While there are concerns this could limit supplies to the US pork market, despite the recent order to remain open, in the short-term at least, supplies for export have remained. Excess supply from the key exporters makes the market increasingly favourable for Chinese buyers, who are reportedly taking the opportunity to cut prices offered. Ongoing difficulties with container availability also heightens competition between suppliers.

Of course, underlying demand on the Chinese market remains significant and will support global pork markets this year. But, supplying China amidst the coronavirus crisis will not be without challenges, at least in the short-term. Exactly how favourable the market will be this year depends on how the key suppliers, as well as China itself, emerge from tackling the virus. Too much economic hardship, driven by a prolonged recovery or second-waves of infection, could pull down the price at which pork can successfully trade.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.