Chinese import figures released for early 2020

Wednesday, 8 April 2020

By Bethan Wilkins

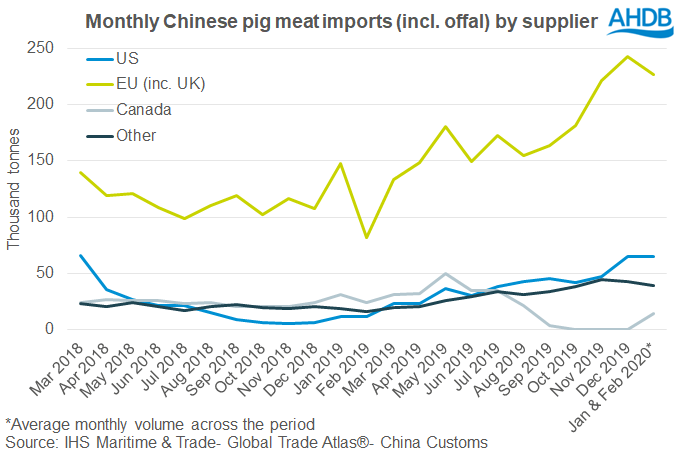

China Customs has recently released combined import data for January and February 2020. However, trade data for the months individually has not been released. Across these two months, China imported twice as much pork and offal than in the same period last year (691,000 tonnes). This is a similar degree of growth to that recorded in the final quarter of last year. It is likely the trade was skewed towards early in the year, given disruption at ports was reported following the coronavirus lockdown at the end of the month.

EU export figures have shown a peak in pig meat exports to China in November, and subsequently fall by about 20% in the following two months. In the Chinese import figures, the peak in EU imports is in December, and the subsequent drop-off in volume is less noticeable. This will partly be due to shipping times and possible delays at ports on arrival.

Looking at other suppliers, volumes from the US surged in December and have remained high into the New Year. The US was the largest single-country supplier of pig meat and offal imports across January and February, supplying 19% of the total volume. This had risen from 16% in the second half of 2019, and just 12% in 2018. The US is hoping to continue increasing its presence on the Chinese pork market, with China agreeing to purchase more US agricultural products as part of the January trade deal.

It is also noticeable that imports of Canadian pork remained lower year-on-year in the most recent data. Even though the ban on imported Canadian pork was lifted in November, Canada has not yet been able to recapture market share.

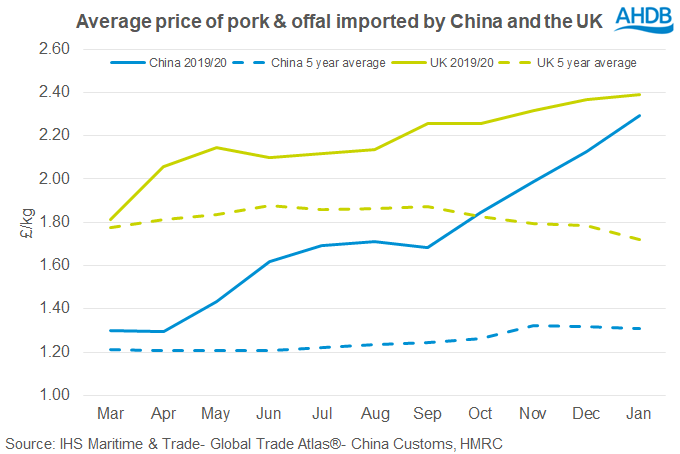

The average price of the imported pig meat has continued to rise, reaching nearly 21RMB/kg in January-February. In sterling terms, this would be about £2.30/kg. To put this in context, the average price the UK paid for fresh/frozen pork imports in January was only a little higher than this, at about £2.40/kg.

While trade with the Chinese market may have been disrupted somewhat recently, the ASF-induced pork shortage means strong market fundamentals remain. Though there are still logistical challenges to overcome, expectations of keen Chinese demand remain supportive of the pig market.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.