Human and industrial demand up but animal feed down: Grain market daily

Thursday, 26 January 2023

Market commentary

- UK feed wheat futures (May-23) gained £3.00/t yesterday, ending the session at £226.00/t. New crop prices (Nov-23) closed at £221.90/t, gaining £2.60/t over the same period.

- UK prices tracked global price movement, as grain markets were supported on concerns that the Russia and Ukraine war is escalating, potentially impacting grain supply from two of the world’s major exporters.

- Chicago soyabean futures (May-23) also firmed yesterday for the first time in six sessions due to technical buying. The contract gained $3.67/t to close at $549.81/t. However, beneficial rains across Argentina limited gains.

- Palm oil futures hit more than a six-week low yesterday, though bargain buying has seen prices rise again this morning. For more insight into the vegetable oil market, see yesterday’s round-up.

- The Secretary of State for Environment, Food and Rural Affairs has today set out more detail on both the Sustainable Farming Incentive (SFI) and Countryside Stewardship (CS). Click here to learn more.

Human and industrial demand up but animal feed down

Earlier today, AHDB published the January UK supply and demand estimates for wheat, barley, oats, and maize for the 2022/23 season.

Availability adjustments

Following the release of official Defra cereal and oilseed production figures for the 2022/23 season in December, UK grain availability has changed somewhat from November’s estimates. UK wheat production for this season sits at 15.54Mt, down slightly from AHDB’s estimate of 15.66Mt, but up 11% on the year down to a larger area and increased yields. Opening stocks and imports remain unchanged from November, with the majority of imports expected to be high protein wheat for milling. This brings total wheat availability this season to 18.61Mt, up 7% on the year.

Barley production this season was also revised up slightly, now at 7.39Mt, up 6% on the year on strong yields despite a smaller area for harvest 2022. Imports remain the same from November’s forecast. Therefore, total availability of barley this season is estimated at 8.42Mt, up 4% year on year.

The estimate for maize availability saw little change from November’s estimate, with strong imports season to date (Jul-Nov). Defra’s final estimate for domestic oat production is 1.01Mt, bringing availability to 1.18Mt, an 8% yearly fall and back 74Kt from November’s estimate.

Wheat usage in animal feed down on previous estimate

Wheat usage in animal feed production has been revised down to 7.14Mt. This is down 98Kt from November’s estimate, and down 1% on last season. While a high domestic wheat availability is expected lead to a higher proportion of wheat used in rations this season, overall cereal inclusion in feed is forecast to be lower on the year due to relative price of protein meals. A fall in overall animal feed production is also expected, largely due to declining numbers in the monogastric sector.

Usage of barley in animal feed is forecast down 4% on the year, but is up 60Kt from November’s estimate, at 4.07Mt. With wheat prices having been elevated, barley use in rations has been slightly higher than previously anticipated, though with large domestic wheat supplies, wheat looks more favourable going forward.

Maize usage in animal feed was revised up to 1.18Mt, 1% higher on the year and 31Kt higher than previously forecast in November. While up on the year, and strong season-to-date imports, the relative high price of maize and greater availability of wheat is expected to cap maize inclusions in rations over the rest of the season.

At 393Kt, oats usage in animal feed is expected to be down 17% when compared with record levels last season. This is also 53Kt lower than November’s estimates. While demand by compounders is expected to fall, much of the decline is driven by a fall in fed on farm usage with a smaller domestic crop of high quality.

Human and industrial demand up on the year

The cost-of-living crisis remains a key watchpoint for domestic demand. However, largely due to a rise in demand from the bioethanol and starch industries and strong brewing, malting and distilling demand, total cereal usage is expected to increase by 219Kt on the year to 10.57Mt.

Human and industrial wheat usage is expected to be up 4% on the year, at 7.38Mt this season. This is back 9Kt from November’s estimate. Steady flour demand is expected to continue, and a rise in demand from the bioethanol and starch sector is expected year-on-year. However, while it’s assumed both bioethanol plants will be operating, it’s not thought they will be at full capacity. High input costs and lower bioethanol prices and the impact on wheat usage in the industry will be key to watch moving forward. Compared with November's estimates, bioethanol demand is forecast lower.

Barley usage in the human and industrial sector is also expected to be strong this season, revised up 50Kt from November’s estimate at 1.97Mt. Usage by the brewing, malting, and distilling (BMD) sector is forecast to be higher, and an increase in capacity in Scotland is expected.

How much grain are we expecting to export?

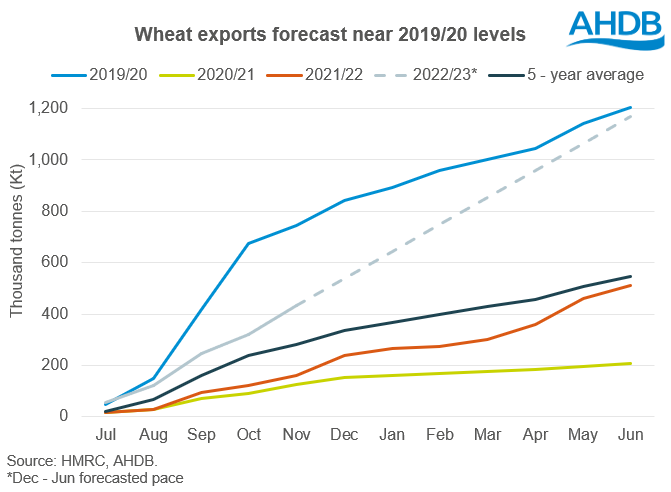

With such a large surplus of domestic grain this year, a big watchpoint is how much we export this season. Wheat exports have initially been forecast at 1.15Mt, up 639Kt on the year. To reach this level, we would need to export at least 100Kt on average per month for the rest of the season (Dec-Jun) given the 432Kt that has been exported to end-November.

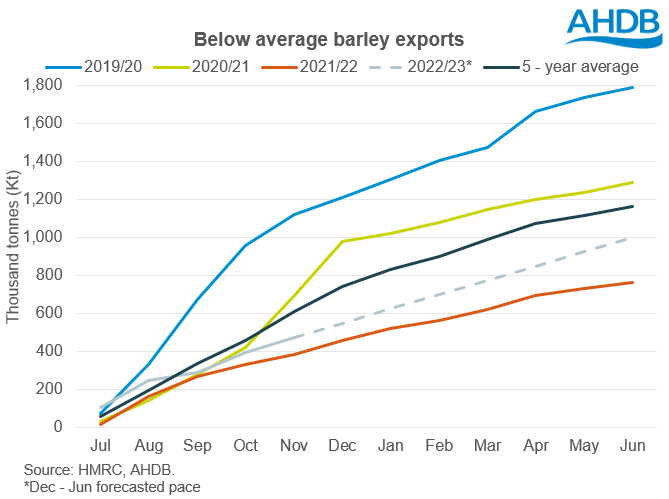

Barley exports are also forecast up on the year, though are behind the five-year average, at 1.00Mt. A yearly rise of 239Kt is expected, with a strong pace so far this season recorded by HMRC (Jul-Nov).

Greater end of season stocks for wheat and barley

Commercial end of season wheat stocks for the 2022/23 season are estimated at 2.59Mt, up 740Kt from last season. If realised, these stocks will be a similar carry-out to 2019/20. Barley ending stocks are forecast at 1.16Mt, up from last season’s figure of 964Kt, and slightly higher than the five-year average.

On the other hand, maize and oats end of season stocks are forecast down on the year. Maize closing stocks are forecast at 225Kt, down 23Kt on the year and the five-year average. Finally, end-season oat stocks are estimated to be down 28Kt on the year at 128Kt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.