How are new-new crop futures shaping up? Grain market daily

Tuesday, 11 May 2021

Market commentary

- UK feed wheat futures (Nov-21) fell back once more yesterday, closing at £185.50/t, a fall of £6.50/t. A similar decline was seen for Paris milling wheat futures, moving €7.75/t lower, to €222.00/t.

- Falls in UK futures prices were seen throughout the day, and were cemented by good planting progress in the US.

- US maize planting continued ahead of average according to the USDA. In the week ending 9 May, 67% of the maize crop was planted, ahead of the five year average of 52%. Emergence is behind last year, but 1 percentage point ahead of the five year average, at 20%.

- Planting of soyabeans and spring wheat continues well ahead of average. Winter wheat conditions improved, 49% of the crop is now rated “good” or “excellent”.

How are new-new crop futures shaping up?

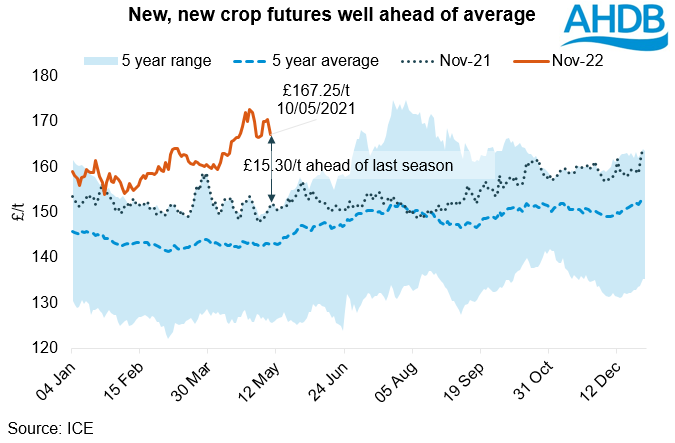

Over the past few weeks, we’ve talked a lot about the impact of the current weather led support on new crop prices. Even with yesterday’s drop, Nov-21 feed wheat futures remain more than £40.00/t ahead of the average of the last five November contracts, at this point in the season.

However, alongside the support for new crop wheat, the Nov-22 contract has also seen some significant support. The contract closed yesterday at £167.25/t, and while liquidity is still low, some volume is being traded on the contract.

As we move towards harvest 2021, now is a great time to start thinking about the value of the crop yet to go in the ground. Looking back across the previous five, new-new crop markets, UK feed wheat futures (Nov-22) currently sit £24.36/t ahead of the average.

Furthermore, the contract is currently £15.30/t ahead of the same point last year, which was the highest point in the last five seasons.

With values strong in historical terms, it may be time to consider whether prices at present are a good place to start your new-new crop average.

Where next for prices?

The forward path for prices will depend very much on what happens with the Nov-21 crop contract. As we mentioned in yesterday’s market report, South American dryness is a key driver for prices at the moment, but it will need to get progressively worse to continue adding support.

Another recent driver has been the progress with US crop planting, however, this has now picked up the pace and is progressing well. This withdraws some short term support, although there is still a long time for the crop to develop and weather will be a key watch point in what is a very tight market.

Chinese demand also continues to support prices. China continues to signal its intent to import large volumes of maize next season, booking a further 1.0Mt of new crop US maize on Monday. Between Friday and yesterday, Chinese purchases of new crop maize totalled 2.4Mt.

Finally, we need to watch tomorrows raft of reports, with Conab and the USDA set to release some key numbers. It is likely that the last few days of falls are repositioning and profit taking in advance of the upcoming releases.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.