How are maize prices driving the global grain market? Grain market daily

Wednesday, 8 January 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday’s session at £190.10/t, up £1.05/t from Monday’s close. The Nov-25 contract was up £0.90/t over the same period, to close at £193.10/t.

- Domestic wheat futures closed higher while global grain markets were mixed. The sterling fell against the US dollar yesterday, supporting UK feed wheat futures. Nearby Paris milling wheat futures were down 0.2%, but Paris maize futures (nearby) were up 0.5% yesterday. Yesterday's EU Commission data once again showed a slow pace for wheat exports in the current marketing year.

- May-25 Paris rapeseed futures closed at €517.25/t yesterday, up €5.75/t (1.1%) from Monday’s close.

- Meanwhile, Winnipeg canola futures (May-25) fell 0.7% as the Canadian market reacts to Prime Minister Justin Trudeau’s plans to resign.

- With the US presidential inauguration fast approaching, fears of a trade war with China are mounting. Soybean prices in particular could be under pressure, something to look out for.

How are maize prices driving the global grain market?

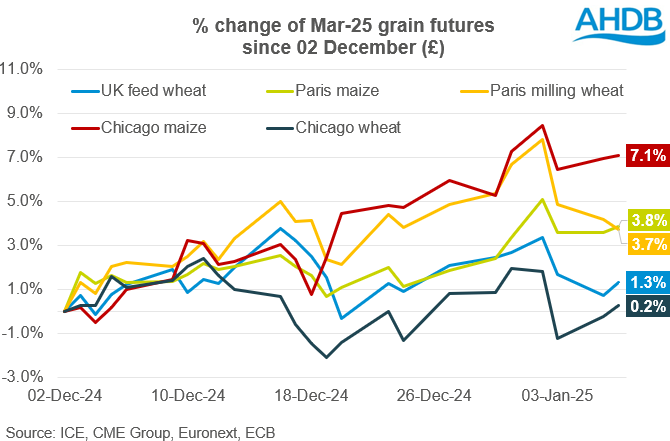

Over the last couple of months, global grain markets have had little momentum and are trying to find some further direction for price movement. Lately, more attention has been focused on maize due to some fundamental factors that could be supporting prices.

The global balance of maize this season is relatively tight, with global ending stocks of maize in 2024/25 at the lowest since 2020/21 and the second lowest since 2014/15. Maize ending stocks held by major exporters US, Brazil, Argentina and Ukraine are forecast 13% lower on the year, and down 4.5% on the five-year average.

Despite a smaller crop, US maize exports this season to date, are higher than the previous year and the five-year average. Ethanol production in the US is at a high level and this has also supported US prices. However, it’s worth noting that current shipments to China have been minimal, and a potential trade war between the US and China would impact the market. Additionally, maize exports from Brazil in December 2024 were 30 % lower year-on-year. While this adds bearish sentiment, limited supplies underpin the market.

From early December, US maize futures have added support to the wider grains complex. High demand for maize on the physical market, with limited supply is driving this gain.

Looking ahead

Fundamentally, maize prices could find some points of support. From December until now, we have seen a trend towards rising maize prices, especially in the US. Hot and dry weather in Argentina is also on the radar as it could reduce the global export supply of maize.

The USDA’s next World Agricultural Supply and Demand Estimates will be published on Friday. The average trade estimate for world ending stocks of maize is 294.8 Mt, 1.6 Mt lower than in the previous report. If we see a greater or smaller revision than this, we could see some market reaction.

Speculators increased their net long positions for Chicago maize in the week ending 31 December. On the one hand, this means that speculators are hoping for the further gains in maize prices, but on the other hand, if the trend turns bearish, covering long positions could accelerate the decline.

As shown above, maize price movements continue to impact UK feed wheat futures this season. As such, changes to the tone of global maize markets should be a key watchpoint when making marketing decisions.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.