Has wheat found its floor? Grain market daily

Tuesday, 28 March 2023

Market commentary

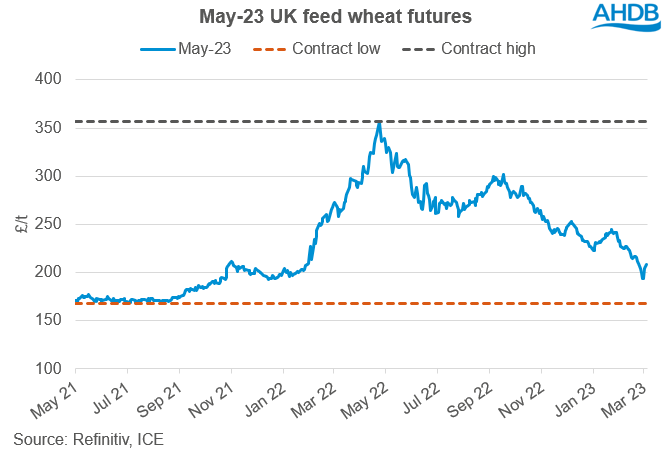

- May-23 UK feed wheat futures gained £4.00/t from Friday’s close, to settle at £208.00/t yesterday. The Nov-23 contract closed at £219.00/t, up £3.40/t from Friday’s close. Read more below about what is supporting prices.

- TMO, Turkey’s state grain board has started to buy wheat from an international tender it put out for 695Kt of the grain.

- Paris rapeseed futures (May-23) closed at €471.75/t yesterday, up €14.75/t from Friday’s close. The support has come from the wider oil and oilseed markets, with crude oil prices recovering, pulling up vegetable oils.

Has wheat found its floor?

Following the analyst insight I wrote last Thursday, How low could wheat go?, old crop (May-23) wheat prices have come back above the £200/t mark, closing at £208/t yesterday, up £14/t from last Wednesday’s 15 month low.

The direction of wheat prices turned on Friday as rumours emerged from a Russian business newspaper, that Moscow had plans to halt wheat and sunseed exports temporarily. However, these rumours were soon stamped out and it was confirmed Russia would not halt exports, but wanted to ensure fair prices for growers to cover the cost of production. Since then, support has come from uncertainty around the future of the Ukraine export corridor, as well as ongoing dryness in Kansas, the US’ top wheat producing state.

So, has wheat found its floor? As it stands at the moment the outlook for wheat markets remains more on the bearish side. Last week, following the latest renewal of the Ukraine export deal, Russian export prices dropped again, with 12.5% protein wheat falling $5/t to $272/t FOB, according to consultancy IKAR (Refinitiv). Cheap Russian supplies will continue to pressure markets and looking towards new crop, plentiful supplies are expected from Europe and US, despite the drought, due to the increase in planted area. However, in the short to midterm, volatility bringing occasional support is set to remain, with the future of the Ukraine export corridor (as we know it) under question and persistent dryness across parts of the Northern Hemisphere. While its likely we could see old crop wheat prices slip back below £200/t, how far down it will go is questionable, given the short-term volatility that is expected.

As I mentioned on Thursday, with such price changes over the past 12 months, it highlights the need for you to fully know the cost of production, your breakeven point and how much you need to sell for to make a profit.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.