Harvest 2022 rapeseed prices peak: Grain market daily

Wednesday, 2 February 2022

Market commentary

- UK feed wheat futures (May-22) gained £1.35/t to close yesterday at £218.05/t. This follows global grain markets. The Nov-22 contract also closed higher yesterday at £198.25/t (+£3.25/t from Monday).

- US soyabeans (May-22) gained $14.33/t yesterday to close at $563.68/t. This follows increased concerns for South American crops which would likely result in higher demand for US supplies.

- Palm oil continues to lead global vegetable oil markets up. Palm oil production has been hampered by weather and labour issues in Malaysia but Indonesia’s announcement to curb exports adds pressure to supply.

Harvest 2022 rapeseed prices peak

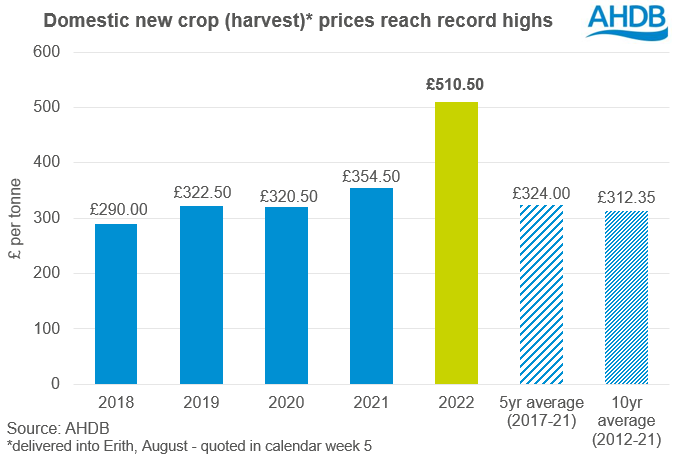

Oilseed rape (OSR) prices have reached historic highs this marketing year (2021/22). With stocks reduced and markets volatile focus turns to new crop. The AHDB delivered survey first quoted OSR for Aug-22 delivery (Erith) in October 2021 at £457.50/t. Last week (28-Jan) delivered rapeseed into Erith in Aug-22 averaged £510.50/t (+12%). The five-year average price for the following harvest at this time of year is £324.00/t, some £186.50/t lower.

Bearish fundamentals for new crop rapeseed could well see these price rises stall. In the UK, the crop size for harvest 2022 is anticipated to rebound. The AHDB’s early bird survey of cropping intentions pegged oilseed rape plantings for harvest 2022 at 359Kha. That is up 17% year-on-year but still a long way off historic levels. Based on a five-year-average yield of 3.3t/ha and no losses to the intended area (optimistic), the OSR crop could be 1.2Mt, the largest since 2019.

Other bearish fundamentals come from Europe and the Black Sea region. Stratégie Grains have revised their EU-27 area estimate up to 5.69Mha (5.27Mha in 2021/22). Subsequently, they have also raised production estimates to 18.19Mt, up 1.25Mt year-on-year and the highest since 2018/19.

A rebound is also anticipated in the Ukraine. UkrAgroConsult estimate the 2022/23 winter rapeseed area to reach 1.15Mha, up 100Kha from last year’s USDA’s figure. If yields match last harvest (2.91t/ha, USDA), 2022/23 production would reach over 3.3Mt. The Ukraine is an important player in global rapeseed markets holding a 14% (five-year average, 2016/17-2020/21) share of global exports behind just Canada and Australia whose crops are yet to be planted for 2022/23.

Paris futures have dropped so far this week with the Nov-22 contract closing yesterday at €610.50/t, down €2.50/t (0.41%) since Friday’s close. This said, excluding Friday (28 Jan) and Monday (31 Jan) this would be a contract high.

What’s easing the fall?

In short, old crop. Since Friday, old crop Paris rapeseed futures (May-22) have gained €10.75/t (1.51%) to close yesterday at €721.25/t. Yesterday, Helen discussed some of the South American worries that is driving soyabean markets. But also rises in palm oil has offered support. In turn, support to soyabeans is aiding old crop rapeseed prices and subsequently softening any drops in new crop markets too. At least for now.

If old crop markets soften, the bearish nature of new crop fundamentals currently could well erode prices and is something to keep a close eye on.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.