Analyst Insight: Politics vs fundamentals, a longer term oilseed view

Thursday, 8 August 2019

Market Commentary

- UK feed wheat futures (Nov-19) continued to slide yesterday.

- Nov-19 futures closed £0.30/t lower, at £143.20/t. Falling every day this month, UK feed wheat futures are now heading toward the previous low of £141.00/t set on 13 May. Despite the currency support of a weakening pound, UK feed wheat has been unable to resist the expectation for a large UK and French wheat harvest.

- Meanwhile Chicago grain and oilseed futures have generally tracked sideways in anticipation of Mondays WASDE and possible revisions to the US planted area.

Politics vs fundamentals, a longer term oilseed view

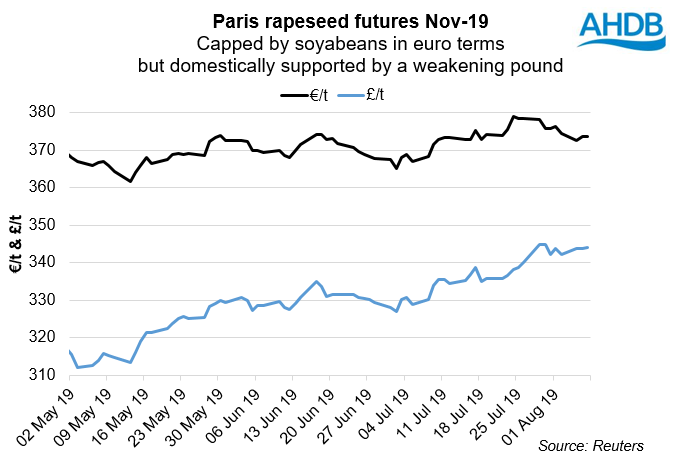

Although the oilseed rape outlook is for a large deficit during 2019/20, prices have been unable to continually climb due to a global oversupply of soyabeans. With this in mind, what are the longer term directions and drivers for the global oilseed complex?

Oilseed market direction

Setting the overall market direction has been the US, where currently soyabeans are in their development and pod fill stage. Following a less than ideal establishment period the condition of the crop is improving which has added downward pressure to oilseed markets.

Trade tensions and uncertain Chinese demand due to African Swine Fever, have led toward the depressed global soyabean and oilseed market, which will likely continue through the rest of the calendar year.

However, the depressed soyabean market and current elevated maize price comes as Brazilian farmers are starting to make their planting intentions. Should this continue, it may remove the incentive for an increasing Brazilian soyabean area. The size of the April harvest of Brazilian soyabeans may then drop below the USDA record breaking crop forecast.

Yet unless US-China relations thaw, the heavy supplies of soyabeans in the US may continue to act as a cap on price gains despite near-term uncertainty over planted areas.

Can oilseed rape markets firm in 2020?

Into 2020, the EU and Ukrainian supply will be diminishing and Australian oilseed rape imports will be critical for the EU (read more here). EU stocks are forecast to reduce to just 1Mt, requiring 5Mt of imports. However, with a Ukrainian crop of near 3Mt, exports of up to 2.6Mt are likely to dry up by the end of 2019. Additionally, the forecast 2.6Mt Australian crop looks uncertain amid dry weather, and may reduce the export potential below the 1.9Mt forecast.

As such, the May-20 Paris rapeseed contract would likely benefit from a tightening global oilseed outlook at the end of 2019/20.

Politics and uncertainty

Yet although the global fundamentals point toward longer term support to the oilseed rape complex, the political uncertainty will continue to muddy the water for future UK domestic prices.

In a hard Brexit scenario, the relevant Paris rapeseed futures contract would likely increase in value in pound sterling terms, with the benefit of no tariffs on any seed trade. Yet with the pound trading at historically low levels already against the Euro, should a comprehensive deal look to become more of a possibility, we could well see the value of the pound bounce back.

With the value of the pound having lost over 8% since a Brexit deal previously looked possible, a return to a stronger pound against the euro of £1=€1.175 would potentially remove over £25/t from UK domestic oilseed rape prices.

In conclusion, while the oilseed complex may receive some support in the latter half of 2019/20, this would be in dollar or euro denoted terms, leaving the path of Brexit potentially the single largest factor for domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.