Analyst Insight: Global oilseed rape deficit

Thursday, 25 July 2019

Market Commentary

Global wheat markets have continued to drift, with Chicago, Paris and UK feed wheat prices lacking direction. With favourable conditions in the US, soyabean markets have also slid.

Yet European maize and oilseed rape markets have continued to climb. As the oilseed rape outlook is tightening, Paris futures (Dec-19) have reached contract high yesterday, testing the €380/t physiological barrier, while expected French maize yields have been trimmed to below average.

However, as the value of the pound has increased over the last week, reversing the previous 10 weeks loss, should this trend continue, UK markets will be pressured.

Global oilseed rape deficit

Following what has been an unfavourable growing season for oilseed rape, both in the EU and across Europe, imports are going to be essential.

For the UK, It would be hard to justify anything other than an average yield from the reported area. With production up to circa 1.7Mt, and a domestic consumption of around 2Mt, there will be a national deficit.

Additionally, Europe as a whole is forecast to import between 4.5Mt to 5.5Mt, so where will the imports come from, and is the outlook bullish for prices?

The cyclical nature of import origins will see Ukrainian oilseed rape imported from August until December and Australian imports for the second half of the year, with occasional Canadian imports.

Ukraine Prospects

While the oilseed rape area in the UK and in Europe has been in decline, the Ukrainian oilseed rape area has reached a new record. Yields have also been increasing year on year, and the USDA was forecasting a record 3t/ha for harvest 2019.

However, with the majority of winter oilseed rape now harvested, yields are so far down year on year at around 2.4t/ha (UkrAgroConsult).

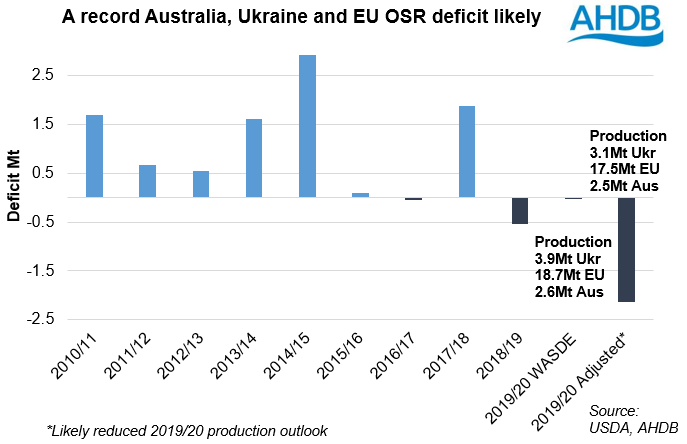

Working with the yield hit, Ukrainian production could well be closer to 3.1Mt, still the largest on record. However, a 0.4Mt domestic consumption would equate to a possible 2.7Mt exportable surplus, 0.8Mt less than currently factored in by the USDA.

Australian Outlook

Following the drought hit harvest of 2018/19, oilseed rape production was forecast to recover in 2019/20, following a better planting window and more favourable conditions. However, available exports are forecast at just 1.9Mt. Recently around 10% of Australian exports have gone to non-EU countries, although this has been higher historically, leaving circa 1.7Mt available for the EU.

Additionally, Australian winter conditions haven’t been perfect for crop development, a continued lack of rainfall could well curb yields.

As such, the supply and demand of oilseed rape for the EU, Australia and Ukraine looks set for the largest deficit on record of over 2Mt, placing additional importance on Canadian production.

Canadian canola

The availability of Canadian canola is more complex when measuring the volume the EU could import whilst satisfying GM approval legislation. In recent years, the EU accounted for around 5% of Canadian exports, and has historically imported a maximum annual volume of 0.7Mt.

With other nations such as China, Japan, and Mexico requiring a combined 8.1Mt, and the remaining nations requiring a combined 3Mt plus, global supply is likely to tighten significantly.

So why haven’t prices climbed higher?

Firstly, the global standard dataset of the USDA will likely reflect the changing outlook once harvests are better underway, but until then, the world appears better supplied and there are large global stocks of oilseed rape to be drawn down.

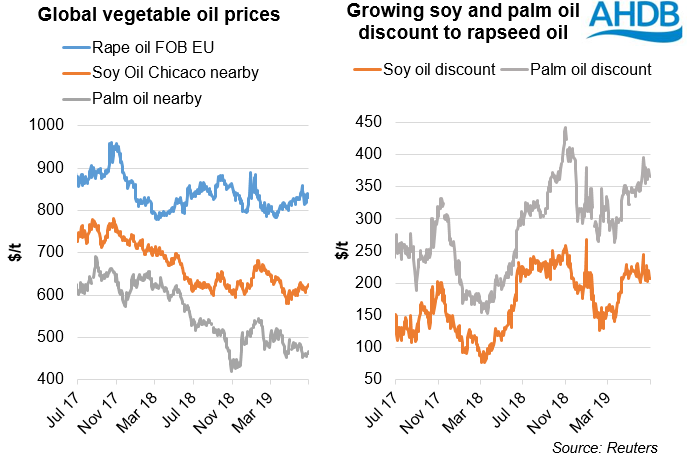

Secondly, likely EU competition for rapeseed and product imports are to come from China, Pakistan and Japan. However, in China and Pakistan as the price discount of soya oil to rapeseed oil has grown, an increased proportion of the overall oil demand will shift away from rapeseed oil and somewhat ease the demand for rape seed.

Through substitution between oils, there is a price ceiling for oilseed rape, where economics will dictate a swap to either palm or soya. As palm and soya oil have both been on a downward trend, the price of rapeseed oil has been unable to continue to rise as the discount has grown.

Where next for rape?

Domestically, and within the EU, there will be an additional incentive to use soyabeans in 2019/20, potentially reducing the domestic consumption of oilseed rape. With the rapeseed pushing the ceiling of substitution, any potential rise in soyabeans would allow rapeseed markets to push higher, in what is an otherwise a currently suppressed oilseed complex.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.