Global speculative interest in commodities: a product of growth? Analyst Insight

Thursday, 6 May 2021

Market Commentary

- London (Nov-21) wheat futures gained £4.20/t from Tuesday’s close, closing at £187.95/t yesterday. Similarly UK May-22 futures gained £4.90/t to £191.00/t over the same period. UK Nov-22 futures gained slightly less to be at £170.10/t, up £3.60/t.

- The FAO global food price index rose for its 11th straight month to April to 120.9. This is a seven year high and a 30.7% increase from April 2020. This is the fastest rise in food inflation levels since 2011.

- Today, the Bank of England has voted to leave UK interest rates unchanged at a current record low of 0.1%.

- We have published the latest monthly usage figures for GB animal feed production and GB human and industrial (H&I) consumption for March 2021. Production of dairy cow feed blends increased 14.5% as grass growth figures struggled amid a lack of rainfall.

Global speculative interest in commodities: a product of growth?

Whilst it remains to be seen if globally we are in a super-cycle for commodities (a multi-year period of growth) we cannot ignore the transformation that commodity markets have undergone since the start of the Covid-19 pandemic. Many futures contracts have been able to hit multi-year highs owing to supply and demand imbalances.

The bullish sentiment has stemmed from increases to global demand, as China began its purchasing spree of agricultural commodities in August 2020 that continues today. It’s not just agricultural commodities however, lumber and some metals including copper have neared record highs in a short space of time owing to supply shortages and healthy demand outlooks.

Whilst seemingly the opposite of a ‘safe haven asset’, notably gold and government bonds, commodity tracking funds have provided a relatively ‘safe’ investment this season with demand levels strong as China and other countries begin to rebuild post-pandemic. Supply concerns in grain markets from reduced EU+UK production have offered market support for the season with new-crop Brazilian and US crop concerns now impacting too.

The Bloomberg Commodity Index (an index that tracks 23 futures contracts in 6 commodity sectors) gained 55% in 263 trading days from April 2020 to yesterday, its biggest percentage movement in less than 300 trading days. This is since the 55% drop during the 2008 financial crisis. Over this same period, gold futures (nearby) have gained 3.2%, though admittedly gold is used for value storage rather than value gain.

Heightened US government spending throughout the pandemic has stimulated economic activity. This has created inflation fears and weakened the value of the US dollar, a key pricing metric. The GBP/USD exchange rate has gained 21% since March 2020 to yesterday.

Have more investors joined the fray?

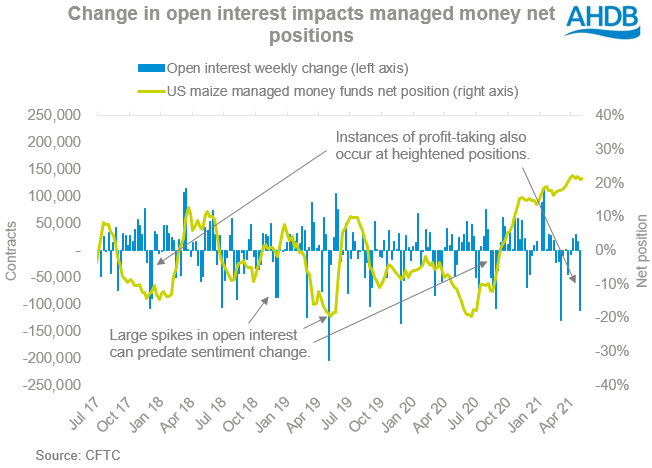

In August 2020, US maize futures (nearby) hit their lowest since August 2016 at $3.07/bsh. At that point last year, open interest (outstanding unsettled contracts) on US maize stood at 1.59M with net managed money fund positions at -12.1% (net short) indicating a bearish outlook.

Several months of aggressive Chinese grain purchases later and the beginning of new-crop maize concerns forms sentiment currently. In March 2021, managed money fund positions recorded their most bullish position at +22.3% (net long), a record since December 2011. By April 2021, open interest had grew 10% to 1.74M, peaking at 1.97M in February. It seems investors favour a bullish market outlook for value growth.

Averages for Jan – April US maize open interest in 2021 are the highest in records dating back to 2006. This year, open interest in US maize stands 29% above the 10-year average for this period. This helps to confirm the theory that an increased volume of speculative investors have seized the value opportunity held within the bullish maize market.

The question for longer-term market outlooks is when will speculative investors leave once agricultural bullish sentiment slows and economic markets show healthy signs of recovery emerging from the pandemic.

What happened in 2008 and 2012?

The global recession that occurred from 2007 to 2010 as well as the Eurozone debt crisis in 2012 provide a worthy comparison for the financial outlook post-pandemic. Government spending was key here to incentivise economic recovery. Global commodity supply levels can influence market direction to a greater degree.

US managed money fund positions in US maize were above +10% (net long) for 93 weeks from July 2010 to April 2012 indicating the economic recovery may have contributed to bullish sentiment for maize. Though this can likely be explained by global maize ending stocks declining 12% in 2010/11.

The Eurozone debt crisis in 2012 also coincided with a 13% drop in US maize production year-on-year. From July 2012, US managed money fund positions in US maize were above +10% (net long) for 33 weeks, indicating a sustained bullish period when combined with the 93 week streak. The lesson learnt here is fundamental imbalances contribute more to maize sentiment than perhaps wider economic activity.

This season, we are currently at a 28-week streak with little signs of bearish sentiment as explained in our market report this week.

In conclusion

The talk around agricultural commodity prices entering a ‘supercycle’ period of growth has foundation but can be better explained by a ‘bottleneck’ situation. This is where temporary imbalances in supply and demand are the cause for prices increases rather than sustained growth.

As we know high prices usually translate to increased planted areas the following season which can bring an end to price rallies. Though far off, the global planted area of next season will be telling indicator if the ‘supercycle’ will come to fruition.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.