GB winter grain crops faring well despite rain: Grain market daily

Wednesday, 3 May 2023

Market commentary

- Old-crop UK feed wheat futures (May-23) closed yesterday at £189.00/t, up £0.15/t from Friday’s close. New-crop futures (Nov-23) closed at £194.75/t, down £4.65/t from Friday’s close.

- Global wheat markets felt overall pressure yesterday, pulling new-crop domestic futures down too. European wheat fell on low offers presented for Egypt’s GASC tender, as well as following Chicago wheat down on favourable weather for Northern Hemisphere crops. Uncertainty still surrounds the renewal of the Black Sea Initiative, with proposed talks this week.

- GASC purchased 655Kt of wheat on Tuesday, for June/July delivery. Russian wheat was the lowest offer presented at $250/t FOB and $260/t FOB, under the semi-official minimum export price of $275/t. Romanian origin wheat also made up some of the purchase, at $260/t FOB. Ukraine reportedly offered wheat at $255.50/t, but this was believed to be disqualified as delivery was conditional on the UN corridor renewal (Refinitiv).

- Paris rapeseed futures (May-23) closed yesterday at €441.00/t, up €2.75/t from Friday’s close. New-crop futures (Nov-23) closed at €446.50/t yesterday, up €3.00/t over the same period.

Schemes in the carbon market: what to look out for

As awareness of carbon credits and different schemes on offer grows, it is important to understand what to look out for in these schemes. We have compiled our main watch points for schemes that offer payments for carbon sequestration in the agriculture sector.

Isabelle discusses the main watchpoints for entering into a scheme in detail, including the length of the scheme, costs, payments, monitoring methods, minimum requirements and restrictions in place on agreement.

For the full article, use this link.

GB winter grain crops faring well despite rain challenges

Yesterday, we released our latest GB crop development report, using data as at week ending 25 April.

Spring planting delays have been reported across all regions, considering unsettled weather conditions continued through April, as well as March. On average, plantings have been delayed about one month, with delays also noted to fertiliser and crop protection applications. With lower yield prospects in late-sown crops, reduced inputs on these crops have been reported.

Winter grain crops are generally faring well, with good yield potential, despite the wet weather. Though on heavy soils, establishment has been reportedly impacted. Recent rainfall is also reported to likely increase pressure from Septoria and other cereal diseases, which remains something to be watched closely, this has been worsened by late fungicide applications.

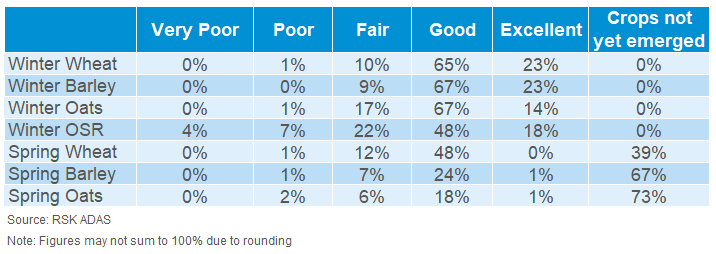

To week ending 25 April, 88% of the GB winter wheat crop was in good/excellent condition, ahead of 84% at the same point last season. Crops are establishing well, though some crops in the North West particularly have been impacted by localised flooding. The management of Septoria will remain an important watchpoint, with high levels observed in most winter wheat crops.

GB winter barley crops were rated 90% good/excellent condition, to week ending 25 April, up from 84% at the same point last year. The last few weeks have seen good crop growth, and in some advanced crops, the flag leaf has become visible. To note in Yorkshire, lodging is noted as a concern, considering PGR applications being delayed or missed. Higher levels of disease have been observed where T0 and T1 spray applications have been delayed or missed.

For oilseed rape (OSR), conditions are very varied. 66% of winter OSR was rated good/excellent to week ending 25 April, down from 70% the same point last year. Cabbage stem flea beetle remains the biggest issue for winter OSR crops, with pigeon damage also reported in several regions. Where necessary, some OSR crops have been replaced with spring beans, spring oats or spring barley.

For more information by crop type, please follow this link.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.