Further rapeseed price support from biodiesel tariffs: Grain Market Daily

Wednesday, 14 August 2019

Market Commentary

- Chicago maize prices continued their descent yesterday, falling a further $6.40/t. Chicago maize prices have now fallen back to pre-weather concern levels.

- The move lower follows yesterday’s movements on back of a bearish USDA supply and demand estimates and area figures (read more here).

- Following the trend in US grain prices, UK wheat futures (Nov-19) have now fallen £3.75/t from Fridays close.

- The 50-day moving average is now on the verge of breaking below the 100-day moving average for the first time since October 2018. With UK feed wheat moving lower, the next point of support remains at £141.00/t.

Further rapeseed price support from biodiesel tariffs

- EU imposing an increased duty of 8% to 18% on imports of subsidised Indonesian palm oil based biodiesel.

- Increased demand for other vegetable oil biodiesel may be felt. This could support rapeseed prices, adding to the pressure of a tight rapeseed supply.

- The impact on UK prices will depend on the path of sterling, which has strengthened so far this week.

Rapeseed prices could be set for support following the decision of the European Union to impose import duties on Indonesian biodiesel. The increase in duty on the fuel could result in a switch in demand to biodiesel produced using other vegetable oils.

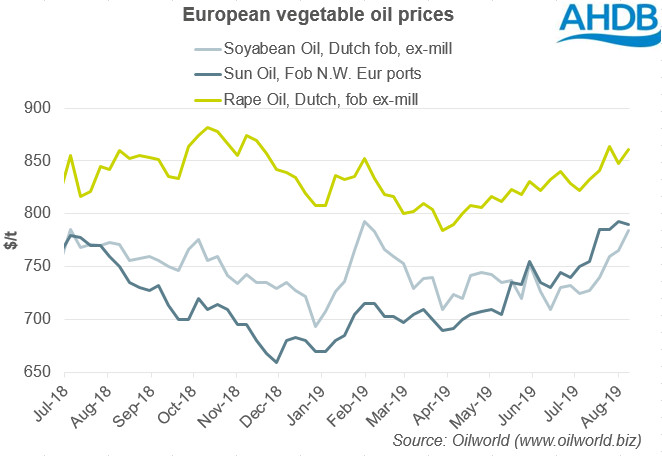

We have already seen support for EU rapeseed oil grow in recent weeks, on the back of a tight EU production outlook. Physical rapeseed oil prices (FoB ex-mill Netherlands, Spot) were quoted at $861.00/t on 8 August. Over the past couple of week’s rapeseed oil prices have risen to their highest point since November 2018.

EU oilseed rape production this season is currently forecast at 17.5Mt by oilseed publication Oilworld (www.oilworld.biz).

Today, Germany’s association of farm cooperatives (DRV) estimated that the winter rapeseed crop in the country will be the smallest in 22 years. This further tightens the EU rapeseed outlook.

The tightness in oilseed rape production, combined with the potential for increased vegetable oil demand for biodiesel, could lend further support to EU and UK oilseed rape prices.

The increased duty is only provisional at this stage, while the EU look into whether more definitive measures can be imposed in December.

For the UK, the impact of any changes to EU prices will also depend on the path of currency in the short term. So far this week sterling has risen against the euro, reducing the impact of any EU rapeseed led price rises on UK rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.