US maize crashes on WASDE release: Grain Market Daily

Tuesday, 13 August 2019

Market Commentary

- UK feed wheat futures (Nov-19) fell to £143.00/t (-2%) yesterday, in a last minute drop before markets closed.

- This was driven by a large fall in Chicago maize futures, which closed limit down in reaction to the USDA's latest US maize production estimates. Chicago wheat futures also fell significantly (read more below).

- Ex-farm volumes of feed wheat and barley for August delivery reached 59Kt and 63Kt respectively in the week ending 8 August, a significant rise on previous weeks. This is a signal of large supplies and Brexit pressure for both crops. For Corn Returns volumes and prices click here.

US maize crashes on WASDE release

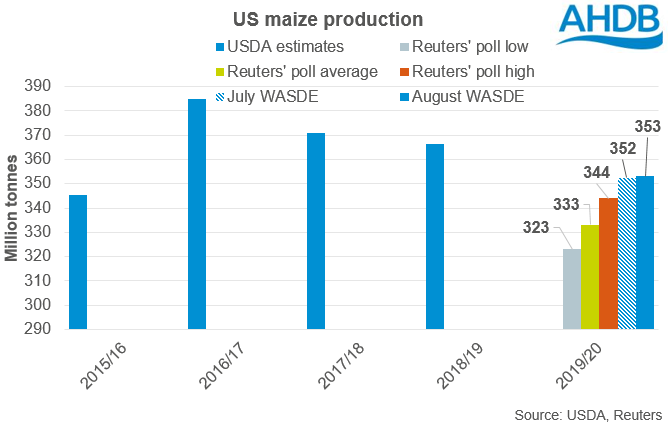

- Increased yield expectations meant that US maize production estimates were raised from July's report, despite a fall in planted area.

- US maize production raised to 353.1Mt (+0.7Mt), 5.4% above average industry expectations (Reuters' poll).

- Chicago maize futures (Dec-19) fell $9.84/t to $154.63/t (-6%) as a result, this decline was capped by the contract reaching the daily trading limit.

- Pressure fed through to the wheat markets with Chicago wheat futures (Dec-19) falling 6.0%. European wheat futures are likely to follow this downtrend during trading today.

Yesterday's WASDE release saw an upward revision to US maize estimates in stark contrast to industry estimates which expected a lower value from July's release. The maize data in yesterday's WASDE and US crop production report all came in above the top end of industry expectations.

- Production estimated at 353.1Mt, up 0.7Mt from July's release and 2.6% above the top end of industry estimates.

- Planted area fell to 36.4Mha, down 1.9% from the USDA's July report, but 2.3% above average industry estimates.

- Estimated yield increased to 11.4t/ha, up 2.8% from average industry estimates.

The response to this data release was immediate with Chicago maize futures falling to the daily limit. This fed through into Chicago wheat which fell 6% before the day's close. Paris and UK wheat futures only dipped 2% with minimal time to react to the WASDE release before trading closed.

Chicago maize futures are likely to move lower again later in the day as the halting of trading may not have allowed the full impact of this data release to be factored in. With the daily limit now raised to 40 cents per bushel, up from 25 yesterday, how far it will fall is unknown but any downward price movements are likely to weigh heavily on wheat and barley markets.

Trading today has seen European futures start to dip in reaction with UK feed wheat futures falling 1% as at time of publication While the USDA's 1.1Mt cut to global wheat ending stocks may lend some support the global outlook is looking healthy and stocks are still estimated to be at record levels.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.