Further falls in fertiliser prices: Grain market daily

Friday, 9 June 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £192.55/t yesterday, up £2.30/t from Wednesday’s close. The Nov-24 contract closed at £201.25/t, up £2.90/t over the same period.

- Domestic wheat futures followed global price movement yesterday, on concerns over Black Sea supplies, adjustments ahead of today’s USDA World Agricultural Supply and Demand Estimates release, and a lack of rain across certain regions in Europe.

- Paris rapeseed futures (Nov-23) gained €5.25/t over yesterday’s session, closing at €431.00/t. Nov-24 futures were unchanged yesterday, closing at €435.00/t.

- Old crop Paris rapeseed prices followed the wider oilseed complex up yesterday, as forecasts of more dry weather in the US added to concern over the country’s soyabean supplies.

Further falls in fertiliser prices

Spot prices for UK produced Ammonium Nitrate (AN) averaged £390/t in May, down 11.2% from April, according to latest AHDB data. This is down 45.5% from the same time last year, but remains 37.2% higher than in May 2021.

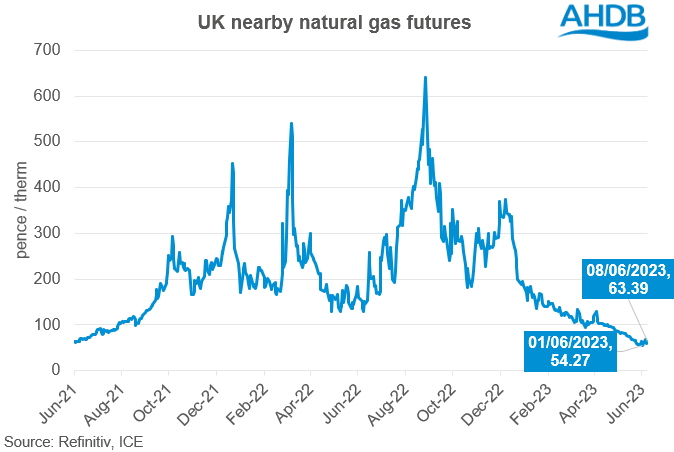

The fall in fertiliser prices over the last few months has been in line with the downward movement of UK nearby natural gas futures.

At the beginning of June, UK nearby natural gas futures hit their lowest point since April 2021, at 54.27 pence per therm. However, over the past few days, there has been some support in prices, closing yesterday at 63.39 pence per therm.

As outlined in previous analysis, pressure in the UK natural gas market has largely been due to the milder weather, and supplies in natural gas stores have increased in Europe in comparison to previous averages (Gas Infrastructure Europe). However, with prices seeing some support over the last few days, could we have reached the market floor?

What could happen to natural gas prices moving forward?

The slight jump seen in prices as of late was due to signs of a tighter liquified natural gas (LNG) market, and the potential for stronger Asian demand (Bloomberg). Currently, US shipments of LNG to Asia are more profitable than shipments to Europe, and there is ongoing concern over the future of Russian supplies.

In other energy news, Saudi Arabia’s energy ministry pledged on Sunday (04 Jun) to cut oil output by 1 million barrels per day throughout July as a way of boosting crude oil prices. With long-term LNG contracts often linked to oil, bullishness in oil markets could filter through to gas prices.

On the other hand, gas storage levels in Europe remain historically high. As at 06 June, European storage facilities were around 70% full, compared to 50% as the same time last year. Given the warmer weather and high storage levels, it’s looking likely that Europe will reach the 90% storage inventory target for November 2023 too.

As can be expected, gas demand for heating will reduce throughout the summer. The weather in Europe is forecast to remain even warmer than normal over the next two weeks, and demand for power towards cooling will likely pick up.

Conclusion

Natural gas prices will likely remain mixed over the next few weeks. Demand for cooling combined with concerns over supply could see some support for prices. However, on the other hand high storage levels could weigh on prices too. In terms of what this means for fertiliser, if natural gas prices have in fact reached their floor, there is potential for fertiliser prices to begin to stabilise too. Though there are many factors to keep an eye on over the coming months.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.