Fresh new highs for UK wheat futures: Grain market daily

Wednesday, 23 March 2022

Market commentary

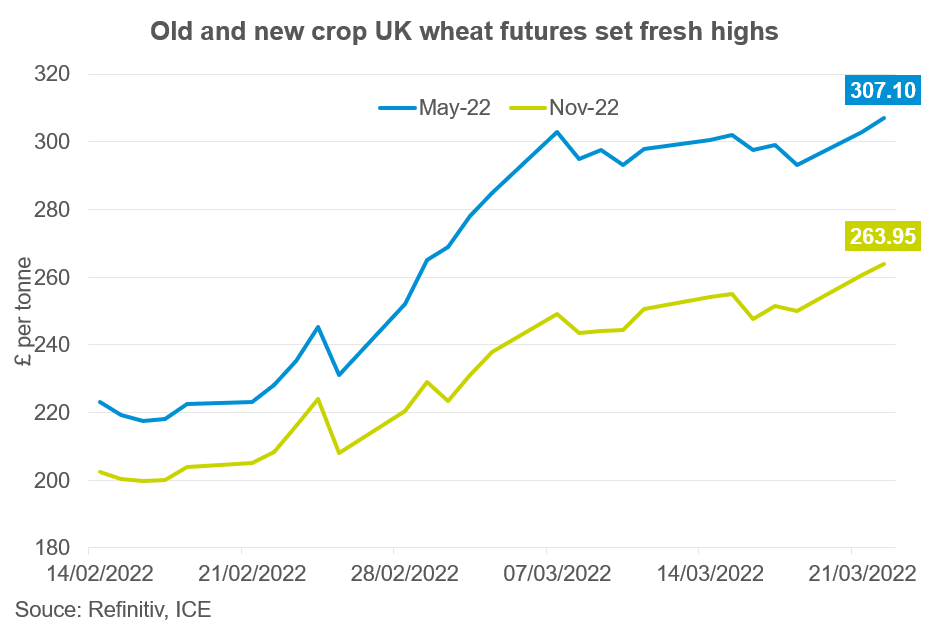

- UK wheat futures (May-22) closed yesterday at £307.10/t, gaining £4.20/t on Monday’s close. November-22 closed at £263.95/t gaining £3.45/t over the same period.

- Paris rapeseed futures (May-22) closed yesterday at €994.50/t, gaining €24.50/t on Monday’s close. The contract has traded at over €1,000/t this morning but there has been limited volumes. New crop futures (Nov-22) closed at €760.75/, gaining €16.75/t over the same period.

Fresh new highs for UK wheat futures

Ongoing issues within the Black Sea brought fresh highs to UK wheat futures yesterday.

There are still a lot of unknowns around how long the war between Russia and Ukraine will last. However, the longer this conflict continues, the longer volatility will continue for global grains and oilseeds.

Chicago wheat futures (May-22) near enough tracked sideways ending down 0.09% yesterday at $410.85/t, while the Paris milling wheat futures contract (May-22) gained 0.6%, closing at €379.00/t.

Domestic markets encapsulated greater gains, with May-22 and Nov-22 up 1.39% and 1.32% respectively. This is despite sterling strengthening against both the Euro (+0.64%) and US Dollar (+0.74%), closing yesterday at £1 = €1.2022 and $1.3263, respectively.

With tight ending stocks for the 2021/22, the old and new crop domestic market are now pricing even closer to import parity with the continent.

By now, it’s well known that Black Sea supplies are now limited to the global market. Net-importers of wheat, such as Egypt, Turkey and Yemen will have to look for alternative origins. Due to the geographical location of these countries, the EU would be the next closest supplier.

Latest data (up until 20 March) shows that the soft wheat exports from the EU are estimated 19.6Mt for the 2021/22 marketing year (EU commission). The latest Stratégie Grains report pegs exports at 32.5Mt, up 2.1Mt from the February report. This revision was off the back of shifting demand due to the Ukraine war.

With demand for EU origin wheat forecast to increase, and if this conflict wages on continental prices could well be supported, providing a further drive for domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.png?v=637826059780000000)