French wheat caps UK grain gains: Grain Market Daily

Friday, 31 January 2020

Market Commentary

- Chinese imports of US soyabeans, throughout December surged compared to year ago levels, on the back of the easing trade war. We could see this continue, following the agreement of phase-1 trade deal between the US and China in January.

- However, continued demand from china is under question as the outbreak of coronavirus continues. Furthermore, despite the recent rise in China’s pig inventories the herd is still significantly reduced, capping demand.

- According to IKAR, Russian wheat production for 2020/21 could reach 79.5Mt after a record winter wheat planted area. However, weather will be a key watch point in determining yields.

French wheat caps UK grain gains

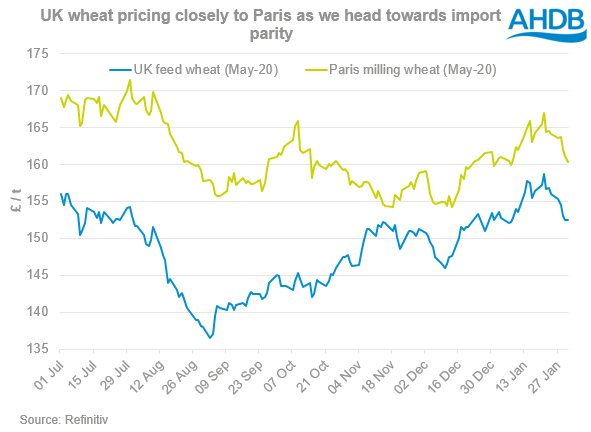

As previously discussed, UK wheat prices are capped by those in Europe as we meet import parity. With a falling MATIF market, this will bring the import ceiling lower and therefore pressure UK prices. UK feed wheat futures (May-20) have been following the track of MATIF closely.

To add insult to injury another fundamental pressuring domestic prices is that of sterling. Since 13 January sterling has strengthened 1.7% against the euro. When pricing against a European market the path of sterling effects the market price.

So what is next for the MATIF market?

From the beginning of December there have been major strikes in France causing some logistical headaches.

The strikes have been causing a number of problems for French trade but the export trade one hit most. FranceAriMer have predicted that France will export 12.4Mt of third country trade this season; however, currently this only sits at 5.3Mt (as at 27 January).

The Paris futures market, which is more of a European view than France alone, continued to rise through December. The May-20 Paris milling wheat futures contract gained €10.75/t from December 2nd to January 21st where it reached the highest price since end of July. The AHDB imported survey recorded gains in the German market, with German A wheat gaining £13.50/t from December 16th to January 13th.

Also, support to Paris futures came from the US. The May-20 Chicago wheat futures contract rose 7.8% in the same period as the Paris rise, equivalent of $15.43/t.

After failing to break through the €200/t mark, since 21 January Paris wheat futures (May-20) have dropped off to close yesterday at €191.25/t. That’s down €5.25 from the recent high and has continued to move lower today.

However, yesterday, Egypt’s state grain buyer, GASC, bought 180Kt of French wheat for shipment 11-25 March. The CIF price of the offered French wheat was $246.10/t. Bids, on a FOB basis, ranged from $231.50/t (French origin) to $246/t (Russian origin) with a number of origins on offer.

If this demand starts to reinvigorate French export market we may see some support to a drifting MATIF futures market. Whilst the psychological barrier of €200/t remains in sight, the volume of French wheat still to export means prices may struggle to consistently break above this level.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.