- Home

- News

- First cereal quality results of 2020 highlight the effect of difficult growing season: Grain Market Daily

First cereal quality results of 2020 highlight the effect of difficult growing season: Grain Market Daily

Tuesday, 8 September 2020

Market Commentary

- UK Nov-20 feed wheat futures gained £1.05/t yesterday, closing at £170.80/t. This is the highest closing price since 4 June. Part of the support for UK prices in recent days is from sterling depreciating against the euro and US dollar.

- Global grain futures price movements were mixed, amid low trading volumes because of the US Labor Day holiday.

- This morning Australia’s government raised its estimates of 2020/21 wheat (+2.2Mt), barley (+0.6Mt) and canola (+0.2Mt) production compared to its June estimates. The country was already expecting big crops after the end of a multi-year drought and recent rain across its east coast have further boosted yield potential.

- Paris Nov-20 rapeseed futures closed marginally lower yesterday, down €0.25/t to €384.25/t. Recent movement in rapeseed had been partially driven by US soyabean prices which have risen of late. This is due to export demand from China, though the price moves have potentially been amplified by the activity of speculative traders.

First cereal quality results of 2020 highlight the effect of difficult growing season

Today, we release the first quality figures for the UK cereal harvest. The AHDB Cereal Quality Survey results examine quality in samples up to mid-August, just before the widespread rainfall that fell in late August. The second release next month will provide a further update to these figures.

The survey quality results will help to quantify concerns around the true impact of the challenging weather in 2019/20 on the UK wheat and barley crops. With reduced availability for cereal grains this season, imports are required to meet the deficit. Though lower quality levels seen in milling and malting samples so far, could exacerbate this import requirement.

Wheat

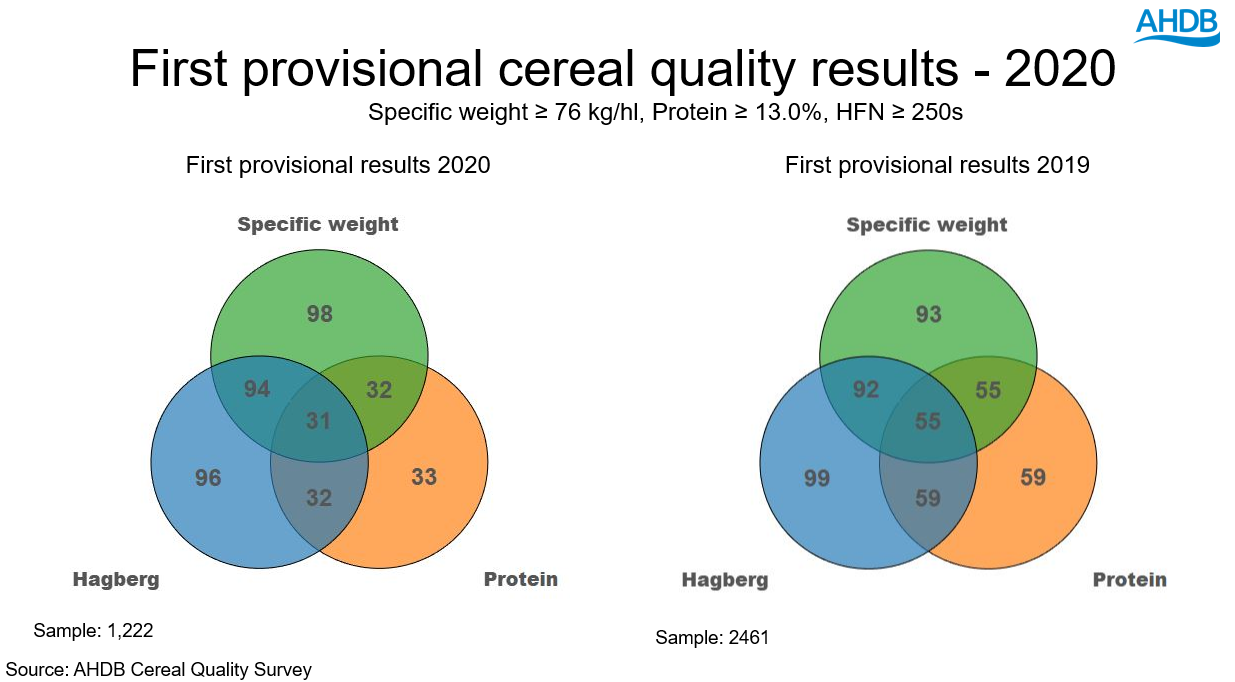

Taking a look at wheat first, less than a third of samples (31%) met the nabim Group 1 milling specifications (Protein – 13%, HFN – 250 secs, Specific wheat – 76Kg/hl). This is below the first CQS release of 2019/20 which saw 55% of samples meet Group 1 specifications. Additionally, the first CQS release from the drought affected season of 2018/19 had 48% of samples meeting this level.

These results highlight the challenges for the domestic milling crop. The recent harvest progress report showed that the UK what harvest was 59% complete as of 18 August. The subsequent late-August rainfall may have impacted the quality of the remaining wheat crop, with Hagberg Falling Numbers most likely to be affected.

There is the option of blending domestic samples with higher protein imported wheat for millers, where possible. These import origins will likely come from Germany and eastern Europe where production figures fared better this season. German A wheat imported into the UK was quoted at £193.50/t for October yesterday.

Barley

Onto barley, the preliminary results highlight higher nitrogen levels for both winter and spring barley versus the initial release last year. This was, to a degree, expected following the drought-like conditions throughout late spring. An average of 1.83% grain nitrogen content means many samples are above the desired domestic range of 1.55%-1.75%, so as to meet traditional malting, brewing and distilling barley specifications.

With greater emphasis for barley exports this season, given the large weight of feed barley availability, export brewing markets permit up to 1.85% grain nitrogen content. This could be an option for some samples of malting barley.

First provisional screenings results for both winter and spring barley are showing as improved year-on-year. The proportion of spring barley retained by a 2.5mm sieve is 96.7% versus 93.6% at the same stage last year. Anecdotal reports suggests screenings are poorer year-on-year and we would expect this to be reflected in future releases.

With greater barley availability and a higher proportion of samples on the high side of malting spec, feed markets look to be well-supplied from a barley front this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.