Fertiliser prices move sideways: Grain market daily

Tuesday, 24 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £188.65/t yesterday, down £1.25/t from Friday’s close. The Nov-24 contract fell by £0.60/t over the same period, ending the session at £202.50/t.

- The Russian rouble has gained strength in recent days which has impacted the competitiveness of Russian origin wheat exports. In response to currency strength, Russian wheat prices have slid to attract demand, weighing on European wheat exports.

- Nov-23 Paris Rapeseed futures fell €2.75/t from Friday, closing at €391.25/t on Monday. The Nov-24 contract closed at €444.00/t, down €9.25/t from Friday’s close.

- In the latest USDA crop progress report (to 22nd October) the US have harvested 76% of the soybean crop, up 9% percentage points (pp) in comparison to the 5-year average (USDA), rapid progression is weighing on the oilseed complex at the moment.

Fertiliser prices move sideways

Fertiliser prices have seen little change from the last fertiliser update, though remain historically high for this point in the season.

Spot prices for imported Ammonium Nitrate (AN) averaged £362/t in September, unchanged from August, but up from £344/t in July. September’s average is down 58.3% from a year earlier but remains up 36.8% on the five-year average for the month, taken before Russia invaded Ukraine (2017-2021).

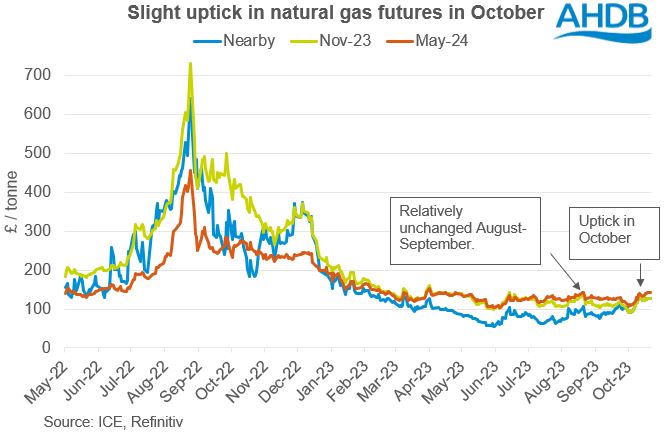

The lack of change in the price of imported AN in September reflects the relatively static movement in UK natural gas futures over the same period.

While gas prices were relatively stagnant from August to September, more recently there have been climbs in prices, with the forward price (May-24) seeing sharper rises than the nearby contract. The reason for the support as of late, is largely to do with the cooler weather as we head into winter and the escalating unrest in the Middle East.

The ongoing Israel/Gaza war is raising concerns over further escalation in the region, an area which is home to some of the largest oil producers in the world, including Saudi Arabia and Iran. There are fears that any further escalation could put more pressure on global supplies and lead to further sanctions.

However, looking ahead, Europe looks to be well supplied as we head into winter. According to Gas Infrastructure Europe (GIE), as at 17 October, gas inventories in the European Union and UK were about 97.9% full, significantly higher than the EU’s target of 90% by 01 November. With much of Europe also expected to have warmer-than-normal temperatures for this time of year over the next 14 days, demand for natural gas remains fairly lacklustre at the moment.

What does this mean for fertiliser prices moving forward?

The increase in UK natural gas futures that we have seen over the last couple of weeks, will likely filter into fertiliser production costs. Moving forward, natural gas markets will remain reactive to any news on the unrest in Israel/Gaza, and should we see other countries in the region involved, natural gas futures could see some support. However, as it stands, EU supplies look to be well stocked as we approach winter, and demand is fairly weak, limiting any major gains in natural gas, and therefore fertiliser prices, short-term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.