Feed grains complex focus on maize: Grain market daily

Wednesday, 4 December 2024

Market commentary

- UK feed wheat futures (May-25) ended yesterday’s session at £185.95/t, up £1.30/t from Monday’s close. The Nov-25 contract was up £2.00/t over the same period, to close at £187.95/t.

- Domestic wheat futures closed higher following global grain markets. Paris milling wheat and maize futures (Mar-25) gained 1.01% and 1.48% respectively yesterday. However, more favourable conditions for winter wheat crops and strong competition among exporters continues to limit gains.

- May-25 Paris rapeseed futures closed at €520.00/t yesterday, up €11.75/t from Monday’s close.

- As well as Paris rapeseed futures sharply gaining yesterday, Winipeg canola futures (May-25) closed higher for the fourth consecutive trading session too. India's vegetable oil imports in November rose to the highest level in four months in November (LSEG), pulling up prices. However, favourable weather in South America weighed on Chicago soyabean futures yesterday.

Feed grains complex focus on maize

The feed grain complex is now at a crossroad and the main reason for this is the supply and demand of maize. We’ve recently produced analysis on the influence of Paris maize futures on UK feed wheat futures. In this article, we take a further look at what may be impacting maize markets going forward and what impact that could have on UK feed wheat markets.

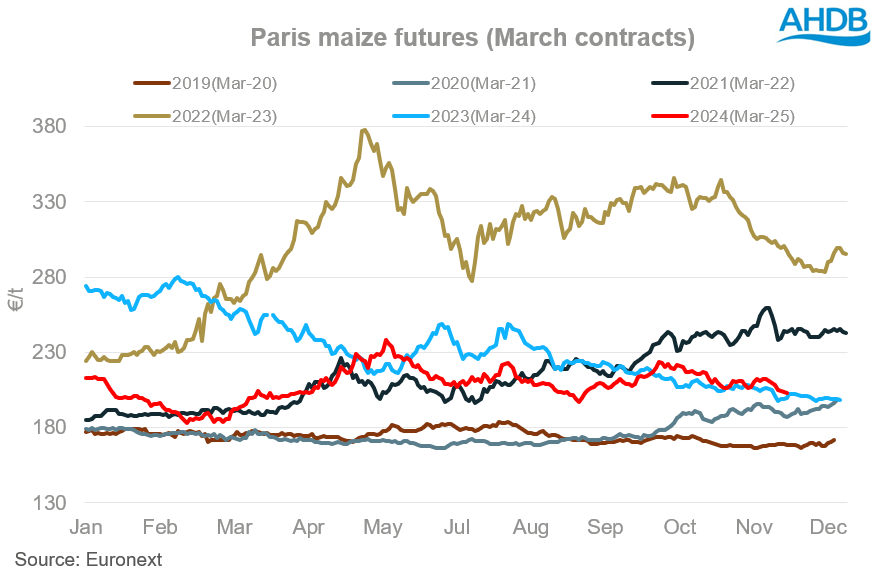

Historically, Paris maize futures (March contract for the coming year) are mainly stable in December and January. For the current marketing year, the Mar-25 Paris maize futures contract shows a declining trend from October 2024. This is due to harvest pressure from the northern hemisphere and improving weather conditions in South America.

The active import of maize to the EU and Mexico in the 2024/25 season has somewhat limited the decline in maize prices. In fact, total US maize exports to Mexico from the start of the 2024/25 season for US maize (1 Sep) to 21 November were higher than last year and the five-year average for the same period. Yesterday, the EU Commission reported maize imports into the EU from the start of the 2024/25 marketing year (1 Jul) at 8.51 Mt as of 01 December, up 10.4% from 7.71 Mt a year earlier.

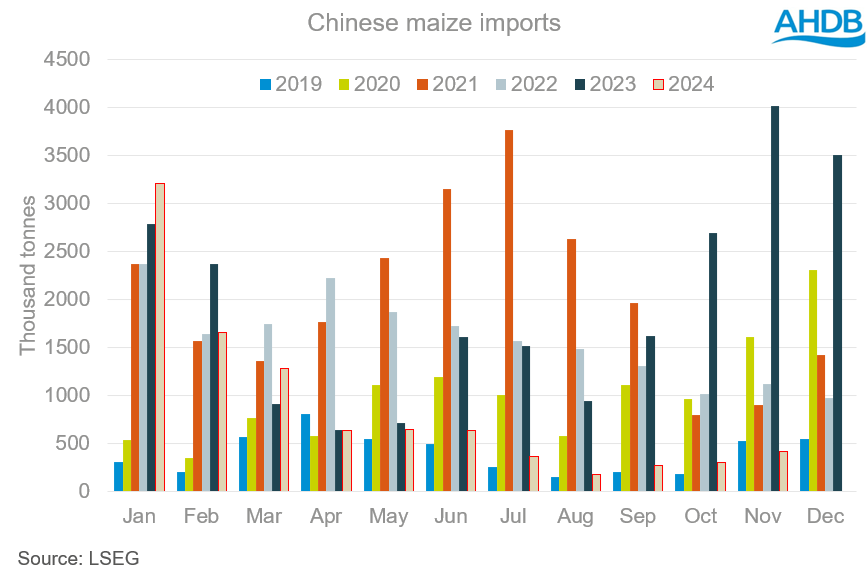

On the demand side, according to the USDA, the largest maize importers in 2024/25 will be Mexico (24 Mt), the EU (19 Mt), China (16 MT, the lowest level in the last four years), Japan (15.5 Mt), South Korea (11.8 Mt) and Vietnam (11.5 Mt). However, China’s maize imports from April-November 2024 have been considerably lower than recent years, adding uncertainty to the market.

Looking ahead

The seasonality of Paris maize futures prices shows limited potential for price increases in the short and long term. Historically, prices are more or less stable in December and January.

More active maize imports from China in the medium and long term could support maize prices, before Brazil accelerates its exports of its bumper Safrinha maize, which will likely weigh on markets.

Looking ahead at maize supply and the price ratio between US soyabean and maize in Chicago futures suggests that US farmers may plant more maize at the expense of soyabeans, which could be an additional bearish factor for maize.

The weight on the maize market has trickled through, with speculators switching from net long positions to net short positions for maize in the week ending 26 November.

What impact does a heavy maize market have on the UK? As previously analysed, maize price movements have had a larger impact on UK feed wheat futures this season. If the bearish tone for global maize continues, we could see this weigh further on UK feed wheat prices. Conversely if we see global maize markets supported by stronger Chinese imports, these could help pull up UK feed wheat prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.